Decentralized Finance System DeFi

High Returns Expected from Loans and Deposit Interest

High Risks and Potential Market Turmoil... Security and Investor Protection Issues Also Present Limitations

[Asia Economy Reporter Gong Byung-sun] Mr. A, who is well-known among cryptocurrency investors, revealed on the 19th that he lost 3.5 billion KRW out of approximately 3.9 billion KRW invested in cryptocurrency in just one day. At that time, the leading cryptocurrency Bitcoin only dropped 5.69% in one day. The reason Mr. A suffered losses beyond common sense was because he invested using a DeFi platform. What kind of investment space is a DeFi platform that caused him to lose most of his money at once?

DeFi, a Decentralized Financial System... Both Loans and Deposits Are Made

DeFi is a term combining "De" meaning decentralization and "Finance," referring to a decentralized financial system. Based on peer-to-peer transactions, cryptocurrency loans and deposits are conducted on what is called a "DeFi protocol," which is a DeFi platform.

On a DeFi protocol, you can deposit cryptocurrency as collateral and borrow new cryptocurrency to generate profits. In a bull market, you can hold more cryptocurrency, leading to significant gains. If there is a strong belief that the market will perform well, you can obtain more cryptocurrency through loans for capital gains.

There is also a way to earn interest by depositing cryptocurrency into a DeFi protocol. The interest rates exceed 10%. Recently, DeFi yield farming has gained even more popularity. When you deposit cryptocurrency, the DeFi protocol pays interest in the form of its own native cryptocurrency.

As the cryptocurrency market surged recently, the native cryptocurrencies created by DeFi protocols were sold at high prices on exchanges, allowing DeFi yield farming investors to earn greater profits. For example, Compound, a cryptocurrency created by the DeFi platform Compound protocol, was traded at 475,370 KRW on the US cryptocurrency exchange Coinbase as of 8:54 AM on the 25th. This represents a 539.95% increase compared to June of last year.

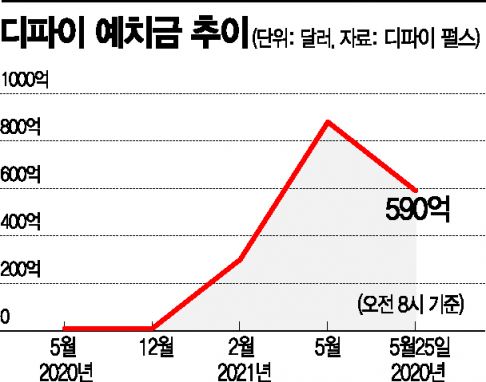

Consequently, the popularity of DeFi has naturally increased. According to DeFi data site DeFi Pulse, as of 8 AM that day, the total amount deposited in DeFi was 59 billion USD (approximately 66.2983 trillion KRW). Just a year ago, it was only 949 million USD. On the 12th of this month, the deposited amount even rose to 88 billion USD.

Higher Risks Than General Investments... Investor Protection Issues Remain Uncertain

The problem is that investments using DeFi carry high risks due to leverage effects. If the cryptocurrency crashes before you can respond, you may lose all the cryptocurrency you deposited as collateral. When you deposit cryptocurrency as collateral, you receive a loan up to a certain percentage of the collateral amount, but as the market price of the collateral cryptocurrency falls, the collateral ratio rises. If the collateral ratio reaches 100%, the DeFi protocol will conduct a forced liquidation by selling all the customer's cryptocurrency regardless of their consent. If a large amount of cryptocurrency is liquidated at once, it inevitably leads to market turmoil.

In fact, the reason for the unusually large drop this time is interpreted as being due to forced liquidations occurring on DeFi protocols. According to US economic media Yahoo Finance on the 21st (local time), Antoni Trenchev, CEO of cryptocurrency lending company Nexo, stated, "The reason for the large correction on the 19th was that many leveraged investors borrowed cryptocurrency to invest."

Security and investor protection issues are also concerning. According to cryptocurrency media The Block, 15 DeFi platforms were hacked last year, with estimated damages ranging from 120 million to 250 million USD. Nevertheless, since DeFi is based on peer-to-peer transactions, responsibility is unclear. According to Korea's Depositor Protection Act, if a bank or financial institution goes bankrupt, deposits are protected up to 50 million KRW per person, but DeFi does not protect investors.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.