Three P2P Companies Registered Under the OnTu Act

Lendit, 8Percent, and PeopleFund Formulate Strategies to Expand Mid-Interest Loans

Strict OnTu Act Registration Requirements... Ultimately, Only Large Firms Likely to Survive

[Asia Economy reporters Kim Jin-ho and Song Seung-seop] About 10 months after the enforcement of the Online Investment-Linked Finance Act (OnTu Act), the first three registered companies have emerged, signaling the beginning of a ‘sorting out’ process in the related industry. It is analyzed that the market will be reorganized around high-quality companies that have successfully entered the institutional framework. Among the approximately 100 companies currently operating, only a few are expected to complete registration within the OnTu Act grace period.

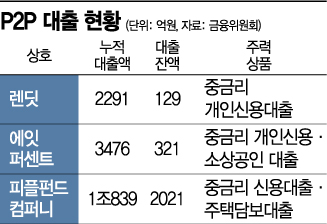

According to the Financial Services Commission on the 10th, three companies?8Percent, Lendit, and PeopleFund Company?have met the registration requirements under the OnTu Act and were registered as the first online investment-linked finance (P2P) financial operators. The Financial Services Commission judged that they satisfied six major registration requirements: ▲capital adequacy ▲personnel and physical facilities ▲business plan and internal control system ▲executives ▲major shareholders ▲applicants.

The three companies that succeeded in registration all plan to focus on targeting the mid-interest loan market. Since they lag behind savings banks that have secured the mid-interest loan market or internet banks that have announced expansion plans, they intend to strengthen their presence through differentiated products.

Kim Sung-jun, CEO of Lendit, said, "It is estimated that P2P finance covers about 8.4% of personal credit loans in the United States," adding, "We expect similar growth in scale domestically in the mid to long term." Lee Hyo-jin, CEO of 8Percent, also stated, "We will continue efforts to bridge the interest rate cliff along with OnTu registration," and Kim Dae-yoon, CEO of PeopleFund, indicated the expansion of mid-interest loans by saying, "Our ultimate goal is to contribute to solving the interest rate gap problem that existing finance has not reached."

P2P Finance Market Likely to Be Reorganized Around Large Companies

The industry expects that with the emergence of officially registered companies, the market will be reorganized around a small number of high-quality companies.

Since the Financial Services Commission stipulates that only registered companies can operate P2P finance, unqualified companies will inevitably be pushed out of the market. Among the approximately 100 companies currently operating, only 41 had applied for OnTu registration with the financial authorities as of the 9th. The financial authorities plan to finalize the review results for the remaining companies, excluding the three registered ones, as soon as possible. However, considering that the current review took about six months, it is expected to be difficult to pass the stringent registration criteria set by the financial authorities.

The industry also raises concerns that many companies may fail during the registration review process. The OnTu Act strictly and meticulously regulates internal controls, conflict of interest management, and capital requirements, making it difficult to meet the registration criteria. A P2P company official said, "Among the companies that applied for registration with the financial authorities, there are many whose names we have never heard before," adding, "Such companies are likely to face difficulties in registration." Ultimately, it is predicted that only large companies with sufficient capital and personnel will survive.

Meanwhile, companies awaiting OnTu registration decisions are eagerly hoping for an earlier announcement. The later a company starts, the more disadvantageous it will be in internal competition within the OnTu industry. An official from a company awaiting review said, "The first P2P company took a long time due to lack of reference materials, but since the selection criteria have become clearer, we expect the announcement of official companies to accelerate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)