Thanks to diagnostic kits, a turnaround last year

Fluctuations due to changes in overseas demand

Antigen diagnostic kits drive performance

No products after herd immunity

The government has authorized the sale of self-test kits that allow individuals to collect their own samples and check for COVID-19 infection. The Ministry of Food and Drug Safety conditionally approved the sale of COVID-19 self-test kits from Humasis and SD Biosensor. Both products have received emergency approval for self-testing overseas and are being used in Europe and other regions. The Seoul Metropolitan Government and Seoul Metropolitan Office of Education have decided to use self-test kits in a limited manner at call centers, logistics centers, dormitory schools with over 100 students, and schools with sports teams. As self-test kits began to be sold at pharmacies, expectations for improved performance of the respective companies have grown. With the steady increase in new COVID-19 cases, demand for self-test kits is expected to be considerable. However, demand may decrease after achieving herd immunity through COVID-19 vaccination. The health authorities anticipate achieving domestic herd immunity by November. Asia Economy examines the financial structure and management status of Humasis and Sugentech, which developed self-test kits, to gauge their future growth potential.

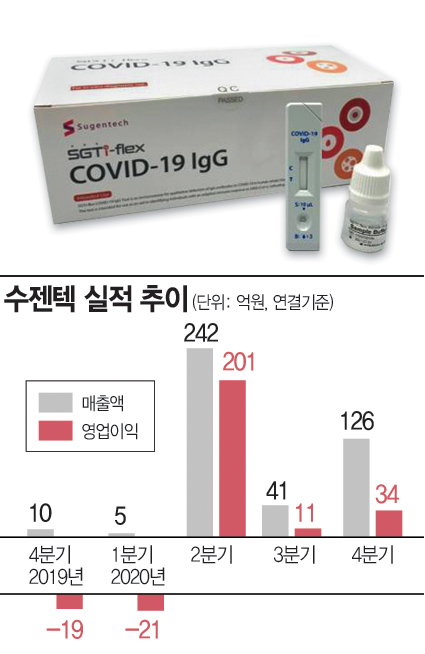

[Asia Economy Reporter Jang Hyowon] Sugentech, a specialized in vitro diagnostic medical device company, is laying the groundwork for a leap forward with its COVID-19 self-test kits. Sugentech, which was listed on KOSDAQ through a technology special case, experienced significant growth last year due to its COVID-19 diagnostic kits. However, it faced quarterly fluctuations in performance due to oversupply of diagnostic kits and changes in demand. Will it be able to surpass last year's growth this year?

Starting a Leap with Antigen Diagnostic Kits + Self-Test Kits

Sugentech, established in 2011, is a specialized in vitro diagnostic medical device company. It possesses immunochemical diagnostic technology that measures the presence or absence of specific proteins causing diseases through antigen-antibody reactions. Based on this, it has commercialized in vitro diagnostic products such as multiplex immunoblot, mobile, and point-of-care diagnostic platforms.

When it entered the KOSDAQ market in 2019, it was a deficit company with losses exceeding sales, and it was listed through a technology special case. In 2019, on a consolidated basis, Sugentech's sales were 3.8 billion KRW, and operating losses were about 7.1 billion KRW. Until then, Sugentech's main sales came from multiplex immunoblot diagnostic products and personal care diagnostic products. Sales of point-of-care diagnostic products existed but accounted for a small portion.

The surge in sales of point-of-care diagnostic products began last year when Sugentech developed COVID-19 diagnostic kits.

Sales of point-of-care diagnostic products, which were about 300 million KRW in 2019, soared to 39 billion KRW last year. 94.4% of total sales came from COVID-19 diagnostic kits. Accordingly, last year's total sales and operating profit were 41.4 billion KRW and 22.5 billion KRW, respectively, marking a 989.5% increase and a turnaround to profitability compared to the previous year.

Most of Sugentech's sales occur overseas. At the early stage of the COVID-19 pandemic, Sugentech quickly commercialized the 'antibody rapid diagnostic kit' and exported it to Europe, Southeast Asia, and South America. Although molecular diagnosis (PCR) is the standard for COVID-19 testing, antibody diagnostic methods have the advantage of rapid diagnosis.

However, Sugentech's quarterly performance showed fluctuations. On a consolidated basis, Sugentech's sales were 500 million KRW in Q1 last year, surged to 24.2 billion KRW in Q2, then shrank to 4.1 billion KRW in Q3. Sales increased again to 12.6 billion KRW in Q4.

This is analyzed to be due to a decrease in demand for antibody rapid diagnostic kits, which Sugentech had focused on. Real-time (RT) PCR methods have an accuracy of 99% but require expensive equipment, while antibody diagnostics have an accuracy of 80-90% and can only diagnose infected individuals 3-7 days after infection, but have the advantage of providing results on-site within 15 minutes without expensive equipment.

Thus, antibody diagnostic kits were spotlighted initially when equipment acquisition was difficult. However, as RT-PCR equipment became more widespread, demand for antibody diagnostic kits declined. Additionally, the antigen diagnostic method, which can relatively quickly identify patients in the early stages of infection, gained prominence, and in Europe and elsewhere, the market was reorganized around antigen rapid diagnostic kits. Subsequently, Sugentech focused on antigen diagnostic kits, and its performance began to recover from Q4 last year.

This year, it is expected to drive performance by supplying rapid antigen diagnostic kits for COVID-19 self-testing. On the 27th of last month, Sugentech announced that its self-test diagnostic kit received approval for use in Germany, the second after Austria. Sugentech has also submitted an application for approval of this product domestically.

Strong Financial Status... What After COVID-19?

Despite fluctuations in performance, Sugentech's overall growth has resulted in a relatively sound financial status. Sugentech's debt ratio decreased from 86.4% in 2019 to 14.5% last year. This is because derivative liabilities such as convertible redeemable preferred shares, convertible bonds, and stock acquisition rights were converted into stocks, reducing liabilities and increasing equity.

In October last year, Sugentech converted 9 billion KRW of its 10 billion KRW convertible bonds into stocks and repaid 1 billion KRW. Although there were large derivative losses from convertible bonds last year, such events are not expected this year.

Due to the surge in sales, the cost of goods sold ratio decreased, improving profitability. The cost of sales ratio, which was 99.8% in 2019, dropped to 23.8% last year, and the operating profit margin improved to 54.4%. Cash inflow from operating activities reached 14.8 billion KRW, and the current ratio rose from 205.5% in 2019 to 824.7% last year.

However, Sugentech's subsidiary continued to incur losses without sales last year. Sugentech owns 90% of the shares of 'Modoricy,' a corporation developing mobile diagnostic kits. Modoricy mainly produces home test self-diagnostic devices.

Since its establishment in 2019, Modoricy has had no sales and recorded losses of 100 million KRW in 2019 and 500 million KRW last year.

Kim Jimin, a senior researcher at NICE Credit Information, said, "In vitro diagnostics is a promising bio field with various government supports, which will positively affect Sugentech, which has high-level immunochemical diagnostic product development capabilities," but added, "However, there is currently no strong product to sustain the current good performance after COVID-19."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.