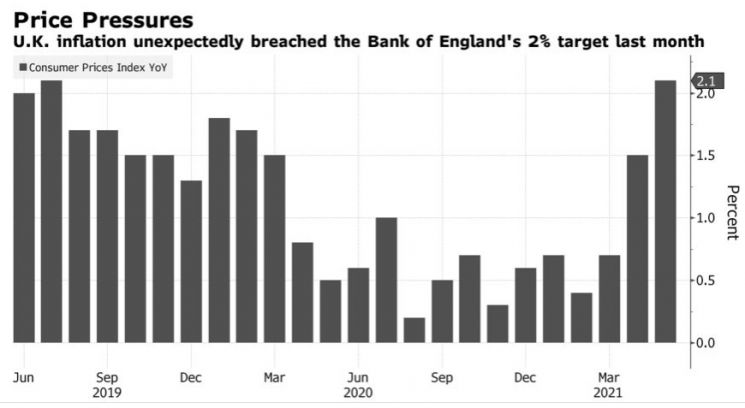

UK May CPI Rises 2.1% Exceeding Monetary Policy Target

Canada May CPI Increase Highest Since May 2011

Brazil Central Bank Raises Benchmark Rate for Third Consecutive Time

[Asia Economy Reporter Park Byung-hee] Inflation is spreading across major advanced countries as the inflation rates in the UK and Canada also exceed the central banks' monetary policy targets. Brazil has raised its benchmark interest rate three consecutive times.

Bloomberg reported on the 16th (local time) that the UK’s Consumer Price Index (CPI) for May rose 2.1% year-on-year, surpassing the Bank of England’s (BOE) monetary policy target of 2% for the first time in nearly two years.

The May CPI increase far exceeded economists’ forecast of 1.8% compiled by Bloomberg, marking the highest level since July 2019. The core CPI, excluding energy and food items, also recorded its highest increase since August 2018 at 2%.

Canada’s Statistics Bureau announced that the May CPI rose 3.6% year-on-year, the highest since May 2011. Canada’s inflation rate has exceeded the Bank of Canada’s (BOC) monetary policy target of 2% since March.

Canada’s CPI increase was only 1.1% in February but surged to 2.2% in March and 3.4% in April. The May core CPI also recorded 2.3%, the highest since 2009.

Both the BOE and BOC maintain the view that the current surge in inflation is temporary. They attribute much of it to the base effect caused by a sharp drop in prices a year ago due to the economic contraction from COVID-19. However, as inflation rises faster than expected, there are forecasts that the timing of interest rate hikes could be accelerated.

James Smith, an economist at ING, stated, "The BOE is expected to raise interest rates in early 2023, but if the economic recovery accelerates, the timing could be moved forward to 2022." The BOC holds the position that it may raise rates in the second half of next year, but the market expects hikes to occur in the first half.

BOC Governor Tiff Macklem appeared before the Senate Banking Committee on the same day and expressed confidence that Canada’s economic recovery is progressing well. He said, "While there may be some fluctuations in the second quarter’s economic growth rate, there will be a strong rebound in growth in the fall and winter."

Meanwhile, the Central Bank of Brazil raised its benchmark interest rate from 3.5% to 4.25% on the day to curb inflation. Brazil’s May CPI, announced on the 9th, surged 8.06% year-on-year. The Central Bank of Brazil’s monetary policy target is 3.75%. Since the monetary policy meeting in March, the Central Bank of Brazil has decided to raise rates by 0.75 percentage points three consecutive times.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.