Ministry of Industry Designates MagnaChip's 'OLED DDI' as Core Technology Late... M&A Review Process Begins

Following the US, Our Government Also Applies Brakes... "Approval Likely Based on US Trends"

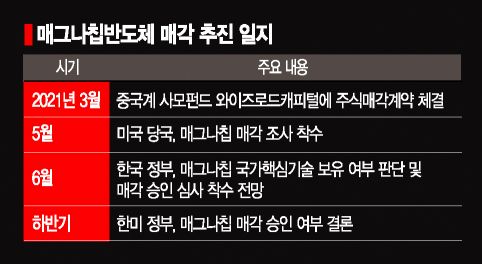

[Sejong=Asia Economy Reporter Kwon Haeyoung] The 'organic light-emitting diode (OLED) display driver chip (DDI)' technology of MagnaChip Semiconductor, which is being sold to Chinese capital, has been designated as a national core technology. Since companies holding national core technologies must obtain government approval when selling overseas, our government plans to soon begin the approval review for the sale of MagnaChip. Initially, both the industry and government insiders expected the sale of MagnaChip to proceed smoothly, but with this designation as a national core technology, a red light has been lit on MagnaChip's sale plans. Recently, as the United States has put a brake on the sale of MagnaChip, there is also analysis that our government is preparing for the possibility of the M&A failing.

According to the Ministry of Trade, Industry and Energy on the 9th, two new national core technologies were designated: 'DDI design and manufacturing technology for driving display panels of HD grade or higher' and 'lithium secondary batteries based on ultra-high-performance electrodes or solid electrolytes with 600mAh/g or higher.' Additionally, the designation for AMOLED panel design, process, and manufacturing technology (excluding module assembly process technology) was changed to AMOLED panel design, process, manufacturing (excluding module assembly process technology), and driving technology. The ministry announced a draft revision of the national core technology designation notice for public comment.

Among these, the DDI (Display Driver IC) design and manufacturing technology for driving display panels of HD grade or higher corresponds to the technology held by MagnaChip.

The government operates the national core technology designation system to prevent the overseas leakage of strategic technologies. Companies holding national core technologies must undergo a review by the Industrial Technology Protection Committee under the Ministry of Trade, Industry and Energy when promoting foreign investment such as overseas mergers and acquisitions (M&A). MagnaChip signed a contract in March to sell all its treasury shares to Wise Road Capital, a Chinese private equity fund, for $1.4 billion, but with the government's recent designation of OLED DDI technology as a national core technology, future overseas sales must receive government approval to be completed.

An industry official said, "The Ministry of Trade, Industry and Energy's designation of OLED DDI-related technology as a national core technology is a strategic move considering the possibility that the U.S. may not approve the sale of MagnaChip," adding, "Once designated as a national core technology, the government can decide whether to approve the M&A or not, so the government will likely decide its stance while watching the U.S. position."

Initially, the industry expected the sale of MagnaChip to proceed smoothly. Although MagnaChip's technological competitiveness was recognized, the prevailing opinion was that OLED DDI technology was not advanced technology. An industry insider said, "LG Group dropped its consideration of acquiring MagnaChip because it judged that the company did not possess advanced technology."

However, since the U.S. Committee on Foreign Investment in the United States (CFIUS) began reviewing the MagnaChip M&A last month, it has become difficult to predict whether the deal will be completed. Approval from both the Korean and U.S. governments is required for the MagnaChip M&A to succeed. The fact that our government belatedly pulled out the national core technology designation card is also interpreted as preparation for the possibility that the U.S. may not approve the M&A. Ultimately, the industry's outlook is that the U.S. stance on the MagnaChip sale will be the final variable influencing our government's decision.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.