US $6700 Trillion Record-Breaking Budget Plan

Government Bond Yields Rise Simultaneously

Market Concerns Over Future Deficit Budgeting

Jamie Dimon, JP Morgan CEO

"If Government Budget Is Not Productive Consumption,

Inflation↑·Slow Growth...

Global Trust Will Be Lost," Warns

Yellen: "Not a Concern for Interest Rate Levels

...Limited Impact on Inflation"

Defense Budget About $800 Trillion

1.7% Increase...Focus on Containing China

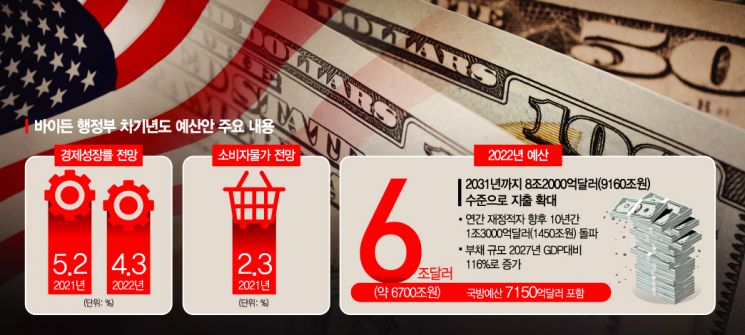

[Asia Economy New York=Correspondent Baek Jong-min, Reporter Park Byung-hee] The Joe Biden administration in the United States has shown its determination to secure the competitiveness of the U.S. economy by preparing an astronomical budget of $6 trillion (approximately 6,700 trillion KRW). However, concerns have also been raised that such large-scale spending could expand liquidity and increase potential instability factors not only in the U.S. economy but also in the global economy. While the Biden administration emphasizes that inflation concerns are temporary, the market remains skeptical.

US Treasury Yields Stir Again Amid Mammoth Budget

= On the 27th (local time), U.S. Treasury yields rose across the board influenced by reports of the Biden administration’s ‘mammoth’ budget proposal. The 10-year Treasury yield recorded 1.609%, and the 30-year yield was 2.289%. Rising Treasury yields mean falling bond prices. The increase in U.S. Treasury yields could become a pressure factor for future interest rate hikes.

The market expressed concerns about the U.S. government having to run an annual deficit budget exceeding $1.3 trillion over the next 10 years. The budget proposal estimates the federal budget deficit will increase to $1.8 trillion in 2022. Total spending is expected to expand to $8.2 trillion (9160 trillion KRW) by 2031.

The Biden administration plans to secure necessary tax revenues through raising corporate taxes, increasing income taxes on high earners, and raising capital gains taxes. Still, the shortfall will have to be financed by issuing government bonds, which leads to rising Treasury yields. Steve Pace, head of bonds at Etico Partners, said, "Supply fears can be quickly reflected in prices."

Janet Yellen, Secretary of the Treasury, appeared at the House Appropriations Committee hearing that day and said, "The standard I pay attention to for the sustainability of the federal government budget is the ratio of interest paid by the government to the overall size of the U.S. economy." According to the Federal Budget Responsibility Committee, the net interest cost borne by the U.S. government is $330 billion this year, about 1.4% of GDP. This is below the 2% average over the past 50 years. Secretary Yellen also reiterated that even with large-scale infrastructure investment, the impact on inflation would be limited.

President Biden’s budget proposal assumes the U.S. economy will grow 5.2% this year, 4.3% next year, and then settle at about 2% growth thereafter. Inflation is projected to be 2.1% this year, 2.2% in 2023, and then 2.3% annually from 2025 through 2031.

The market and critics hold different views.

Jamie Dimon, CEO of JPMorgan Chase, who led efforts to overcome the 2008 global financial crisis with government support, appeared before Congress on the 26th and expressed concern, saying, "If government budgets are not spent productively and are wasted, we will see higher inflation, lower productivity, and slower growth." He even warned, "American democracy will lose the trust of people worldwide."

Larry Summers, professor at Harvard University, criticized the Biden administration’s economic policymakers as complacent and emphasized, "President Biden had the opportunity to be a great president, but he must learn lessons from the failures of the Lyndon Johnson and Jimmy Carter administrations."

Meanwhile, fund rating company Morningstar forecasted core inflation at 2.5% for this year a day earlier. Core inflation between 2022 and 2025 was also estimated at 2.3%, all exceeding the White House’s projections.

Defense Budget Increased by 1.7%... Focus on Containing China

= In the Biden administration’s first fiscal year budget proposal, the Department of Defense budget was allocated $715 billion (approximately 799.227 trillion KRW). This is a 1.6% increase compared to the $704 billion spent in the current fiscal year.

During Donald Trump’s presidency, the Department of Defense budget growth rate was around 3-5%. The defense budget is the area that best shows the difference between the Biden administration and the Trump administration. While the Biden administration has focused on reducing income inequality and expanding social welfare policies such as education and healthcare, the defense budget has not been significantly increased. Bloomberg News reported that considering inflation, the defense budget is effectively a 0.4% decrease in real terms.

The Federal Bureau of Investigation (FBI), Department of Energy, and others also have budgets related to national security. The total of these budgets is $38 billion, and combined with the defense budget, the total national security-related budget is $753 billion. This also represents only a 1.7% increase compared to the current fiscal year.

According to foreign media, the defense budget includes investment plans for readiness, space industry, nuclear weapons technology, and the ‘Pacific Deterrence Initiative (PDI)’ aimed at containing China. The PDI is a plan to strengthen U.S. military readiness by supporting missile, satellite, and radar systems in the Indo-Pacific region, targeting China containment.

The U.S. Department of Defense is reportedly pursuing plans to secure funds by disposing of old equipment with high maintenance costs, such as four coastal combat ships and A-10 attack aircraft.

Immediately, Republicans criticized the defense budget as insufficient. Defense Secretary Lloyd Austin appeared before Congress that day and responded that $715 billion is sufficient to respond to threats from a rising China, climate change, and risks from the COVID-19 pandemic.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)