P2P Platforms Incorporated into the System Since August Last Year Under On-tu Act

Existing Companies Granted Grace Period Must Register to Operate

[Asia Economy Reporter Park Sun-mi] Online investment-linked finance (P2P finance) companies must meet the legal registration requirements and apply for registration with the financial authorities by the end of next month. Failure to register will result in a ban on operations. Existing P2P companies must also complete registration by August 26 to continue operating.

On the 29th, the Financial Services Commission explained that with the enforcement of the "Online Investment-Linked Finance Business and User Protection Act (OnTu Act)" since August 27 last year, companies intending to operate P2P must meet requirements such as capital adequacy and complete registration with the FSC.

A Financial Services Commission official emphasized, "Even companies currently handling linked loans through P2P-linked lending registration may face closure if they fail to register under the OnTu Act," adding, "Investors should consider this and make investment decisions carefully under their own responsibility."

P2P finance, incorporated into the regulatory framework since August 27 last year, allows only companies registered with the financial authorities after meeting the requirements to operate P2P finance, and existing companies must complete registration within the one-year grace period.

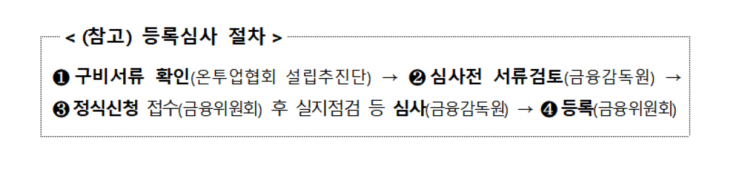

If registration is not completed within the deadline, new business operations are prohibited until registration is finalized, and violations will be subject to penalties. However, loan claim recovery and principal and interest repayment to investors under existing contracts must continue. Companies wishing to register must submit documents to the Financial Supervisory Service and the Financial Services Commission through the Online Investment-Linked Finance Association Establishment Promotion Team. The financial authorities review whether P2P companies meet personal and material requirements such as capital adequacy (minimum 500 million KRW), major shareholder requirements, and appointment of compliance officers.

Only a Very Few P2P Companies Will Survive... Possibility of Mass Bankruptcies

Market forecasts suggest that only a very small number of P2P companies will survive. In fact, since the enforcement of the OnTu Act, only six companies?Lendit, PeopleFund, 8 Percent, Ocean Funding, Y Fund, and Winkstone Partners?have applied for registration. Considering there are about 100 P2P companies, the possibility of mass bankruptcies is being raised.

The financial authorities stated, "Since the enforcement of the OnTu Act, document reviews have begun, and formal registration examinations are underway for six companies, with results expected to be finalized soon."

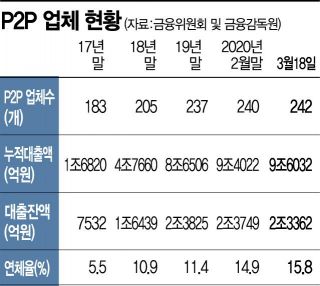

Meanwhile, the number of registered P2P-linked lending companies has shrunk by more than half, from 237 in August last year to 113 as of today. This is due to cancellations of registration by the financial authorities, voluntary closures, or conversions to general lending companies.

A Financial Services Commission official pointed out, "P2P investments do not guarantee principal recovery," and warned, "When investing in P2P products through financial platforms such as KakaoPay and Toss, it is important to note that these are not products of the financial platforms themselves."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.