Financial Services Commission Announces Measures to Alleviate Burdens Such as Credit Rating Downgrades

[Asia Economy Reporter Jin-ho Kim] Financial authorities have decided to minimize loan disadvantages for small and medium-sized enterprises (SMEs) and small business owners facing the risk of credit rating downgrades due to deteriorating business performance caused by COVID-19. Even if the credit rating falls, borrowers without insolvency will not face reductions in loan limits or interest rate increases.

On the 6th, the Financial Services Commission announced a plan titled "Measures to Alleviate Burdens Such as Credit Rating Downgrades." This measure reflects concerns from the SME sector worried about worsening loan conditions following credit rating downgrades, following the extension of loan maturities and repayment deferrals related to COVID-19.

According to the Korea Federation of SMEs, more than six out of ten SMEs expressed concerns last year about worsening loan conditions due to decreased sales. Considering the ongoing COVID-19 crisis, the Financial Services Commission decided to temporarily ease the burdens caused by credit rating downgrades for SMEs and small business owners experiencing deteriorated business performance.

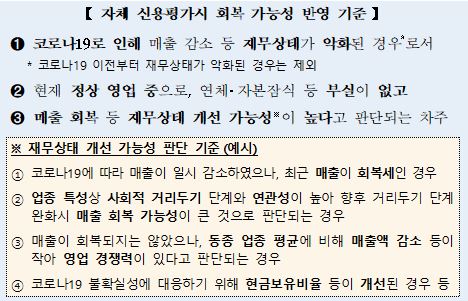

First, financial institutions conducting their own credit evaluations, such as banks, insurance companies, and policy finance institutions, are required to sufficiently reflect recovery potential in non-financial evaluations or the final rating calculation process when evaluating SMEs and small business owners this year.

The reflection criteria include ▲ cases where sales have decreased due to COVID-19 ▲ cases of normal business operations without delinquency or capital erosion ▲ cases with high potential for financial condition improvement such as sales recovery.

Based on these criteria, each institution will establish operational standards, and if the credit rating does not decline, loan conditions such as loan limits and interest rates are expected to be maintained. However, some increase in loan interest rates due to rising market interest rates is possible.

Even if the credit rating falls, for borrowers without insolvency, disadvantages such as loan limit reductions and interest rate hikes will be minimized. If there is no delinquency or capital erosion, loan limits will be maintained in principle according to each institution’s operational standards, and interest rate increases will be minimized through adjustments such as branch-level discretionary interest rates and additional interest rates.

To ensure smooth implementation of these measures, financial authorities will exempt financial institutions from inspections and sanctions. A letter signed by the Financial Supervisory Service Commissioner will be sent to exclude these institutions from inspection targets, and no sanctions will be imposed on financial institutions or their employees.

A Financial Services Commission official explained, "Each financial institution will establish operational standards by the end of this month," adding, "From the 1st of next month, these standards will be applied to credit evaluations and loans for SMEs and small business owners affected by COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.