Goldman Sachs Forecasts Eurozone Q3 GDP Annualized Growth Rate at 13%

UK Records Zero Deaths for First Time in 14 Months... Germany's Economic Sentiment Index Hits Highest in 21 Years

Norway Withdraws Record Funds for Second Consecutive Year from Sovereign Wealth Fund to Stimulate Economy

[Asia Economy Reporter Park Byung-hee] As the European economy begins to rebound in earnest, Bloomberg News reported on the 11th (local time) that Europe will become another pillar driving the global economic recovery, following the United States and China.

With the acceleration of vaccine rollout in Europe, the economic recovery trend in Europe is expected to become more pronounced. In a report released on the same day, Goldman Sachs predicted that the Eurozone's GDP growth rate in the third quarter of this year will reach an annualized 13%, surpassing that of the United States. It analyzed that after the US GDP growth rate peaked at 10.5% in the second quarter, the European GDP growth rate will come into focus. Jan Hatzius, an economist at Goldman Sachs, stated, "If vaccine rollout is successfully carried out over the next few months, the European economy could show growth significantly above trend."

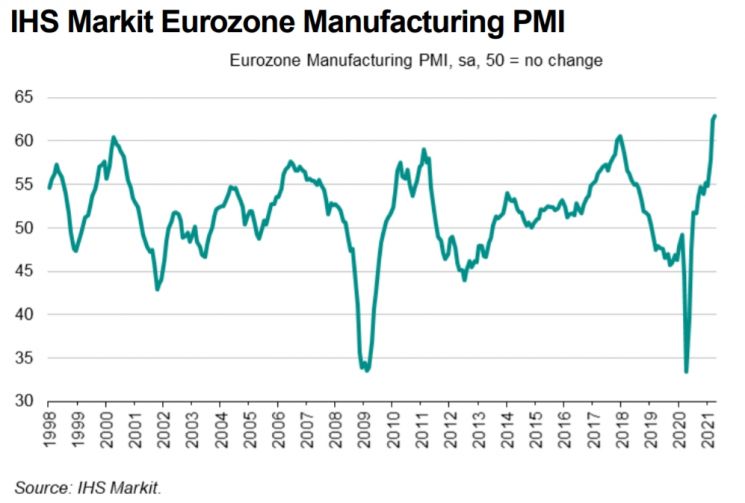

Financial information firm IHS Markit announced that last month, the Eurozone Manufacturing Purchasing Managers' Index (PMI) recorded 62.9, the highest since the index began in 1997. Following 62.5 in March, it marked the highest level for two consecutive months, raising expectations for economic recovery.

The European Central Bank (ECB) forecasts the Eurozone economic growth rate at 3.9% this year. However, on the same day, Klaas Knot, President of the Dutch Central Bank and ECB Executive Board member, expressed that the Eurozone economic growth rate forecast for this year could be revised upward to over 4%.

As vaccine rollout spreads, the return to normalcy in the European economy is also accelerating. Spain lifted nighttime curfews and inter-regional travel restrictions on the 9th, for the first time in half a year.

In the United Kingdom, no COVID-19 deaths were reported on the 9th for the first time in 14 months. From the 17th, the UK plans to further ease COVID-19 restrictions by removing mask-wearing recommendations in secondary schools and allowing overseas travel. From the 21st of next month, it is also considering easing social distancing rules requiring at least 1 meter of distance.

Germany, where the vaccination rate has been rapidly increasing recently, also lifted nighttime curfews and gathering restrictions for vaccinated or recovered individuals starting last weekend. Germany's vaccination rate, which was at 12% in early April, rose to 32.6% as of the 9th.

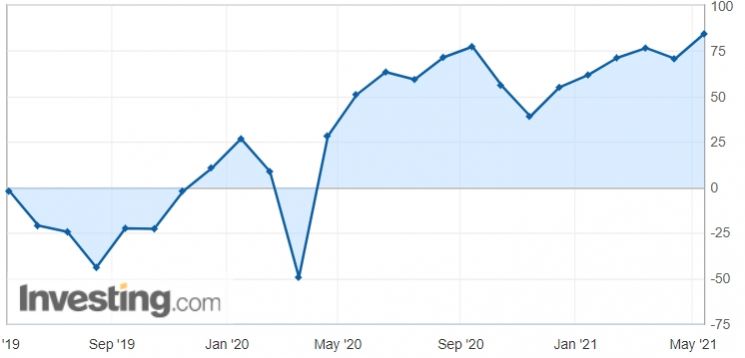

With the increase in vaccinations, expectations for the economy are also growing. The Center for European Economic Research (ZEW), a German private economic research institute, released the May Economic Sentiment Index on the 11th, recording 84.4, the highest in 21 years. This is a 13.7-point increase from the April index.

Isabel Schnabel, an ECB Executive Board member, said in an interview with German media on the same day that inflation could exceed 3% due to Germany's economic recovery, but that high inflation rates are unlikely to persist.

European governments' efforts to stimulate the economy are also ongoing. The Norwegian government announced its budget spending plan on the same day, stating it will withdraw 402.6 billion kroner from its sovereign wealth fund to spend on economic recovery.

Norway operates its sovereign wealth fund with revenues generated from North Sea oil fields. The fund's size is about $1.3 trillion, making it the largest pension fund in the world. The Norwegian parliament has set a 3% cap on the withdrawal of sovereign wealth fund assets for government use. However, exceptions to the 3% cap are allowed during economic difficulties.

Last year, the Norwegian government also withdrew 369.3 billion kroner from the sovereign wealth fund to stimulate the economy. This amount was four times the previous maximum withdrawal. This was due to Norway's GDP shrinking by 2.5% last year, marking the worst performance since World War II.

This year's withdrawal amount is about 9% higher than last year's. The government expects the withdrawal to be about 3.7% of the sovereign wealth fund's assets, anticipating that the 3% cap will be exceeded for the second consecutive year.

The 402.6 billion kroner is significantly higher than the 331.1 billion kroner forecasted in November last year. The Norwegian government explained that the economic growth rate for this year is expected to be 3.7%, lower than the 4.4% forecast made in October last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)