May Retail Sales Down 1.3%

Auto, Furniture, Appliance Sales Decline

Restaurant and Travel Spending Rise

Producer Prices Up 6.6%, Inflation Concerns Grow

Notable Drop in Lumber Prices

[Asia Economy New York=Correspondent Baek Jong-min] U.S. retail sales in May have turned to a decline. This is interpreted as American consumers increasing spending in the service sector rather than purchasing goods. The Producer Price Index (PPI) rose again, fueling inflation concerns. Attention is focused on the direction of the Federal Reserve's monetary policy announced after the Federal Open Market Committee (FOMC) meeting on the 16th (local time).

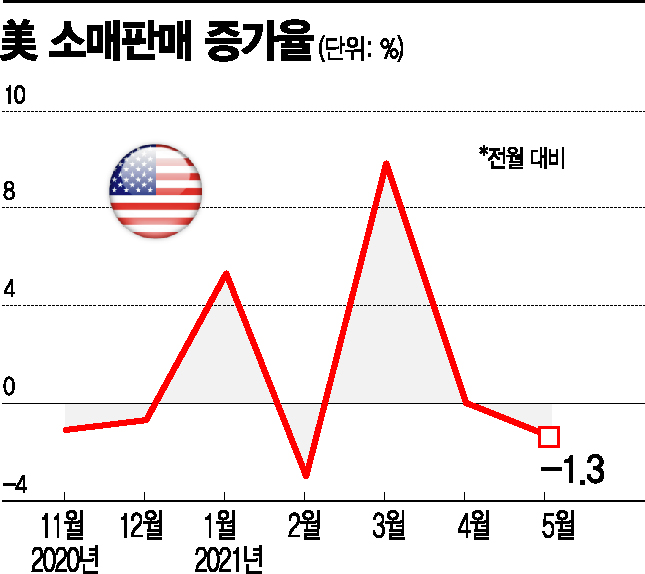

◇ Traveling and dining out instead of shopping = On the 15th, the U.S. Department of Labor announced that May retail sales decreased by 1.3% compared to the previous month. This marks a reversal from the 0.9% increase in April.

Market experts had predicted a 0.8% decline in May retail sales, but the actual result was worse. The retail sales growth rate has been continuously declining since the government’s cash payments in March, which recorded a 9.8% increase.

Compared to the same period last year, retail sales growth reached 28%, but this is attributed to the base effect caused by the COVID-19 pandemic last year. The year-over-year retail sales growth rate in April was as high as 53%.

The Wall Street Journal (WSJ) explained that supply chain bottlenecks, the reopening of economic activities, and price increases due to rising inflation were reasons consumers reduced shopping. The categories with decreased spending included automobiles, furniture, electronics, and building materials.

WSJ identified that the decline in retail sales was because consumers shifted their spending targets. Instead of purchasing goods, which had increased significantly during the COVID-19 lockdown, spending on services such as dining and travel is expanding.

Spending in the service sector is not included in retail sales statistics. WSJ predicted that the Commerce Department’s consumer spending indicator, which includes service sector spending, will reflect this situation. Consumer spending in April increased by 0.5%, with food and beverage services rising by as much as 1.8%.

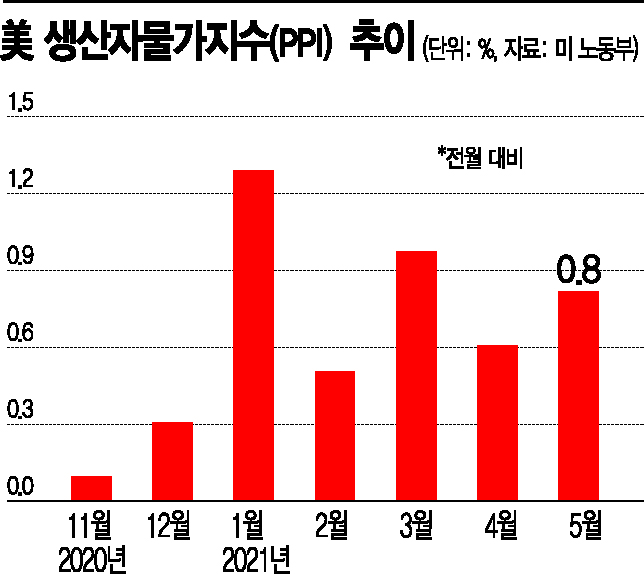

◇ Producer prices rise at the largest rate in 11 years = Unlike the decline in retail sales, producer prices continued their high-level surge. The year-over-year PPI increased by 6.6%, slightly exceeding the expected 6.3%. This is the highest level in 11 years since the statistics began being compiled.

PPI also rose 0.8% compared to the previous month, surpassing the expected 0.6%. This indicates that production costs for companies are soaring due to inflation. Increases in metals, grains, and meat led the PPI rise. Core PPI, which excludes volatile food and energy prices, also rose 4.8%, suggesting growing inflationary pressure. PPI is recognized as a leading indicator of the Consumer Price Index (CPI).

The 5.3% surge in single-family rental prices in April, announced by real estate information company CoreLogic on the same day, could also fuel inflation concerns. CNBC reported that this was the highest increase rate in 15 years. There are significant worries that if housing rents rise substantially, it will have a considerable impact on overall prices.

On the other hand, there are signs that inflation concerns are easing. A representative example is lumber. WSJ reported that lumber futures prices have fallen about 42% from the May peak of $1,711.20. Lumber prices have been a major factor causing concern as they influence U.S. housing prices. Of course, current lumber prices are still about three times higher than normal levels.

Following a 5% increase in the May CPI and the PPI rising to an all-time high, the need for early interest rate hikes is highlighted, but opinions continue that it will be difficult for the Fed to take action.

Peter Duffy, Chief Investment Officer at Penn Capital Asset Management, predicted, "It may be a mistake to think the Fed will act too early. Since the Fed aims for sustainable inflation, it will show patience this time as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)