[Asia Economy Reporter Yuri Kim] Hyundai Department Store Duty Free stopped operating duty-free product delivery counters at regional airports last month. This means that passengers boarding international flights departing from regional airports can no longer receive Hyundai Department Store Duty Free products, effectively abandoning consumers on routes departing from regional areas. Considering that non-stop overseas sightseeing flights from major regional airports began this month, this is an unusual move.

◆100 Cases per Month, Delivery Counter Operation Suspended

According to the distribution industry on the 7th, Hyundai Department Store Duty Free suspended the operation of delivery counters at regional airports such as Gimhae and Daegu airports on the 26th of last month. This applies to regional airports excluding Incheon and Gimpo airports. At Gimpo Airport, operations related to the non-stop sightseeing flights that started this month are only carried out on a limited basis.

The reason Hyundai Department Store Duty Free made this decision is that the number of duty-free product deliveries at regional airports sharply decreased due to the impact of COVID-19. It is explained as a decision for management efficiency amid the ongoing COVID-19 situation. The duty-free store said, "Even at Gimhae Airport, which has the highest number of deliveries among regional airports, the number was less than 100 cases per month," adding, "We had no choice but to suspend operations."

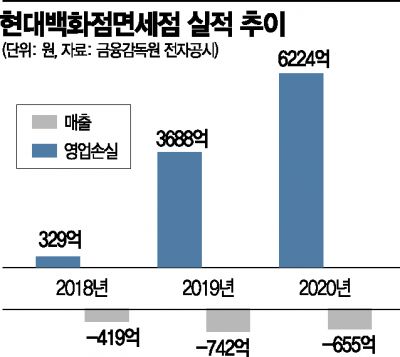

Hyundai Department Store Duty Free is the fourth largest operator following Lotte, Shilla, and Shinsegae Duty Free. As of the end of last year, its market share based on downtown duty-free stores was about 10.7%. It obtained its first downtown duty-free license in the Seoul area in October 2018, and recorded operating losses of 41.9 billion KRW in 2018, 74.2 billion KRW in 2019, and 65.5 billion KRW last year.

In the first quarter of this year, operating losses were significantly reduced to 11.2 billion KRW compared to the same period last year. Industry analysts say this was greatly influenced not only by temporary rent reductions but also by management efficiency efforts across the business, such as the suspension of delivery counter operations at regional airports.

◆Duty-Free Stores at a Crossroads for Survival

Reducing the scale of duty-free stores to cut costs is continuing across the industry. Earlier, Shinsegae Duty Free, the third largest operator, also announced that it will withdraw its Gangnam branch, operated in Central City, Seocho-gu, Seoul, starting July. This is three years after opening the Gangnam branch in July 2018, closing before completing the five-year license period. Shinsegae Duty Free said the withdrawal of the Gangnam branch is part of a "business restructuring for survival." The industry believes that the annual rent of up to 15 billion KRW was burdensome during the 'soft opening' situation caused by COVID-19.

Shinsegae Duty Free also recorded an operating loss of 42.6 billion KRW last year, turning to a deficit. Although performance improvement is expected in the first quarter of this year, it is analyzed that this is also the result of "tightening the belt" rather than an improvement in business conditions.

The duty-free industry unanimously agrees that fundamental competitiveness enhancement is necessary rather than temporary relief. Last year, Chinese duty-free stores, which focused on expanding scale by significantly raising duty-free limits under government leadership, rose to become the world's number one, increasing the sense of crisis. To find solutions, the industry has decided to officially request the government to raise the duty-free limits. The domestic duty-free limit has remained at $600 (about 670,000 KRW) for seven years, and the need for an increase has been consistently raised.

An industry official said, "Non-stop sightseeing flights, which have scale limitations, cannot fundamentally solve the difficulties of the duty-free industry," adding, "In this situation where even existing operations cannot be maintained and stores are withdrawing, we cannot help but be outpaced by China, which is expanding scale under government leadership. For strengthening global competitiveness, government-led improvement efforts are needed before the post-COVID era fully begins."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.