Song Okju, Chair of the National Assembly Environment and Labor Committee & Ministry of Environment

Hold a Forum on Improving ESG Information Disclosure and Reporting

[Asia Economy Reporter Kiho Sung] As financial companies increasingly make investment decisions based on ESG (Environmental, Social, and Governance) evaluations, there is a growing call for companies to more actively pursue mandatory disclosures related to ESG. Although the Financial Services Commission currently encourages voluntary participation by companies in ESG information disclosure and reporting, there are calls to expedite mandatory policies to enhance the competitiveness of financial firms.

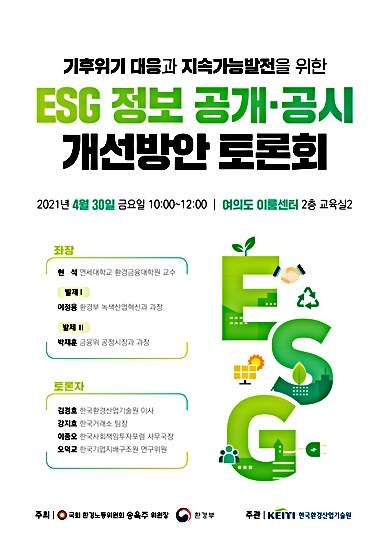

On the 30th, Song Okju, Chairperson of the National Assembly’s Environment and Labor Committee, and the Ministry of Environment held a forum titled “Discussion on Improving ESG Information Disclosure and Reporting for Climate Crisis Response and Sustainable Development” in Yeouido, Seoul. The forum was organized to analyze the current status and regulations related to ESG information disclosure and reporting, and to explore ways to expand and improve ESG information disclosure.

During the discussion, panelists emphasized the need to accelerate ESG information disclosure in South Korea. Previously, the Financial Services Commission mandated the disclosure of sustainability management reports and corporate governance reports. The scope of mandatory disclosure for corporate governance reports, which was limited to KOSPI-listed companies with total assets exceeding 2 trillion KRW, will expand to companies with assets over 1 trillion KRW starting next year, over 500 billion KRW from 2024, and to all KOSPI-listed companies by 2026.

Lee Jong-oh, Secretary-General of the Korea Socially Responsible Investment Forum, stated, “Compared to the pace of countries leading ESG such as the European Union (EU) and the United Kingdom, we are excessively conservative in timing,” adding, “Since voluntary disclosure or voluntary reporting related to ESG information has already been concluded globally to be ineffective, mandatory implementation could enhance the competitiveness of our companies and financial institutions.”

Concerns were also raised about the ambiguous disclosure methods of ‘non-financial information’ and the ‘CoE (Comply or Explain)’ approach, which reduce their usefulness as reference materials for financial companies’ investment decisions and thus need improvement. The CoE method is a system where companies voluntarily disclose whether they comply with corporate governance best practices and, if not, explain why. Kim Kyungho, Director at the Korea Environmental Industry & Technology Institute, particularly regarding improvements to environmental information disclosure systems, introduced, “We will adjust to highly usable items reflecting the demands of financial institutions and corporate acceptance through analysis of domestic and international trends,” adding, “A research project is currently underway.”

Information related to the activation of green investment, which has recently attracted the attention of financial companies, was also introduced. Jung Sumyung, Director at the Ministry of Environment, stated, “After establishing a Korean-style green bond classification system, we will conduct pilot applications and continuously supplement and develop it,” adding, “We will build a support system for external review costs of green bonds and promote tax exemption benefits, and collaborate with policy financial institutions to discover and support carbon neutrality implementation programs.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)