[Asia Economy Reporter Minji Lee] A tense standoff continues between individual investors and institutional and foreign investors regarding the direction of the index. In the exchange-traded fund (ETF) market, individuals have been net buyers of leverage ETFs that predict index rises, while institutions and foreigners have been buying inverse ETFs, betting on index declines.

Institutions and Foreigners ‘Inverse’ vs Individuals ‘Leverage’

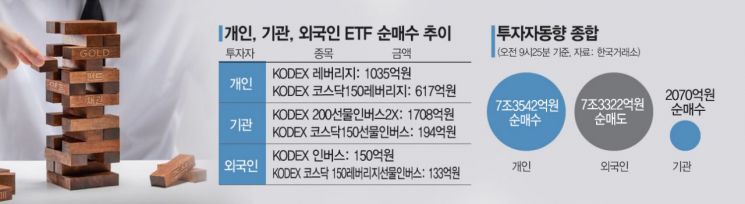

According to the Korea Exchange on the 18th, individual investors have purchased 103.5 billion KRW worth of ‘KODEX Leverage’ this month, making it the most bought ETF. From the 10th to the day before, they net bought 245.4 billion KRW worth of this stock over a week, emphasizing a bullish view on the index. The same trend is seen in the KOSDAQ market. Individuals have continued to bet on index rises by buying 62 billion KRW worth of ‘KODEX KOSDAQ150 Leverage,’ which aims to achieve twice the rise of the KOSDAQ index, since May.

However, the inverse ETFs, which they had been steadily buying, turned into net sales. From the beginning of this year until the end of last month, individual investors increased their investment in inverse ETFs more than in leverage ETFs. They bought 473.8 billion KRW worth of ‘KODEX 200 Futures Inverse 2X,’ which seeks twice the inverse movement of the index, and 121.7 billion KRW worth of ‘KODEX Inverse.’ But this month, they sold 157 billion KRW worth of KODEX 200 Futures Inverse 2X.

Conversely, foreign and institutional investors absorbed all the inverse ETF volumes sold by individuals, betting on index declines. This month, institutions bought 170.8 billion KRW worth of KODEX 200 Futures Inverse 2X, ranking fourth in institutional net purchases. Foreigners also predicted index declines by buying ‘KODEX Inverse (15 billion KRW)’ and ‘KOSDAQ150 Leverage Inverse (13.3 billion KRW).’ In fact, foreigners and institutions continued a net selling trend in domestic stocks. Foreigners have persistently net sold this month, offloading a total of 7.3542 trillion KRW worth of stocks, while institutions only net bought 207 billion KRW worth of stocks.

Heightened Wait-and-See Sentiment... Long-Term ‘Bullish’ on the Index

The fact that foreigners and institutions are betting on index corrections can be interpreted as them reacting more sensitively to negative news than positive ones. Concerns about an early start to the U.S. Federal Reserve’s tapering (asset purchase reduction) due to inflation, the resurgence of COVID-19 in Asian countries such as Taiwan and India, and the resumption of short selling have combined to deepen the wait-and-see sentiment toward the index. In the U.S. stock market, which leads the domestic stock market, uncertainty over inflation remains unresolved, expanding cautious sentiment toward risk assets. Junho Byun, a researcher at Heungkuk Securities, said, “Although the Fed has repeatedly stated it will continue accommodative policies, the market sees tapering as likely in the second half of the year. Investors may realize profits within the second quarter, so until Fed-related uncertainties clear, it will be difficult for the index to maintain a resilient upward trend.”

However, as corporate profitability recovery due to economic recovery becomes visible, the upward trend of the index is expected to continue. Shinhan Financial Investment projected the KOSPI band for the second half of the year to be between 3000 and 3700, analyzing that profit improvements from economic recovery and the restoration of corporate dividend payout tendencies will support the index rise. Seokhyun Park, a researcher at KTB Investment & Securities, explained, “Domestic GDP growth is expected to reach up to 4% this year, which accompanies a positive outlook for corporate profits. Contrary to market concerns, the fundamental conditions of the stock market environment are favorable, so continuing to buy sectors with strong earnings momentum will be positive.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.