Pre-Training and Simulated Investment Required... "Infinite Losses, Caution Needed as Endurance Strategy Also Fails"

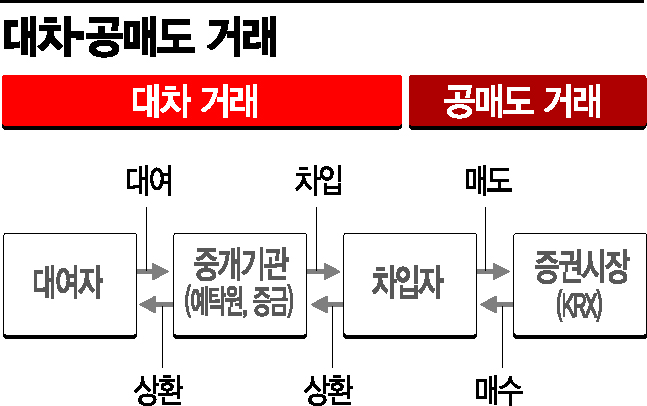

[Asia Economy Reporter Lee Seon-ae] The "GameStop incident" refers to the event where U.S. retail investors, opposing short-selling forces, massively bought GameStop shares targeted by short-sellers, thereby damaging the profits of those short-selling forces. On the 3rd, as short-selling resumed only for KOSPI 200 and KOSDAQ 150 stocks, the question arises whether retail investors in the domestic stock market can also demonstrate the "power of ants" against short-selling forces and make profits. Retail investors are showing enthusiasm to actively participate in short-selling, which had been considered the exclusive domain of foreigners and institutions and perceived as a source of fear, while also expressing their determination to reenact a "Korean version of GameStop," drawing attention to future developments.

◆ 10,000 Short-Selling Retail Army Faces Rough Road = According to the financial investment industry on the 3rd, since short-selling investment is risky, inexperienced retail investors must first complete a 30-minute preliminary education at the Korea Financial Investment Association and then participate in a 1-hour mock trading session at the Korea Exchange before engaging in short-selling. Currently, the number of retail investors who have completed the short-selling preliminary education at the Financial Investment Education Institute has surpassed 13,000, and about 5,000 have completed the mock trading at the Exchange. Considering that retail investors who have previously used the short-selling lending system can trade short-selling immediately without preliminary education (as of 2016, there were 6,400 retail accounts that engaged in short-selling), at least 10,000 retail investors can participate starting immediately.

The market is continuously improving systems and regulations to encourage retail participation, so the proportion of their short-selling trades is expected to increase in the future. However, the issue is whether retail investors can actually make profits.

Experts are skeptical for now. Lee Jin-woo, head of investment strategy at Meritz Securities, said, "Each stock has a different lending interest rate; companies with high liquidity have lower interest rates but also lower volatility, making it difficult to earn profits. Conversely, stocks with low trading volume and high volatility have higher interest rates, making it hard to achieve expected returns." He added, "Retail investors borrow to trade, so costs are doubled, and they need to enter 'short cuts' when prices rebound sharply, requiring more attention than regular trading."

.

Losses can be unlimited. Short-selling profits when the stock price falls, but losses increase infinitely if the stock price rises. In normal trading, stock prices cannot go below zero, so losses do not exceed the principal, but in short-selling, losses increase as much as the stock price rises, potentially exceeding the principal. If the collateral maintenance ratio agreed upon in the short-selling contract is not maintained, forced liquidation through opposite trades can occur, making the "hold on" (a slang for enduring until the end) strategy impossible.

Jung Yong-taek, head of research at IBK Investment & Securities, said, "Institutions can cover short positions by borrowing even if they cannot do 'short covering,' but retail investors must cover with their own credit, which is difficult." He added, "Many in their 20s and 30s suffered losses with inverse ETFs last year; since short-selling is a domain for professional players, it requires very cautious approach."

◆ Between High Spirits and Reality = Views on reenacting a Korean version of GameStop are also skeptical. Although improvements to the short-selling system are underway, further enhancements are needed, and the scale of short-selling is currently limited. New investors can trade only up to a limit of 30 million KRW. If the number of trades exceeds five and the cumulative borrowing amount exceeds 50 million KRW, the trading limit increases to 70 million KRW. For second-stage investors who have traded for more than two years or are professional investors, there are no restrictions.

Moreover, it is uncertain how many retail investors will actually engage in short-selling. The collateral ratio for retail investors borrowing stocks is 140%, higher than foreigners and institutions (each 105%). Also, foreigners and institutions have virtually no mandatory repayment period, but retail investors must repay within 60 days. Seo Jeong-hoon, a researcher at Samsung Securities, said, "Initially, various trial and error will be necessary, so retail investors will not reach a scale to influence the short-selling market."

However, retail investors’ determination to defeat short-selling forces together is strong. The Korea Stock Investors Union (HanTuYeon), a retail investor group, announced in February that it would start a movement to unite with individual shareholders and fight against short-selling forces, beginning with Celltrion in KOSPI and HL Biopharma in KOSDAQ, which have the highest short-selling balances, similar to the GameStop incident. Jung Eui-jung, head of HanTuYeon, emphasized, "We have entered an era of 10 million retail investors with ample market liquidity. If retail investors’ resistance intensifies and idle funds flow into the stock market, a Korean version of the GameStop incident is possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)