Refining Margin at $3.2 in Last Week of April... Below Breakeven Point

International Oil Prices Falter... Q2 Inventory Revaluation Losses Likely Increase

[Asia Economy Reporter Hwang Yoon-joo] The refining margin, which gauges the profitability of oil refiners, has returned to the $3 range for the first time in 1 year and 2 months. This improvement is due to better gasoline margins ahead of the driving season (May to September), when oil demand increases. However, the recovery in refining margins is not expected to significantly impact the refining industry's earnings for the second quarter of this year. Despite the gradual recovery in refining margins, they still remain below the breakeven point, and the sharply rising international oil prices have turned downward, increasing the likelihood of inventory valuation losses.

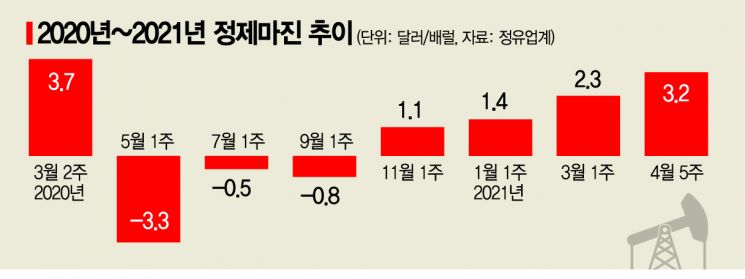

According to the refining industry on the 4th, the Singapore complex refining margin in the last week of April recorded $3.2 per barrel. The refining margin returning to the $3 range is the first time in 59 weeks since the second week of March last year ($3.7). During this period, refining margins fell to minus $3.3 in the first week of May 2020 due to the impact of the COVID-19 pandemic, then fluctuated between zero and negative values after June of the same year, before turning positive from September, but remained stagnant at the $0 to $1 level.

The gradual rise in refining margins since April this year is interpreted as being influenced by gasoline-centered supply and demand. Gasoline demand is increasing mainly in countries such as the United States and Europe, where vaccinations are underway. In South Korea, gasoline consumption is also rising as outdoor activities increase in spring. For example, domestic gasoline consumption steadily increased from 6.13 million barrels in January to 6.49 million barrels in February and 6.51 million barrels in March. Diesel and jet fuel consumption, which slightly decreased in February, also rose again in March to 13.04 million barrels and 1.83 million barrels, respectively.

Low gasoline inventory levels also supported refining margins. In April, U.S. gasoline inventories were 235 million barrels, which is 2.4% lower than the five-year average of 241 million barrels.

The refining margin is the amount obtained by subtracting crude oil prices and costs such as transportation and operating expenses from the prices of petroleum products like gasoline and diesel. Generally, a recovery in refining margins is interpreted as an improvement in the profitability of the refining industry. However, the refining industry's outlook remains bleak as refining margins still fall short of the breakeven point (around $4 to $5 per barrel).

The movement of international oil prices is also a factor pressuring second-quarter earnings. After rising in the first quarter, international oil prices have slightly declined in the second quarter. When international oil prices fall, inventory valuation losses are recorded because crude oil is imported, refined, and sold 2 to 3 months later, meaning refiners end up buying crude oil at higher prices and selling products at lower prices. The refining industry expects to record inventory valuation losses in the second quarter.

Reflecting this, the earnings consensus for the refining industry in the second quarter is below expectations. According to FnGuide, SK Innovation's operating profit for the second quarter is forecasted to be 217.8 billion KRW, a 42.4% decrease compared to the first quarter. S-OIL is also estimated to drop 47.9% to 327.8 billion KRW.

A refining industry official said, "Operating profit in the second quarter may decline compared to the first quarter due to inventory valuation losses. While there is great expectation for demand recovery starting in the second half of the year, many variables such as international oil price trends and vaccination progress need to be monitored."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)