[Asia Economy Reporter Oh Hyung-gil] It has been pointed out that measures should be established to provide practical incentives for private pension contributions to middle-class or low-income groups who are at risk of falling into poverty after retirement.

On the 9th, Lee Tae-yeol, Senior Research Fellow at the Korea Insurance Research Institute, stated in the report titled "Effectiveness and Improvement Tasks of Tax-Qualified Personal Pension Tax System," "Since the income replacement rate expected from public pensions and retirement pensions is insufficient, it is necessary to provide incentives for individuals to accumulate private pensions on their own."

According to the report, the tax characteristics of Korea's tax-qualified personal pensions are the application of tax credits at the contribution stage and the application of separate taxation up to a certain limit at the receipt stage.

The report explained, "For those whose income tax rate is higher than the tax credit rate, there is an issue where income tax is effectively imposed at both the contribution and receipt stages on a significant portion of the principal. On the other hand, for low-income groups whose tax credit rate is higher than the income tax rate, there are often no final tax amounts, limiting the motivation provided by tax credits for voluntary retirement income preparation."

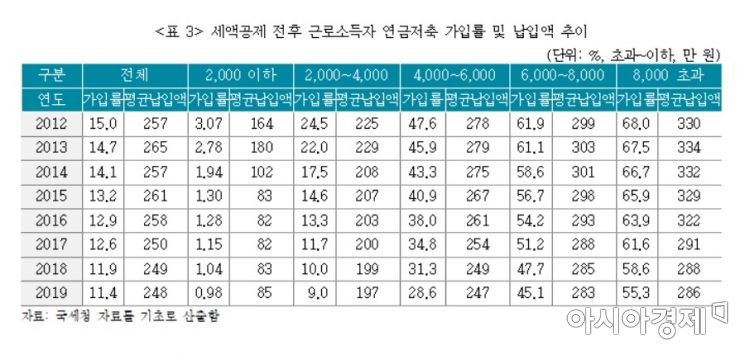

In particular, for those with an annual income of 20 million won or less, the subscription rate is virtually close to 0%, and even for those earning between 20 million and 40 million won, the subscription rate in 2019 was below 10%.

Trends in Employee Pension Savings Enrollment Rate and Contribution Amount (Source: Korea Insurance Research Institute)

Trends in Employee Pension Savings Enrollment Rate and Contribution Amount (Source: Korea Insurance Research Institute)

He added, "It is desirable for the tax system of tax-qualified personal pensions to exempt the entire contribution amount from taxation, but if the current tax credit is to be maintained, the 'separate taxation' and 'non-application of social insurance premiums' applied at the pension receipt stage should be continuously maintained," and "through low-rate separate taxation and exemption from social insurance premiums, the burden at the receipt stage should be alleviated to allow room for voluntary retirement income preparation using tax-qualified personal pensions."

The report also proposed, "It is necessary to generalize the function of medical expense pension accounts to apply additional separate tax limits for unavoidable expenses such as medical costs through computerized processing without requiring account designation or medical expense document verification," and "Since Korea already allows the establishment of medical expense pension accounts using existing pension savings, setting additional separate tax limits for medical expenses should not be difficult."

The researcher emphasized, "Since tax-qualified personal pensions are subscribed to by various occupational groups, it is necessary to consider the characteristics of these groups and review whether there are other expenses besides medical costs that require additional separate tax application."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)