Impact of Increased Capital Gains Tax on Multi-Homeowners

Decrease in All 24 Districts Except Gwangjin

[Asia Economy Reporter Onyu Lim] Concerns about a freeze in apartment listings in Seoul due to the increased capital gains tax on multi-homeowners are becoming a reality. In Gangnam-gu, 200 listings disappeared in just ten days. Although the government warned that "Seoul apartment prices are approaching their peak," there are worries that the seller's market caused by the shortage of listings will continue, inevitably driving house prices upward.

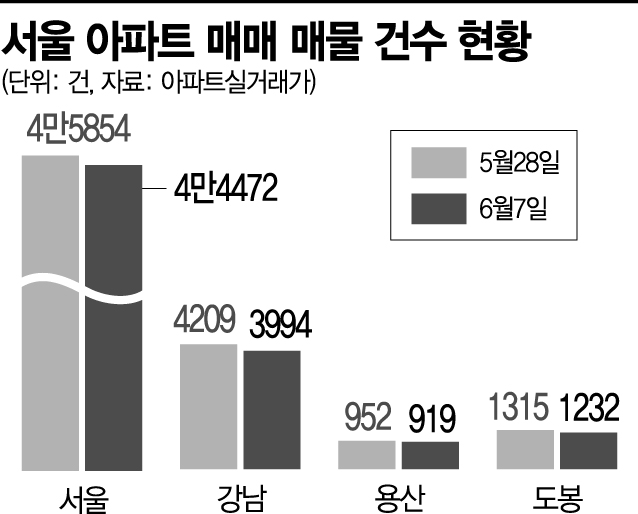

According to Apartment Real Transaction Data, a real estate big data company, the total number of apartment listings in Seoul was 44,472, down by about 1,400 from 45,854 ten days earlier. This trend is appearing across all areas of Seoul, regardless of whether they are in Gangnam or Gangbuk. Among the 25 autonomous districts, listings decreased in all 24 districts except Gwangjin-gu.

In particular, Gangnam-gu, where high-priced homes are concentrated, saw its listings drop from 4,209 to 3,994 during this period, a decrease of more than 200. The number of listings in Gangnam-gu falling to the 3,000 range is the first time in four months since February 15 (3,997 listings).

In the market, there is an analysis that concerns about a freeze in listings due to increased transaction costs after the end of the capital gains tax exemption at the end of last month have materialized. From this month, owners of two homes must pay up to 65% capital gains tax, and owners of three homes must pay up to 75%. For three-homeowners, including a local tax of 7.5%, the total tax exceeds 80% of the capital gains. A real estate agent office official in Gaepo-dong, Gangnam-gu, said, "The holding tax assessment date (the 1st) has already passed, so for multi-homeowners, the holding tax burden is the same regardless of when they sell until the end of May next year," adding, "The reaction is rather to hold on and watch the market atmosphere."

Concerns are growing that the freeze in listings could stimulate house prices. Recently, within the ruling Democratic Party, there are reports that discussions are underway to reduce even the capital gains tax exemption for single-homeowners, which could further intensify this phenomenon. The Democratic Party is currently considering a plan to impose capital gains tax on single-homeowners who sell their homes and earn capital gains exceeding 500 million KRW. This plan would ease the non-taxable capital gains threshold for single-homeowners from 900 million KRW to 1.2 billion KRW but reduce the benefits of the long-term holding special deduction. A real estate industry official said, "As transaction costs increase, the size of assets shrinks and it becomes harder to trade up, making it difficult to sell homes easily."

Yang Ji-young, head of R&C Research Institute, said, "As tax-saving listings are cleared, the freeze in listings will inevitably deepen," adding, "Expectations for house price stabilization due to government supply measures have also faded, so the upward trend is likely to continue in the second half of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.