Last Year, 939 Citi Bank Retail Finance Staff

Management States "Prioritizing Full Sale"

Mass Layoffs Inevitable if Liquidation Scenario Occurs

The specific exit roadmap for Citibank Korea, which has confirmed its withdrawal from the domestic consumer finance market, remains unclear. Concerns are growing that this uncertainty will inevitably increase employee anxiety. There is growing speculation that the prioritized full sale by Citibank will not be easy, raising the likelihood of difficulties in employment succession. There are also worries that if a split sale, phased withdrawal, or liquidation process occurs, a large-scale layoff crisis could arise.

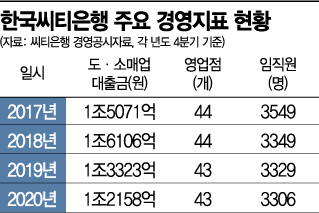

According to the financial sector on the 6th, among the approximately 3,500 Citibank employees, 939 retail finance personnel were working at branches as of the end of last year. The labor union estimates that including the group headquarters, the total number of personnel related to retail finance is around 2,500. This accounts for nearly 70% of the total workforce, and branch staff alone make up 26% of the total.

Citibank confirmed its withdrawal from retail finance on the 16th of last month, but the method remains undecided. At the board meeting held about ten days later, no specific schedule or details were finalized, but it was explained that the focus was on a sale. It remains unclear when the next board meeting will be held or by when a decision will be made.

As discussions on withdrawal intensify, concerns about employee job insecurity are expected to grow. If a split sale occurs, dividing business units such as cards and banking, some personnel losses will be inevitable. For the labor union, differing employment succession conditions by business unit will make response difficult and create a challenging situation. If liquidation procedures begin, there is a high possibility of facing a large-scale layoff crisis.

Citibank Prioritizes "Full Sale"... Uncertain Until Negotiations Are Settled

Citibank plans to prioritize the full sale of its retail finance business. It is judged to be the exit strategy with the least friction in terms of employment and finances. A Citibank official stated, "Further discussions are needed on how to proceed with the exit strategy," but added, "Since a full sale is the most ideal option for both employees and customers, we will prioritize it."

However, it is uncertain whether negotiations for a full sale will be concluded. This is due to the enormous labor costs and the estimated sale price of about 2 trillion won. The average tenure of Citibank employees is 18.2 years, longer than other major domestic banks, which average 15 to 16 years. The average annual salary per employee is also relatively high at 112 million won. The large severance pay based on tenure is another obstacle. Potential buyers might opt not to mandate employment succession and instead acquire only high-quality assets and liabilities.

In the past, Hongkong and Shanghai Banking Corporation (HSBC) also attempted to sell its personal finance division to the Korea Development Bank but failed and eventually liquidated it. At that time, HSBC and the Korea Development Bank could not reconcile differences over employee wages and employment conditions, leading to about 90% of retail finance employees taking voluntary retirement.

The labor union argues that since the closure of foreign bank branches and business transfers require regulatory approval, they will actively express their position to financial authorities. A union representative emphasized, "There should be no attempts to urgently split and sell or liquidate long-term matters," adding, "We will closely communicate with the Financial Services Commission and the Political Affairs Committee to prevent a large-scale unemployment crisis."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)