Price Increases in Raw Materials → Supply Disruptions → Sales Slump

Profit-Taking in Tech Growth Stocks Expected to Continue for a While

Focus on US Consumer Price Index on the 12th (Local Time)

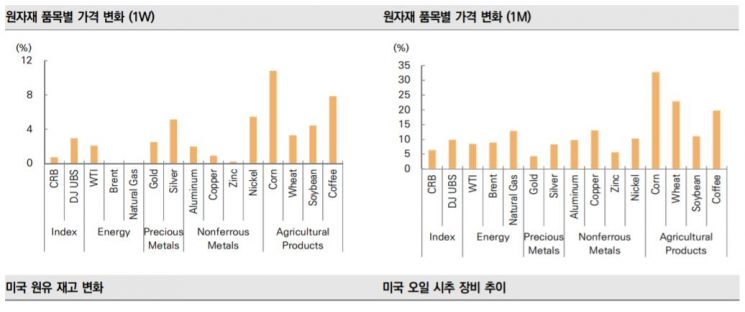

[Asia Economy Reporter Ji Yeon-jin] Recently, as various indicators such as international oil prices, grain prices, and maritime freight rates have risen and supply disruptions have occurred, attention is focused on the impact on the stock market. Amid renewed inflation concerns linked to U.S. Treasury Secretary Janet Yellen's remarks on interest rate hikes, if the speculative demand that recently exacerbated supply disruptions disappears, sectors considered beneficiaries of inflation, such as automobiles and semiconductors, are expected to gain.

According to the financial investment industry on the 9th, last month, the U.S. ISM Purchasing Price Index rose to its highest level since July 2008. Opinions on the persistence of inflation were divided, but recently, various indicators such as international oil prices, grain prices, and maritime freight rates have stimulated inflation sentiment, causing the U.S. 5-year Breakeven Inflation Rate (BEI) to rise to 2.7%, the highest since July 2008. The BEI 10-year rate is at its highest level since September 2012.

In this situation, Treasury Secretary Yellen's remarks on interest rate hikes on the 4th (local time) poured cold water on the stock market. Secretary Yellen mentioned the necessity of raising interest rates to curb economic overheating, and although Federal Reserve officials actively denied this, the impact was limited. However, it is expected that such situations are likely to recur in the future. Park Hee-chan, a researcher at Mirae Asset Securities, said, "Since the U.S. capital gains tax issue remains uncertain, the rotation phenomenon involving profit-taking in tech growth stocks and the concept of economic normalization and interest rate hikes is likely to continue for some time."

The financial investment industry is focusing on the U.S. April Consumer Price Index to be released on the 12th (local time). Inflation is expected to rise significantly year-on-year due to the base effect from last year's COVID-19, and if it is higher than the previous month, it is anticipated that the faction supporting Secretary Yellen's interest rate hike opinion will increase.

In particular, if supply disruptions worsened by speculative demand continue, inflationary pressures this summer could be stronger than expected, putting pressure on the Federal Reserve. Additionally, risks are mentioned that corporate earnings could suffer due to production disruptions caused by supply issues. In this case, automobiles and electronic products could be disadvantaged. Lee Eun-taek, a researcher at KB Securities, said, "U.S. automobile sales have so far managed sales by securing dealer inventory, but if production delays continue, sales volume could be impacted, and other finished products may face similar issues," adding, "however, if the speculative demand problem is resolved in the second half of the year, automobiles and semiconductors will rather benefit as supply bottlenecks disappear."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.