Pressure Grows to Specify Response Ahead of Summit Schedule

Urgent Need for M&A and Investment Plans to Overcome Global Competition

Samsung Faces Delays in Major Decisions Amid Chairman's Absence

[Asia Economy Reporter Su-yeon Woo] Although the global semiconductor sales in the first quarter of this year recorded an all-time high, marking the full-scale start of the semiconductor industry's 'supercycle,' Samsung Electronics is facing deeper concerns as investment decisions are delayed due to the absence of its chairman. Vice Chairman Lee Jae-yong officially formalized the succession of management rights by inheriting the shares of the late Chairman Lee Kun-hee, but he is struggling with bold and swift investment decisions as he is tied up by judicial risks. In particular, unlike Intel and TSMC, which moved quickly in line with the Biden administration, Samsung Electronics has yet to announce any investment plans, and is under pressure to provide a response in line with the schedule of the upcoming South Korea-U.S. summit.

On the 3rd, business circles are highly anticipating that Samsung will announce a large-scale semiconductor investment plan in time for the South Korea-U.S. summit scheduled for the 21st. Some even mention a 'vaccine swap' exchanging COVID-19 vaccines for semiconductors, raising expectations that Samsung Electronics' role at the national level will increase, following its participation in the semiconductor meeting held at the White House last month.

◆ Accelerating U.S. Semiconductor Supply Chain Restructuring... South Korea Faces Isolation Risk Amid Hesitation = At the U.S.-Japan summit held last month, the two leaders agreed to jointly invest $4.5 billion in 5G communication networks, semiconductor supply chain restructuring, artificial intelligence (AI), and next-generation information and communication technology (ICT) cooperation. Since the inauguration of the Biden administration, the U.S. has been actively involving allies, including Japan, to counter China in advanced fields such as next-generation mobile communications and semiconductors.

The semiconductor meeting hosted by the White House on the 12th of last month (local time) was ostensibly held to address the supply crisis of automotive semiconductors, but the prevailing view is that it reflected the U.S. intention to exclude China from the new semiconductor supply chain restructuring.

At the upcoming South Korea-U.S. summit, the Biden administration is expected to request South Korea's participation in the 'semiconductor supply chain restructuring' aimed at countering China. In particular, the U.S. is concerned about the concentration of semiconductor production facilities in South Korea and Taiwan and is encouraging investment attraction for production facilities within the U.S. Therefore, there is advice that the South Korean government should appropriately utilize the semiconductor investment card to successfully lead the summit and seize the initiative.

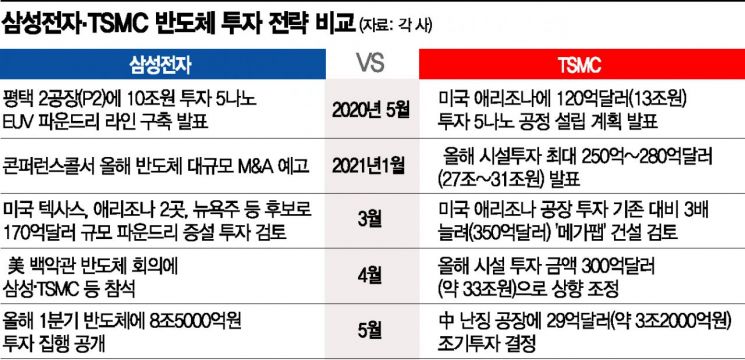

Taiwan, South Korea's most direct competitor in the semiconductor industry, is moving flexibly and swiftly amid the U.S.-China semiconductor conflict. TSMC, a Taiwanese foundry company that attended the White House semiconductor meeting alongside Samsung Electronics, raised its capital expenditure plan for this year from $28 billion (approximately 31 trillion KRW) to $30 billion (approximately 33 trillion KRW) just before the meeting, and declared immediately after the meeting that it would not accept new orders from China's Phytium, which is on the U.S. sanctions blacklist. Around the same time, TSMC decided to invest an additional $2.887 billion (approximately 3 trillion KRW) in its production line in Nanjing, China, presenting a two-track strategy to not miss out on semiconductor demand within China.

◆ Samsung's Investment Delay Burden Grows... Decision Imminent = On the other hand, Samsung Electronics has yet to announce a large-scale investment plan that could overwhelm the industry. Although it hinted at large-scale mergers and acquisitions (M&A) related to semiconductors this year during the fourth-quarter conference call last year, specific investment plans remain undecided.

In the first quarter of this year, Samsung Electronics made investments totaling 8.5 trillion KRW, a 41.7% increase compared to the same period last year. In the memory semiconductor sector, investments were concentrated on expanding and converting advanced processes at the domestic Pyeongtaek and Chinese Xi'an plants to meet demand, while in the foundry sector, investments focused on advanced processes such as the 5nm process using extreme ultraviolet (EUV) lithography equipment.

Industry insiders believe that Samsung Electronics' semiconductor capital expenditure plan for this year will inevitably be revised upward. Earlier, Vice Chairman Lee, after his incarceration, urged employees in an internal message, saying, "Samsung must continue on the path it must take," and emphasized that the company must also fulfill its fundamental duties of investment and job creation.

In April 2019, Samsung Electronics announced 'Semiconductor Vision 2030,' a mid-to-long-term plan to invest 133 trillion KRW in the system semiconductor sector over the next decade. However, as the semiconductor market has entered the early stages of a supercycle recently, competitors have announced plans to pour in much larger amounts in a short period.

Recently, TSMC announced an investment plan of $100 billion (approximately 110 trillion KRW) over the next three years. Considering that the $30 billion (approximately 33 trillion KRW) investment plan for this year will be executed separately, it means that TSMC plans to invest over 140 trillion KRW over the next four years. This figure far exceeds Samsung's previously announced 133 trillion KRW investment in system semiconductors over ten years in terms of scale and speed.

Lee Jong-ho, director of the Seoul National University Semiconductor Joint Research Center, emphasized, "Not only in memory but also in the system semiconductor sector, speedy investment is necessary where needed," adding, "However, it is important to focus investment on areas where we can excel the most within the broad system semiconductor market, and also consider semiconductor talent development and synergy with other industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)