Denial of Link Between Corporate Bond Sales and Asset Purchase Reduction

Announcement Made During Sensitive Period

Calls for Tapering Discussion Within Fed Continue

Tapering Debate Likely to Intensify if Employment Data Remains Strong Amid Inflation Concerns

[Asia Economy New York=Correspondent Baek Jong-min] The U.S. Federal Reserve (Fed) has unexpectedly decided to sell corporate bonds and exchange-traded funds (ETFs) it purchased in response to the COVID-19 crisis, sparking analysis that this might be a warm-up for tapering asset purchases. Seemingly aware of this, the Fed emphasized that this is not a signal of monetary policy. However, upcoming inflation and employment indicators suggest that debates over tapering asset purchases will continue.

◇Why now... Fed says "This is not a monetary policy signal"= The Fed’s announcement to sell corporate bonds was unplanned. It was a move that exceeded market expectations, reminiscent of the series of measures taken last year in response to COVID-19. Bloomberg reported that the Fed’s decision came at a sensitive time when the market was closely watching the possibility of tapering discussions by the Fed.

The Fed appeared to try minimizing the market impact of the corporate bond sales while avoiding signaling a tapering of asset purchases. A Fed spokesperson emphasized, "The sale of corporate bonds has nothing to do with monetary policy and is not a signal regarding monetary policy." The New York Times also noted that the Fed tried to signal that this was not a tapering of asset purchases.

Judging by the scale of the corporate bonds being sold, it is difficult to consider this as tapering asset purchases. The $13.7 billion worth of assets being sold is only a very small portion compared to the Fed’s $8 trillion balance sheet. Therefore, the market impact is not as significant as tapering. No particular turbulence was detected in the bond market on the day.

However, the timing of the announcement is sensitive. It was made amid growing opinions that the Fed should discuss tapering asset purchases as the economy recovers rapidly. On the same day, Patrick Harker, President of the Philadelphia Federal Reserve Bank, said it is "at least time to start thinking" about tapering asset purchases.

The Fed’s recently released Beige Book economic report also stated that the economy expanded somewhat faster and that price pressures increased compared to the previous report. This reveals the Fed’s concern about the spread of inflation caused by the rapid economic recovery. If inflation rises more than expected, the Fed’s tapering discussions could be accelerated.

◇The ‘COVID fighter’ stepping down= In March last year, as economic damage from COVID-19 surged, the Fed announced it would use emergency lending authority to purchase corporate bonds. An emergency facility was also established for this purpose. The Secondary Market Corporate Credit Facility (SMCCF), which purchased the corporate bonds being sold now, was one such facility.

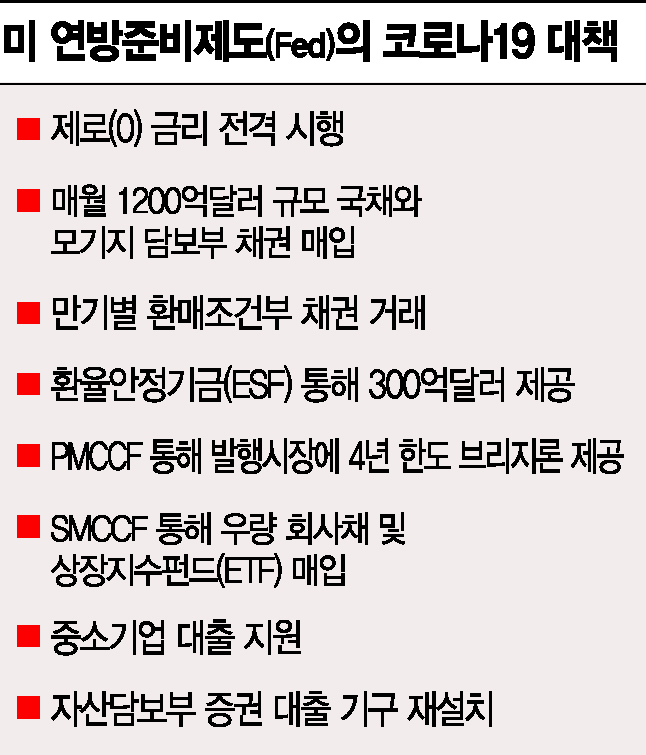

The Fed, unusually for a central bank, directly purchased corporate bonds to provide relief to U.S. companies facing the initial COVID-19 crisis. This was a measure considering that purchasing $120 billion per month of Treasury and mortgage-backed securities alone could not overcome the real economy crisis.

This bold decision by the Fed served as a catalyst for other central banks and fiscal authorities worldwide, including the Bank of Korea, to act swiftly.

The Fed purchased corporate bonds with support from the Treasury Department. At the time, when the Fed responded with support from the Trump administration, criticism arose from the Democratic side. On this day, the Fed emphasized, "The SMCCF played an important role in restoring market functioning and supporting credit for large employers, thereby strengthening employment during the COVID-19 situation."

Primarily investment-grade corporate bonds, or bonds that were investment-grade before the facility was created but later downgraded to speculative grade, as well as related ETFs, benefited from this program. The assets purchased through this program amounted to about $13.7 billion, which was less than initially planned, and purchases ended at the end of last year. This was due to then-Treasury Secretary Steven Mnuchin’s refusal to extend the Fed’s emergency lending program.

The Fed has not disclosed specific plans on when it will sell the corporate bonds it holds. Fed Chair Jerome Powell stated at a House hearing in June last year, "We may sell some corporate bonds into the secondary market, but ultimately we are in a buy-and-hold position."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.