[Asia Economy Reporter Park Byung-hee] Most Wall Street economists expect Jerome Powell, Chairman of the Federal Reserve (Fed), to be reappointed. They believe that with Donald Trump stepping down from the presidency, the tradition of reappointing the Fed chairman is likely to be revived.

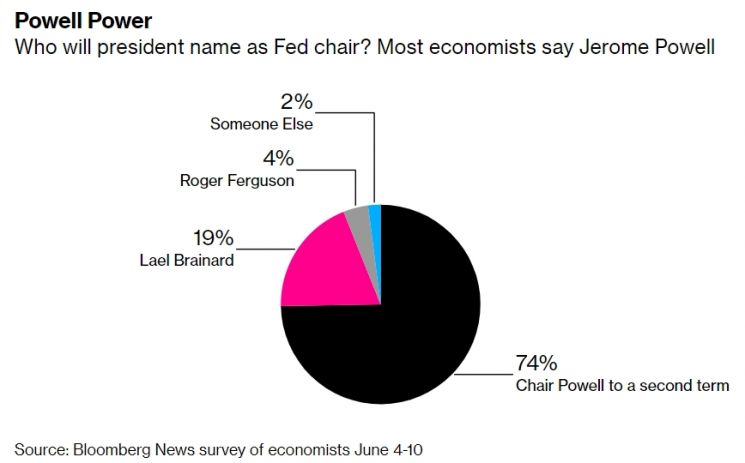

Powell's term expires in February next year. In a Bloomberg survey of 51 Wall Street economists asking about the next chairman candidate, 74% expected the current Chairman Powell to be reappointed.

Even when administrations changed, the Fed chairman was traditionally reappointed. This symbolized the guarantee of the Fed's independent monetary policy regardless of political ideology.

However, former President Donald Trump broke this tradition and prevented the reappointment of the Fed chairman during his tenure. At that time, the Fed chairman was Janet Yellen, the current Treasury Secretary. Yellen became the first Fed chairman in 40 years since William Miller in the late 1970s to complete a single term without reappointment.

The percentage of economists who expected Lael Brainard, current Fed Governor, as the next Fed chairman candidate was 19%. Brainard has served as a Fed Governor since 2014 during the Barack Obama administration.

Next, 4% expected Roger Ferguson, CEO of the Teachers Insurance and Annuity Association (TIAA), as the candidate. Ferguson stepped down as TIAA CEO earlier last month, and there are speculations about his possible appointment in the Biden administration.

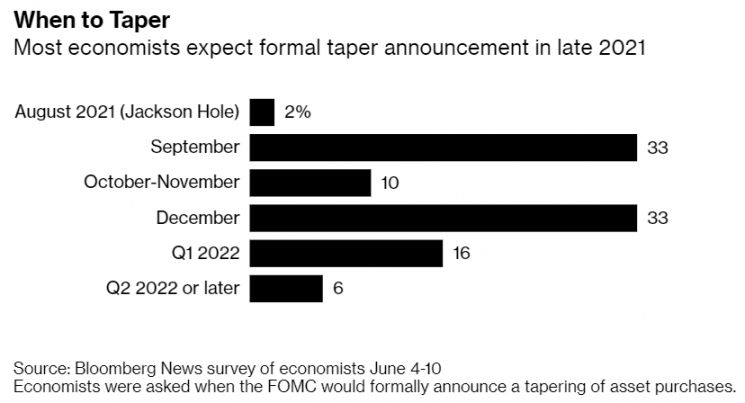

Meanwhile, in the Bloomberg survey, economists expected the Fed to officially announce the tapering of quantitative easing at the Federal Open Market Committee (FOMC) meeting in September this year. Many believed that the Jackson Hole meeting held from August 26 to 28 would hint at the tapering, followed by an official announcement at the FOMC on September 21-22. There were also many responses suggesting that the December FOMC would be the timing for the quantitative easing announcement. When asked about the timing of the quantitative easing announcement, September and December each received the highest support at 33%.

The Fed will hold the last FOMC meeting of the first half of this year on June 15-16. At this FOMC, economic outlook forecasts will also be revised. Economists expected the economic growth forecast for this year to be revised upward to 6.6%, and inflation rates to be revised upward to 2.7% this year and 2.1% next year. However, the Fed is expected to express that employment recovery is slower than anticipated in March. Economists expected the Fed to present an unemployment rate forecast of 4.7% at the end of this year. The unemployment rate forecast presented by the Fed in March for the end of this year was 4.5%.

John Silvia, an economist who founded Dynamic Economic Strategies, said, "The Fed will continue stimulus measures because the unemployment rate still exceeds the target."

Regarding interest rate hike forecasts, economists expected a 0.25 percentage point increase in 2023 and a 0.50 percentage point increase in 2024. Many still expected the Fed not to rush raising the benchmark interest rate. More than half expected at least one benchmark interest rate hike in 2023. On the other hand, the rest expected no benchmark interest rate hikes until early 2024.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.