20s Youth Borrow 32 Trillion Won via Mortgage Loans

Variable Rate Loans Estimated at About 70% Share

Increased Risk of Youth Defaults Due to Interest Rate and Asset Volatility

[Asia Economy Reporter Song Seung-seop] Since the launch of the Moon Jae-in administration, the number of people in their 20s taking out housing-related loans from banks has surged. As the mentality of get-rich-quick schemes spreads and debt-financed investment (debt investment) leads many to jump into stocks and cryptocurrencies, concerns are rising that the youth will be the first to be hit hard when interest rates rise.

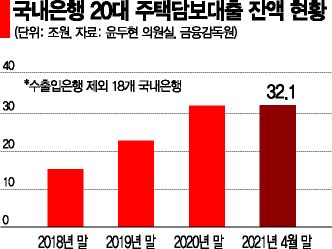

According to the ‘Status of Housing Mortgage Loan Balances by Age Group at Domestic Banks’ submitted by the Financial Supervisory Service to Yoon Doo-hyun, a member of the National Assembly’s Political Affairs Committee from the People Power Party, housing mortgage loans for those in their 20s, which stood at 15.2 trillion won at the end of 2018, surged 111.1% (16.9 trillion won) to 32.1 trillion won as of the end of April. Compared to increases of 32.0% for those in their 30s, and 14.5% and 8.9% for those in their 40s and 50s respectively during the same period, this suggests that people in their 20s have recklessly taken on debt to buy their own homes.

The total housing mortgage loan balance also approached 600 trillion won. The housing mortgage loan balance, which was 493.6 trillion won at the end of 2018, reached 599.2 trillion won as of the end of April.

The problem is that loan interest rates have been rising recently. It is estimated that variable-rate loans account for 70% of the total housing mortgage loan balance. As loan interest rates rise, the burden of interest repayment inevitably increases, raising concerns that the youth, who have rapidly increased their debt, could become the ‘weak link’ in terms of delinquency.

The sharp volatility of risky assets such as stocks and cryptocurrencies also appears to increase the risk of insolvency among young people. As of the first half of last year, more than half of the 7.23 million new stock accounts opened at six major securities firms belonged to people in their 20s and 30s. Their credit loan balances surged 55% compared to the end of the previous year.

According to the cryptocurrency exchange Bithumb, as of the end of January, people in their 20s and 30s accounted for 32.9% and 29.1% respectively of cryptocurrency investments. Baek Jong-ho, a research fellow at Hana Financial Management Research Institute, also diagnosed in his report ‘Status and Implications of Youth Debt after COVID-19’ that "while youth debt is rapidly increasing compared to other age groups after COVID-19, there is a spotlight on the boom in risky asset investments leveraging youth leverage."

In particular, Research Fellow Baek mentioned, "Due to worsening employment conditions and income reductions, vulnerable youth are excluded from financial access, leading to multiple debts, illegal loans, and worsening debt conditions, deepening polarization." As young people rely on secondary financial institution loans to secure living expenses, they fall into multiple debts, perpetuating a vicious cycle of credit delinquency. At the end of last year, the card loan balance for those in their 20s reached 1.1 trillion won, a 19% increase compared to 963 billion won in 2019. The increase rate of revolving service usage was also the highest among all age groups at 6.8%.

Youth Drowning in Debt as Interest Rates Rise... "Easing or Tightening Loans Alone Won't Solve the Problem"

The ‘housing loan dark clouds’ over the youth are expected to deepen. According to the Financial Supervisory Service, the proportion of variable-rate loans, including bank jeonse (key money deposit) loans, in housing mortgage loans is approaching 50%. This means they are vulnerable to interest rate hikes. According to past simulations by the Financial Supervisory Service, the monthly repayment amount for a 300 million won principal loan with a 30-year term and a 3.5% interest rate would increase by about 170,000 won if the interest rate rises by 1 percentage point.

Experts urge the need for careful management based on a comprehensive overhaul of housing policies, rather than simply loosening or tightening loans.

Assemblyman Yoon said, "Due to the Moon Jae-in administration’s flawed real estate policies, panic buying among youth occurred, and debt surged amid the boom in risky asset investments. When interest rate hikes begin, there is a risk that insolvency will spread due to the deterioration of the youth’s loan repayment ability."

Professor Sung Tae-yoon of Yonsei University’s Department of Economics said, "Among the youth, loans should be expanded for borrowers with income and stable future repayment ability, and those who borrowed loans beyond their capacity should be managed proactively." This means a ‘selective approach’ based on repayment ability is necessary. He added, "Ultimately, we need to solve the challenge of how young people can live in quality housing," and analyzed, "We must normalize the chaos in the real estate market that began with the Moon Jae-in administration’s intervention."

Professor Kim Sang-bong of Hansung University’s Department of Economics also advised, "If financial authorities only consider whether to loosen or tighten loans, the problem will not be solved," and suggested, "Since this stems from housing prices, the way to solve the surge in loans is for the skyrocketing real estate asset prices to come down."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.