Korea Development Bank Reports Sharp Increase Compared to Same Period Last Year Due to Non-Recurring Factors

[Asia Economy Reporter Kim Jin-ho] In the first quarter of this year, the net profit of domestic banks surged by a staggering 71.8% compared to a year ago, reaching 5.5 trillion won. The state-run Korea Development Bank (KDB) had a significant impact. The net interest margin (NIM), which had been declining, also turned upward.

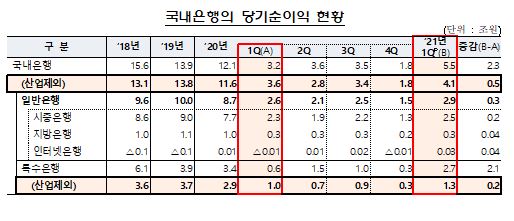

According to the '2021 First Quarter Domestic Banks' Operating Performance (Preliminary)' announced by the Financial Supervisory Service on the 17th, net profit was 5.5 trillion won, an increase of 71.8% (2.3 trillion won) from 3.2 trillion won in the same period last year.

The sharp increase in net profit in the banking sector was due to non-recurring factors at KDB. KDB, which recorded a loss of 400 billion won in the first quarter last year, posted a net profit of 1.4 trillion won in the first quarter this year. This was influenced by non-interest income of 900 billion won from increased convertible bond valuation gains due to stock price fluctuations of HMM (formerly Hyundai Merchant Marine) and dividend income of 300 billion won from Korea Electric Power Corporation. Excluding KDB, the net profit of the other 18 banks was 4.1 trillion won, an increase of 500 billion won from 3.6 trillion won in the same period last year.

Interest income was 10.8 trillion won, up 700 billion won from 10.1 trillion won in the same period last year. This was thanks to a 9.7% increase in operating assets such as loan receivables despite the decline in NIM. The NIM in the first quarter of this year was 1.43%, up 0.05 percentage points from 1.38% in the previous quarter, halting the downward trend that had continued since the first quarter of 2019.

Non-interest income rose by 800 billion won to 2.5 trillion won from 1.7 trillion won in the same period last year. Selling and administrative expenses increased by 100 billion won to 5.7 trillion won from 5.6 trillion won in the same period last year. Labor costs increased by 200 billion won, while material costs decreased by 100 billion won.

Loan loss provisions were 600 billion won, down 400 billion won from 1 trillion won in the same period last year. A Financial Supervisory Service official explained, "This is a reflection of the increased provisions made last year in preparation for COVID-19."

Non-operating income and expenses were 400 billion won, an increase of 1.2 trillion won compared to the same period last year. However, excluding KDB, the non-operating income and expenses of the other 18 banks decreased by 100 billion won.

Profitability indicators such as return on assets (ROA) and return on equity (ROE) rose sharply. They increased by 0.02 percentage points and 3.46 percentage points, respectively, to 0.73% and 9.7% compared to the same period last year. Based on the 18 banks excluding KDB, ROA was 0.59% and ROE was 8.42%, rising by 0.02 percentage points and 0.44 percentage points, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.