The season for ‘Chimaek’ (chicken and beer) has returned. In contrast to chicken prices soaring well beyond 20,000 won, the price of live chicken remains in the 2,000 won range, similar to 10 years ago. Although the wholesale price of broiler chickens reached as high as 3,400 won last January, prices have fallen again since May, putting the 2,000 won level at risk. Poultry processing companies, sensitive to external factors such as livestock diseases, international grain prices, and exchange rates, have suffered years of poor performance despite the ‘Chimaek’ craze and the popularity of chicken breast for dieting. This is because the introduction of imported broiler chickens has significantly increased market competition. Harim and Maniker, competing for the top 1-2 shares in the domestic broiler processing market, are striving to find new growth engines. They are restructuring their business model, which has been centered on business-to-business (B2B) transactions, into business-to-consumer (B2C) transactions. They have also revised their survival strategies by entering the home meal replacement market, including instant rice and ramen, as well as chicken.

[Asia Economy Reporter Park So-yeon] Harim is the largest company in the domestic chicken market, focusing on the production of processed broiler products as its main business. It was established in 1990 for the purpose of processing and selling livestock products and manufacturing feed. Despite continuous deficits, Harim’s financial situation worsened due to large-scale investments in production facilities, which increased borrowings. However, this year, it succeeded in turning a profit in the first quarter, aiming to transform into a comprehensive food company.

◆ Harim succeeds in turning a profit = According to the Financial Supervisory Service’s electronic disclosure system on the 7th, Harim posted an operating profit of 8.8 billion won on a consolidated basis in the first quarter of this year, turning profitable compared to an operating loss of 7.3 billion won in the same period last year. The net loss of 16.5 billion won in the first quarter of last year also turned into a net profit of 8 billion won this year. Sales increased by 37.2% to 254.6 billion won compared to the first quarter of last year.

A major factor in the improved performance was the outbreak of highly pathogenic avian influenza (AI) at the end of last year. The large-scale culling of chickens to prevent the spread of AI eased the long-standing oversupply of live chickens. According to the Korea Broiler Association, the average price of live chickens per kilogram in the first quarter of this year was 2,106 won, up 24.6% from the first quarter of last year.

A Harim official explained, "The normalization of the smart factory completed last year contributed to competitiveness, and policy effects such as large-scale culling led to supply shortages, causing live chicken prices to rise." He added, "The market situation has been stable since the second quarter, and we are steadily carrying out internal quality and financial improvement activities."

