S&P Maintains Rating, Moody's Also Keeps Existing Sovereign Credit Rating (Aa2, Stable)

Ministry of Economy and Finance: "Credit Rating Agencies Focused on Countries' Fiscal Stabilization Efforts... Will Ensure Thorough Measures Including Strengthened Total Volume Management"

[Sejong=Asia Economy Reporter Kim Hyunjung] The international credit rating agency Moody's has forecast that the Korean economy could grow by 3.5% this year, supported by strong export performance and an expansionary fiscal strategy. However, concerns were raised about aging population pressures and the rapid increase in government debt.

According to the Ministry of Economy and Finance on the 12th, Moody's revised upward its forecast for Korea's GDP growth rate this year from the previous 3.1% (February) to 3.5%, an increase of 0.4 percentage points. Christian de Guzman, Moody's Director of Government Credit Ratings, stated, "Korea's GDP growth rate last year was -1.0%, outperforming similarly rated advanced countries," adding, "Especially due to strong demand for Korea's manufacturing exports in the electronics sector and the government's appropriate fiscal strategy, the growth rate is expected to rebound to 3.5%."

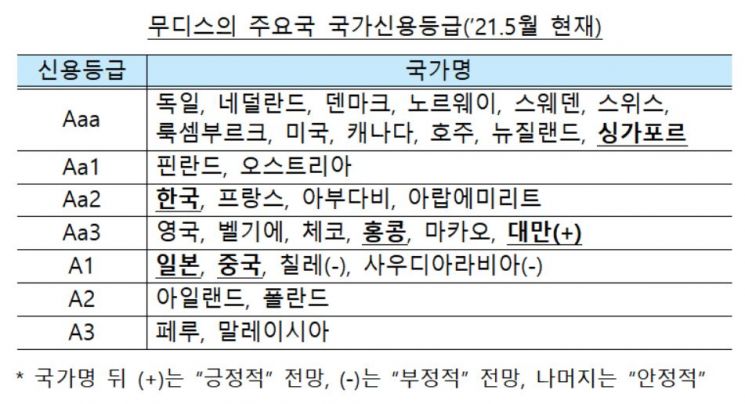

Korea's sovereign credit rating and outlook were maintained at 'Aa2·Stable.' This is the second highest rating among Asian countries after Singapore (Aaa), and the third highest overall based on the entire credit rating scale (Aaa, Aa1, Aa2). Moody's explained, "This reflects very strong fundamentals that supported a resilient recovery from the COVID-19 shock."

Concerns were expressed regarding Korea's aging population, rapidly increasing government debt, and risks related to North Korea. Moody's stated, "Korea's credit issues are related to long-term cost burdens from aging and military issues with North Korea," adding, "As the Korean government's expansionary fiscal stance is expected to continue, national debt is also at historically high levels." They further noted, "This could test Korea's long-standing fiscal discipline."

However, Moody's viewed that Korea has sufficient capacity to manage its debt. They forecast, "As tax revenues gradually recover and debt costs remain stable under low interest rate conditions, Korea's debt capacity will continue to be strongly maintained." Factors that could lead to an upgrade of Korea's credit rating include ▲ economic and structural reforms that can raise potential growth rates and ▲ reduction of geopolitical risks, while factors for a downgrade include ▲ escalation of geopolitical risks ▲ strong and sustained economic damage from domestic and external shocks ▲ significant deterioration of government finances.

In response, the Ministry of Economy and Finance emphasized, "Considering that credit rating agencies have recently shown great interest in governments' fiscal stabilization efforts after COVID-19, we will actively promote the legislation of fiscal rules together with the National Assembly, and ensure thorough fiscal stabilization efforts such as strengthening total volume management when preparing the 2021-2025 National Fiscal Management Plan."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.