Guidelines for Policy Financial Support to Selected Companies Released... Plan to Maximize Support

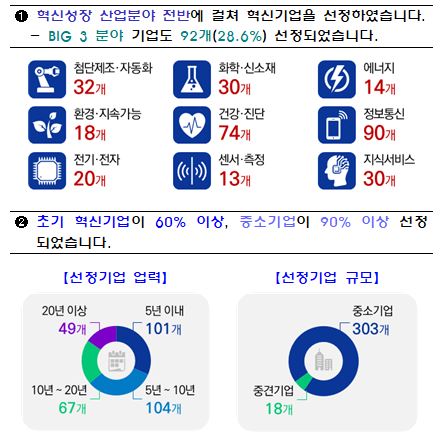

[Asia Economy Reporter Jin-ho Kim] The Financial Services Commission announced on the 6th that it has additionally selected 321 companies in the 3rd round of the 'Innovative Companies National Representatives 1000,' which will become a new growth engine for the Korean economy.

The Innovative Companies National Representatives 1000 is a project that selects representative companies leading future innovation in each industry based on evaluations by institutions with a high understanding of the industrial sector. A total of 600 companies have been selected over three rounds so far.

The 3rd round of innovative companies was selected by nine government ministries with a high understanding of each industrial sector, such as core manufacturing and ICT (Information and Communication Technology), considering the characteristics of each industry. ICT companies were the most numerous with 90, followed by health and diagnostic companies with 74, advanced manufacturing and automation companies with 32, and knowledge service companies with 30. More than 60% of the selected companies are early-stage innovative companies, and 90% are small and medium-sized enterprises.

Along with the selection of the 3rd round of innovative companies, the Financial Services Commission also disclosed the 'Policy Financial Support Guidelines for Selected Companies' to increase predictability regarding financial support for the selected companies.

First, at the selection stage, each ministry will evaluate companies based on their own criteria for innovation and technological capabilities, while considering disqualifications for financial support such as credit warning information and whether the company was fully capital impaired in the previous year.

Next, at the financial support stage, each policy financial institution will conduct a minimum review and provide preferential support regarding loan limits and conditions. Even companies with low credit ratings will have separate evaluation criteria considering innovation and technological capabilities, and decision-making will be expedited through measures such as lowering approval authority.

For complaints regarding financial support among selected companies, a 'Financial Difficulty Support Team' composed of the Innovative Companies National Representatives 1000 Comprehensive Support Team, the Financial Services Commission, and the selecting ministries will continuously monitor the situation.

Additionally, the selecting ministries will periodically check for serious damage to the ongoing business value due to failures in technology mass production and dissemination, lack of marketability of technology, or occurrence of social issues, and companies with problems will be excluded.

For the selected companies, active support will be provided according to their funding needs. In particular, industry-specific limits will be excluded, and operating fund limits will be expanded.

The Korea Development Bank and Industrial Bank of Korea will provide loans amounting to 50-60% of estimated sales, and the Export-Import Bank of Korea will provide loans up to 100% of export performance. Interest rate reductions of up to 0.9 to 1.0 percentage points will also be applied.

For innovative companies requiring credit enhancement, support will be provided to use loans through guarantees. Operating fund limits will be expanded within the maximum guarantee limits (KODIT 15 billion KRW, KIBO 10 billion KRW).

Investment inducement for innovative companies will also be pursued through policy-type New Deal Funds and Innovation Solution Funds.

Companies selected as innovative companies can apply by visiting the Innovative Growth Policy Finance Center website or policy financial institutions when financial needs arise.

Meanwhile, among the 279 companies selected in the 1st and 2nd rounds, 140 companies with funding needs have received a total of 359 cases of support amounting to 1.7983 trillion KRW (1.3076 trillion KRW in loans, 353.7 billion KRW in guarantees, and 137 billion KRW in investments).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.