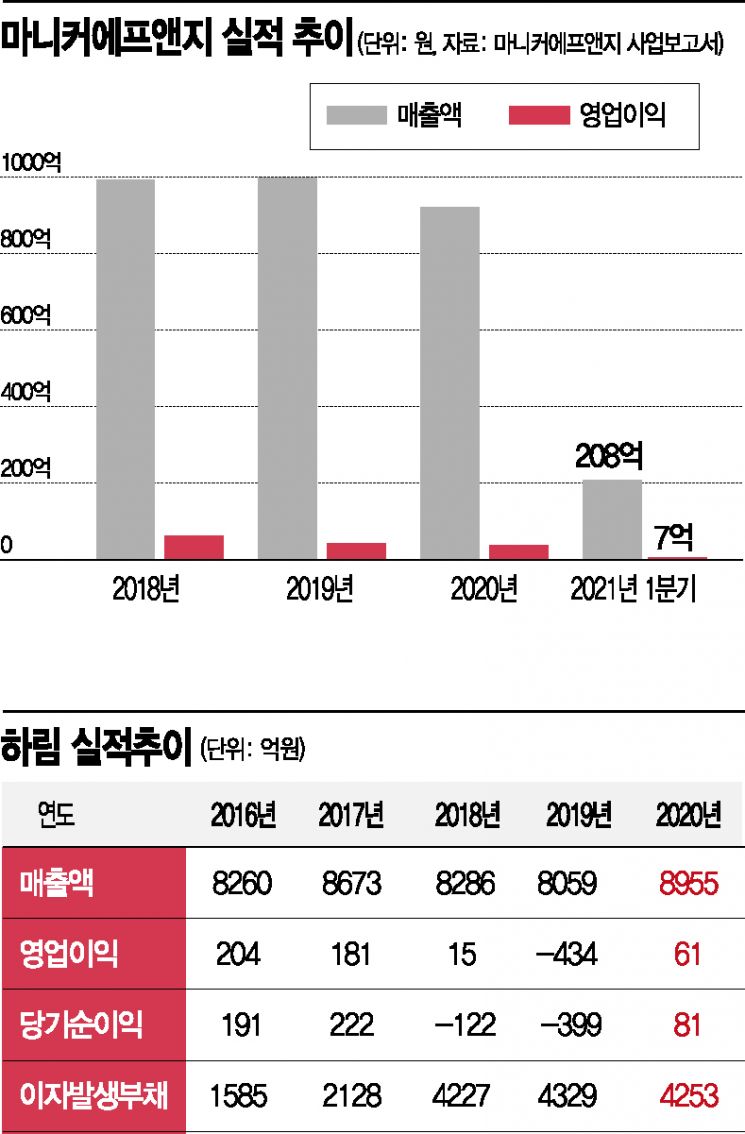

◆ Poultry processing industry with high external volatility, deteriorated financial condition = Until the third quarter of last year, Harim showed poor performance, recording an operating loss of 4 billion won on a consolidated basis. Operating profit margins were 2.47% in 2016, 2.08% in 2017, 0.18% in 2018, -5.39% in 2019, and 0.68% in 2020, showing poor performance around 0% for three consecutive years.

The poor performance was largely due to the sluggish broiler segment, the main business. Since 2018, oversupply caused by increased imports of chicken led to a price collapse of live chickens and deteriorated profitability. Especially, broilers and pork chickens are sensitive to domestic economic conditions and livestock diseases, causing prices to fluctuate sharply. As the economic recession continued around 2015, consumption shrank, delivering a direct blow to the broiler market. Additionally, the industry suffered from consecutive outbreaks of AI and African swine fever (ASF) every year.

The ‘Chimaek’ craze and the popularity of chicken breast as a diet food have only meaningfully improved the performance of famous chicken brands and chicken distribution companies, according to analysis. A Harim official explained, "Feed accounts for 50% of costs, and fluctuations in international grain prices and exchange rates all pressure costs. While the performance of distribution companies improved positively, it was difficult to actively demand price increases for live chickens even if demand rose." It was not easy to secure price competitiveness as cheap imported live chickens flooded the market.

In particular, Harim invested huge costs in factory expansions over the past three years. From 2018 to 2019, when net profits were in deficit, Harim invested 260 billion won to build a smart factory in Iksan, Jeonbuk. As a result, debt increased sharply. Harim’s interest-bearing debt was 158.5 billion won in 2016, 212.8 billion won in 2017, 422.7 billion won in 2018, 432.9 billion won in 2019, and 425.3 billion won in 2020, with a sharp increase in 2018. The debt ratio rose from 120% in 2016 to 183% in 2020.

Recently, with the completion of smart factory expansions for the first and second plants, there is growing expectation for improved quality competitiveness and credit rating upgrades this year. A Harim official said, "Although the timing varies by financial institution, some have already upgraded credit ratings and lowered interest rates, and we expect sequential upgrades. Credit rating agencies’ evaluation results will be announced soon, and we have positive expectations."

Large-scale culling due to avian influenza outbreak

eased oversupply

First quarter operating profit turns to 8.8 billion won

Recent factory expansion investments increased borrowings

Debt ratio rose from 120% to 183% in 4 years

Plans to diversify product portfolio beyond chicken

◆ Challenge to rebirth as a comprehensive food company = This year, Harim took its first step toward diversifying its food business by starting production and sales of instant rice. To overcome the limitations of its chicken-centered business, which accounts for 80% of total sales, Harim plans to produce and sell a variety of products including instant rice, ramen, and soup/stew. Harim differentiated itself in instant rice by using 100% rice, unlike competitors whose products typically contain 99% rice and other additives. This is why Harim named its product ‘Pure Rice.’ Harim, having recruited retired executives from the ramen industry, is also preparing to launch ramen this year. Additionally, by using the Yangjae-dong logistics center, it plans to reduce intermediate logistics costs and secure price competitiveness. Harim also plans to strengthen ESG (environmental, social, and governance) management by expanding its animal welfare product lineup.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.