[Asia Economy Reporter Ji Yeon-jin] The tapering issue, related to concerns over U.S. inflation, is permeating the domestic stock market. Although the U.S. consumer price index surged last month more than expected, bringing the tapering issue to the forefront, the prevailing analysis is that considering the U.S. economic recovery situation, it is not yet the time for tapering signals to become visible.

According to the financial investment industry on the 23rd, the first tapering by the U.S. Federal Reserve (Fed) in 2013 refers to the 'taper tantrum,' an unexpected spasmodic phenomenon that can occur when tightening policies such as raising interest rates are implemented unexpectedly by market investors.

However, the taper tantrum's shock to the stock market gradually eased through communication between the Fed and the market afterward, and foreign capital outflows calmed in the domestic stock market, which had favorable fundamental conditions.

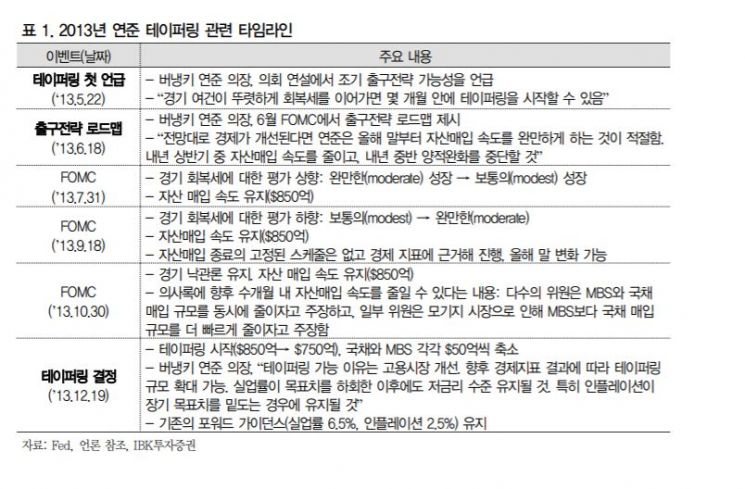

Bernanke, then Fed Chairman, directly mentioned the possibility of tapering in a congressional speech on May 22, 2013. Less than a month later, at the June Federal Open Market Committee (FOMC), a concrete exit strategy roadmap was announced. Because tapering discussions proceeded rapidly without much communication with the market, the taper tantrum occurred. Interest rates surged sharply, and stocks fell significantly.

The S&P 500 and KOSPI dropped nearly 5% and 10% respectively from their peaks. After experiencing the taper tantrum, the Fed focused on communication with the market. Although the overall direction of tapering remained unchanged, the Fed narrowed differences in views with the market regarding decision criteria and timing, and in the process, the impact of the Fed’s tapering signals on the stock market gradually weakened. In fact, when tapering was decided to begin at the December FOMC based on employment recovery, both the U.S. and domestic stock markets rose.

However, concerns remain that the Fed’s tapering possibility, the spread of COVID-19 in neighboring countries such as Taiwan, and the sharp fluctuations in Bitcoin prices could become variables. Especially, the mention of the possibility of starting tapering discussions in the April FOMC minutes has shaken investor sentiment. An So-eun, a researcher at IBK Investment & Securities, said, "Considering the slower recovery of U.S. employment and consumption indicators released after the April FOMC, the condition of ‘if the economy continues to progress rapidly’ is not met," adding, "As confirmed through various remarks by Chairman Powell and other key voting members after the April FOMC, a dovish stance is being maintained. There are limits to tapering signals becoming visible immediately."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)