Total Project Cost 2.6 Trillion Won Brazil FPSO... Awarded with Italian Company

Last Month, Korean Shipbuilding Also Secured a 2.5 Trillion Won-Class Unit with Singapore

Domestic Companies Achieve Consecutive Successes in Large-Scale Projects... Prices Also on the Rise

[Asia Economy Reporter Choi Dae-yeol] With the global economic recovery and an increase in ship orders due to environmental regulations, domestic shipbuilders are consecutively securing trillion-won scale projects.

On the 14th, Daewoo Shipbuilding & Marine Engineering (DSME) announced that it had won an order for a Floating Production Storage and Offloading (FPSO) unit from Brazilian energy company Petrobras, in collaboration with Italian engineering firm Saipem. The total project cost is 2.6 trillion KRW, with DSME's contract amounting to 1.0948 trillion KRW.

The FPSO ordered this time can produce 180,000 barrels of crude oil and 7.2 million cubic meters of natural gas per day. The crude oil storage capacity is 2 million barrels. DSME will manufacture the hull capable of storing crude oil and part of the topside structure. The topside structure, constructed by Saipem, will be received and finally installed at the Okpo Shipyard, with delivery to the client scheduled around 2024. It will operate in the B?zios field, one of the world's largest oil fields in Brazil. This is DSME's first offshore facility order in over two years since 2019. It is also the first time in seven years that DSME has secured a large-scale project worth trillions of won, following the 3 trillion KRW oil production facility order in 2014.

Earlier, Korea Shipbuilding & Offshore Engineering (KSOE) also secured an FPSO order from Petrobras last month, together with Singapore's Keppel. The project is worth 2.5 trillion KRW, with KSOE responsible for the hull portion of the construction, valued at approximately 850 billion KRW. Petrobras had temporarily suspended projects but recently resumed them, with Korean shipbuilders consecutively winning orders for two projects (P-78, 79). Petrobras is also reviewing the next project (P-80), and it is reported that both KSOE and DSME have qualified to participate in the bidding.

Floating Production, Storage, and Offloading (FPSO) facility built by Daewoo Shipbuilding & Marine Engineering

Floating Production, Storage, and Offloading (FPSO) facility built by Daewoo Shipbuilding & Marine Engineering

Offshore facilities range from several hundred billion KRW to trillion-won scale for large projects. Due to the significant scale, large shipbuilders have been keen to secure orders, but orders had been halted for several years amid a low oil price trend. In the early 2010s, when domestic shipbuilders competed fiercely for orders, profitability concerns arose. Recently, with forecasts of increasing oil demand and rising oil prices, global oil majors are recalculating their investments. According to the Korea National Oil Corporation, international oil prices, which fell to around $10 per barrel in mid-April last year, have recently risen to about $70 per barrel, the highest level in the past two years.

Earlier this January, POSCO International also secured a marine plant construction contract for gas field development in Myanmar, awarded to KSOE. Petrobras plans to deploy an additional eight FPSOs by 2030, in addition to the four currently operating. Furthermore, domestic shipbuilders are participating in major projects such as Qatar's oil field development project (Galaf Phase 3) and Nigeria's Bonga project, with the industry viewing them as either having secured orders or being in a favorable position.

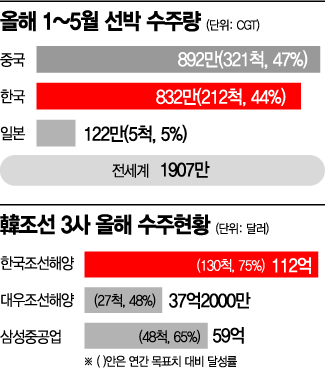

With global cargo volumes increasing and strengthened environmental regulations, new ship orders have reached the highest levels since 2008. According to Clarkson Research, a shipbuilding and shipping market analysis firm, the cumulative global order volume reached 19.07 million CGT (Compensated Gross Tonnage) by the end of last month this year, a 179% increase compared to the same period last year. Korean shipbuilders' order volume was 8.32 million CGT, about seven times higher than the previous year. This is the highest level in 13 years since 2008 (January to May: 9.67 million CGT).

As order backlogs accumulate, ship prices also show a clear upward trend. With shipyards filled with construction work, the shipbuilding industry can be selective in accepting orders. The Clarkson Newbuilding Price Index stood at 136.1, the highest level since December 2014 (137.8).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.