How Much Has the Tax Burden Increased?

With Soaring Official Property Prices and Tax Rate Hikes, Multi-Homeowners Face More Than Double Tax Burden

Ruling Party and Government Yet to Conclude Tax Reform...Concerns Over Tax Bomb for Single-Homeowners Too

[Asia Economy Reporter Jo Gang-wook] The strong tax resistance among the public, especially regarding real estate holding taxes, is due to the rapid increase in tax burdens over a short period. While it is natural for holding taxes to rise as housing prices increase, the extent of the increase has reached a level that is difficult for most salaried earners to bear. After the April 7 by-elections, the government and ruling party attempted to reform the tax system to reduce the holding tax burden on single-homeowners, but with no conclusion yet, concerns are rising that not only multi-homeowners but also a significant number of single-homeowners may face a tax bomb.

According to the government on the 4th, the main reasons for the sharp increase in holding tax burdens this year, including the comprehensive real estate tax, are the surge in publicly announced property prices and the hike in tax rates. From this year, the general comprehensive real estate tax rate will rise from the current 0.5?2.7% to 0.6?3.0%, and the rates applied to owners of three or more homes or two homes in regulated areas will increase from 0.6?3.2% to 1.2?6.0%. As a result, many multi-homeowners will see their holding tax burden more than double compared to last year. Currently, all areas of Seoul, most parts of Gyeonggi and Incheon, and many large provincial cities are designated as regulated areas.

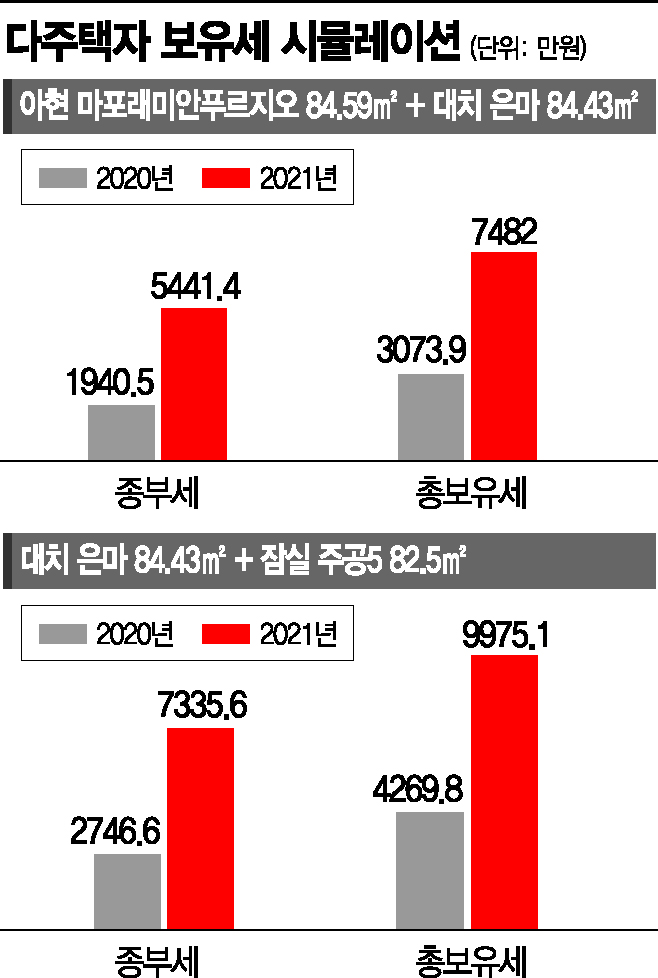

According to calculations by Woo Byung-tak, team leader of Shinhan Bank’s Real Estate Investment Advisory Center, a two-homeowner holding two apartments?Mapo Raemian Prugio (Marae-pu) 84.59㎡ (exclusive area) in Ahyeon-dong, Mapo-gu, Seoul, and Eunma 84.43㎡ in Daechi-dong, Gangnam-gu?must pay 74.82 million KRW in holding taxes this year. This amount is 2.4 times higher than last year’s 30.74 million KRW.

For the Marae-pu 84.59㎡, the publicly announced price rose by 17.27% from 1.077 billion KRW last year to 1.263 billion KRW this year due to government measures to reflect market prices more accurately. The Eunma 84.43㎡ price increased by 11.02%, from 1.533 billion KRW last year to 1.702 billion KRW this year. Consequently, the taxable base moved into higher tax brackets, and the progressive tax rates applied to multi-homeowners in regulated areas further increased the tax burden. By tax category, property tax rose from 1.83 million KRW last year to 2.4 million KRW this year, a 1.3-fold increase, while the comprehensive real estate tax jumped from 19.41 million KRW to 54.41 million KRW, a 2.8-fold increase.

Another two-homeowner holding Eunma 84.43㎡ and Jugong 5 Complex 82.5㎡ in Jamsil-dong, Songpa-gu, must pay 99.75 million KRW in holding taxes this year, 2.3 times the previous year’s 42.7 million KRW. The comprehensive real estate tax increased from 27.47 million KRW to 73.36 million KRW, a 2.6-fold rise. Additionally, a two-homeowner holding Marae-pu 84.59㎡ and Jugdong Prugio 84.99㎡ in Jugdong, Yuseong-gu, Daejeon, paid 9.7 million KRW last year but will pay 23.08 million KRW this year, a 2.4-fold increase. For a three-homeowner holding Marae-pu 84.59㎡, Eunma 84.99㎡, and Jugdong Prugio 84㎡ in Daejeon, the holding tax will rise from 37.85 million KRW last year to 91.31 million KRW this year, also a 2.4-fold increase.

However, discussions between the government and ruling party on reducing holding taxes have made little progress. So far, the only conclusion reached is expanding the property tax exemption threshold from homes valued under 600 million KRW to those under 900 million KRW. Regarding the comprehensive real estate tax, the plan is to impose it on the top 2% of publicly announced property prices, but this approach causes the taxable base to change annually, making it difficult for taxpayers to know whether they are subject to the tax. There are also criticisms that defining the taxable base by proportion violates the principle of legality in taxation.

Moreover, the government draws a line on revising the method of calculating publicly announced property prices, which is the main cause of the sharp rise in holding taxes. Although it disclosed the basic data for calculating apartment prices for the first time this year, the controversy over the 'black box' system continues, and many complexes have filed objections.

Professor Seo Jin-hyung of Gyeongin Women’s University (President of the Korean Real Estate Society) pointed out, "There is no place in the world that imposes taxes by calculating rates in this way," adding, "The government’s policy has failed because it does not understand the psychology of multi-homeowners."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.