Exchanges Must Complete FIU Reporting by September 24 per Special Act on Reporting

ISMS Certification and Bank Real-Name Account Verification Required

Currently, the Four Major Exchanges Are the Most Likely Candidates

[Asia Economy Reporter Kim Jin-ho] Cryptocurrency exchanges that have completed registration with financial authorities are expected to emerge as early as July or August. With the deadline for the Special Financial Transactions Information Act (Special Act) exemption just over three months away, both the financial authorities and exchanges are reportedly accelerating related work. One of the so-called 'Big 4' exchanges?Upbit, Bithumb, Korbit, or Coinone?is expected to be the first to register.

According to the financial sector on the 6th, the Financial Intelligence Unit (FIU) under the Financial Services Commission held a meeting with cryptocurrency exchange officials on the 3rd. The meeting was arranged to provide guidance on recommendations to be reflected in the 'business promotion plan of cryptocurrency operators.' Since the registration process with the FIU must be completed by September 24 under the Special Act, consulting work has begun.

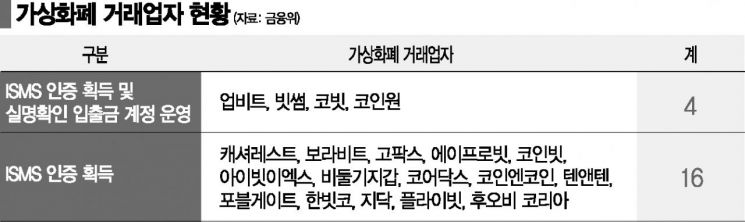

Registration of cryptocurrency exchanges requires Information Security Management System (ISMS) certification first. Among about 60 cryptocurrency exchanges identified by financial authorities, 20 have obtained ISMS certification. It is also known that only exchanges with ISMS certification attended the meeting on the 3rd.

Along with ISMS certification, a key registration requirement is a bank-issued real-name verified deposit and withdrawal account certificate. Among the 20 exchanges, only four (Bithumb, Upbit, Coinone, Korbit) currently operate real-name verified deposit and withdrawal accounts.

Major exchanges are expected to submit their registration to the FIU as soon as the bank-issued real-name verified account certificates are issued. Considering that FIU reviews typically take about three months, the first registered exchange is expected to be approved as early as July or August.

The industry is focusing on the four major exchanges: Upbit, Bithumb, Coinone, and Korbit, as they have both ISMS certification and bank real-name verified deposit and withdrawal account certificates. An industry insider said, "Large exchanges are more likely to pass the review than small and medium-sized exchanges without real-name accounts."

However, there are concerns that even the Big 4 cannot be complacent. For FIU registration, these exchanges must undergo bank evaluations again to receive real-name verified account certificates. Currently, partner banks such as K Bank for Upbit, NongHyup (Bithumb, Coinone), and Shinhan Bank (Korbit) are reviewing contract renewals. Depending on the renewal decisions, these exchanges will be able to proceed with FIU registration.

Meanwhile, failure to register by the Special Act exemption deadline of September 24 or continuing operations without approved registration will result in penalties. Unregistered operations are punishable by imprisonment of up to five years or fines up to 50 million KRW. Even if an exchange closes, it must return deposits and cryptocurrencies to customers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)