Shinsegae-Lotte Two-Way Battle Narrowed Down... Estimated Bid Price 3 to 4 Trillion Won

Concerns Over Excessive Acquisition Cost Even If Securing 2nd Place in E-Commerce

[Asia Economy Reporter Jo In-kyung] The candidates for the acquisition of eBay Korea, which is set to change the landscape of the domestic e-commerce industry, have ultimately narrowed down to a competition between retail rivals Lotte and Shinsegae. Both companies are calculating that they can instantly challenge the second place in online shopping, and at the same time, their acquisition strategies reflect the determination not to let the other side take it away. However, concerns remain about the overvaluation of eBay Korea's price. Even if one wins the acquisition battle, there is a significant view that the 'winner's curse' could occur, where the financial condition deteriorates after acquisition if an excessive acquisition price is mobilized or if eBay Korea's market share declines in the future.

Too Expensive Even If Expensive

According to industry sources on the 8th, eBay reportedly insisted on an appropriate acquisition price of 4.5 trillion to 5 trillion KRW for eBay Korea until just before the deadline for the main bid the day before. Lotte and Shinsegae have remained silent about their bid prices, but the industry estimates that they offered prices in the high 3 trillion to low 4 trillion KRW range. This means there is about a 1 trillion KRW gap between the desired sale price and the bid price.

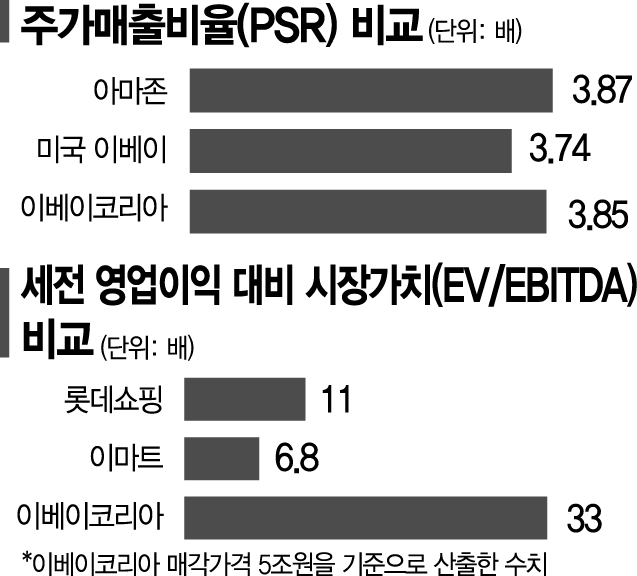

eBay calculated the value of eBay Korea at 5 trillion KRW by multiplying last year's sales of 1.3 trillion KRW by a price-to-sales ratio (PSR) of 3.85 times. Amazon's PSR is around 3.87 times, and eBay's position is that it should be evaluated at Amazon's level. Another valuation metric used to estimate corporate value, the enterprise value to EBITDA ratio (EV/EBITDA), also shows significant overvaluation. Based on the sale price of 5 trillion KRW, eBay Korea's EV/EBITDA was about 33 times last year. Applying the same standard, Lotte Shopping's ratio is 11.6 times, and Emart's is only 6.8 times.

The retail industry views eBay Korea's appropriate EV/EBITDA to be around 13 to 20 times. Translated into price, this corresponds to about 2 trillion to 3 trillion KRW. Considering that as of the 8th, Lotte Shopping's market capitalization is about 3.48 trillion KRW and Emart's is 4.46 trillion KRW, the 5 trillion KRW valuation is still seen as overvalued by the retail industry.

Concerns Over the Winner's Curse

Even if either Lotte Shopping or Emart wins the acquisition after fierce competition, they may suffer aftereffects from excessive acquisition costs. In the past, Kumho Asiana Group spent about 6.4 trillion KRW to acquire Daewoo Engineering & Construction in 2006 and about 4 trillion KRW to acquire Hanjin Transportation the following year. They borrowed as much as 3 trillion KRW from financial institutions, and the resulting deterioration in financial conditions led to the collapse of the entire group.

Woongjin Group also paid 660 billion KRW to Lone Star in 2007 to acquire Geukdong Construction but faced management difficulties in 2008. Despite massive additional capital injections, Woongjin entered court receivership in 2012 and even sold its core asset, Woongjin Coway.

An industry insider said, "Unlike Coupang, eBay Korea, the original open market operator, does not have logistics networks or other tangible assets and earns money only through brokerage fees generated between sellers and buyers, so it is difficult to compare it with typical companies." He advised, "Depending on the situation, the final acquirer must consider not only the sale price but also the enormous logistics investment and platform integration costs that will follow."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)