Demand for Substitute Officetels Surges Due to Loan Regulations and Price Ceiling

'Apartel' Dietre at Dongtan Station Priced Twice That of Nearby Apartments

[Asia Economy Reporter Jo Gang-wook] In the Seoul metropolitan area, there is a growing phenomenon of ‘price inversion’ where officetel prices surpass those of apartments within the same complex. This is a market distortion caused by loan, tax, and pre-sale price regulations on apartments.

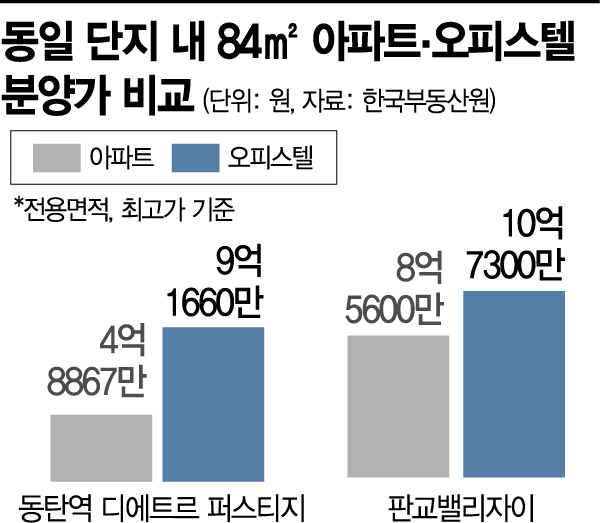

According to the Korea Real Estate Board’s subscription homepage on the 16th, the pre-sale price of an 84㎡ officetel at Dietre Prestige Officetel near Dongtan Station in Hwaseong-si, Gyeonggi-do, which is accepting applications from the 16th to the 17th, was set at a maximum of 916.6 million KRW. This amount is nearly double the pre-sale price of an apartment of the same size in the same complex sold last month (488.67 million KRW). While apartments were sold at about half the market price due to the application of the pre-sale price ceiling system, officetels are not subject to such regulations, which explains this unusual phenomenon.

The same applies to the Pangyo Valley Xi officetel in Godeung District, Seongnam-si, Gyeonggi-do, which was pre-sold in January this year. The highest pre-sale price for an 84㎡ officetel there was 1.073 billion KRW. Although this was up to 300 million KRW more expensive than the apartment pre-sale prices for the same size (770 million to 856 million KRW), 65,503 applicants competed for 282 units, resulting in an average competition rate of 232 to 1. Similarly, the Hillstate Dobong Station Welga officetel, pre-sold by Hyundai Engineering in December last year, had a highest pre-sale price of 973.39 million KRW for an 84㎡ unit, which was over 300 million KRW higher than the actual transaction price of the nearby ultra-station area Dobong Raemian Apartment of the same size, yet it was sold out.

Since the implementation of the pre-sale price ceiling system at the end of July last year, price inversion between nearby apartments and officetels has been occurring in many places. The reason for this phenomenon is that buyers, blocked by skyrocketing apartment prices and the government’s strong loan regulations, have turned to officetels to secure their own homes. Officetels can be applied for by anyone aged 19 or older regardless of subscription savings account, residence restrictions, or home ownership. Also, the loan-to-value ratio (LTV) for mortgage loans can be up to 70% of the pre-sale price, making the entry barrier relatively low. Officetel pre-sale rights are not counted as housing when calculating acquisition tax and capital gains tax. The capital gains tax rate applied when disposing of pre-sale rights is the basic rate (6-45%, with a holding period condition of over 2 years).

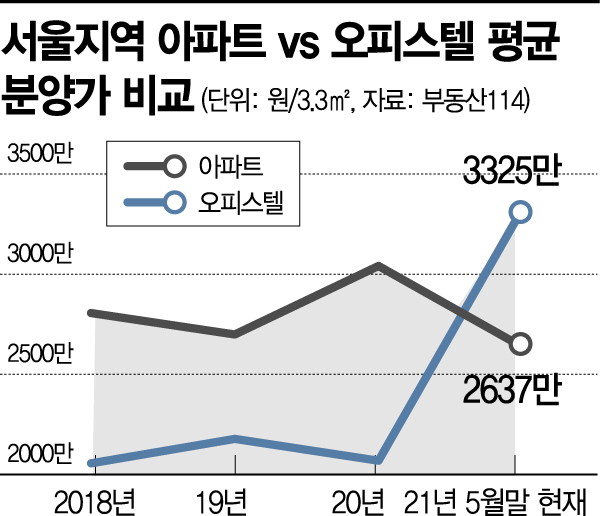

Because of this, the popularity curve of medium-to-large officetels, so-called ‘apatels’ (apartment + officetel), which are considered substitutes for apartments, has steepened. In fact, the average pre-sale price of officetels sold in Seoul this year was 33.25 million KRW per 3.3㎡, which is 60.7% higher than last year. This is 6.88 million KRW higher than the pre-sale price of private apartments in Seoul, which was 26.37 million KRW.

Criticism has also been raised that due to the government’s pre-sale price ceiling system, which sets apartment pre-sale prices far below surrounding market prices, the construction industry is instead raising officetel pre-sale prices to secure profits. It is pointed out that they are profiting by exploiting the desperate real demand flocking to officetels. An industry insider said, "Due to price controls on pre-sale prices, cases of converting apartments into officetels or selling them simultaneously to increase profitability are increasing." However, the common analysis is that this is a result caused by the government’s artificial price control.

Seo Jin-hyung, president of the Korea Real Estate Society (professor of business administration at Gyeongin Women’s University), said, "A ‘balloon effect’ is appearing where profits are made through officetels due to apartment price regulations," adding, "In addition to problems such as overheated subscription and ‘lottery subscriptions,’ some apartment pre-sale prices have decreased while housing supply has declined, causing side effects. Therefore, realistic pre-sale price setting measures need to be considered."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.