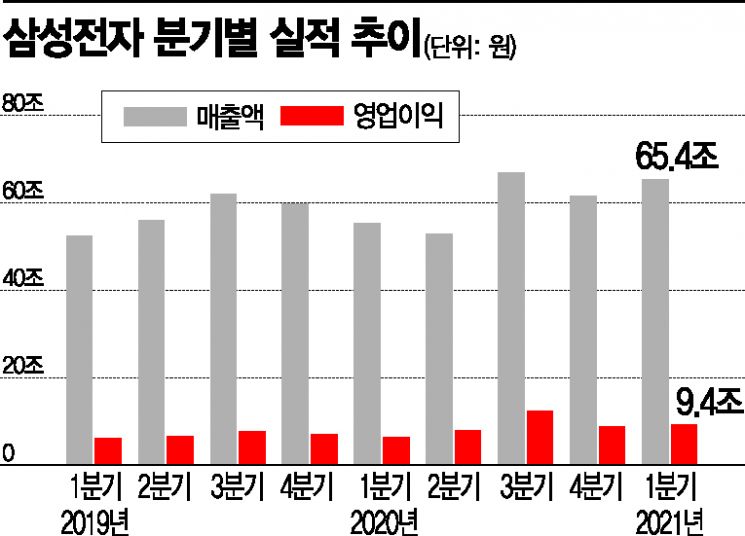

[Asia Economy Reporter Jeong Hyunjin] Samsung Electronics achieved record-high sales for the first quarter and an operating profit exceeding 9.3 trillion KRW despite production disruptions at its Austin, USA plant in Q1. This earnings surprise was driven by continued pent-up demand due to COVID-19, which significantly boosted sales of smartphones, premium TVs, and home appliances.

To maintain its unique ultra-gap strategy, Samsung Electronics invested more than 5.4 trillion KRW in research and development, the highest quarterly amount ever.

On the 29th, Samsung Electronics announced that its consolidated sales for Q1 this year reached 65.39 trillion KRW, with an operating profit of 9.38 trillion KRW. Sales increased by 6.2% compared to the previous quarter and by 18.2% year-on-year, marking the highest Q1 sales ever. Operating profit rose 45.4% year-on-year.

By division, the DS division, including semiconductors, recorded Q1 sales of 19.01 trillion KRW and an operating profit of 3.75 trillion KRW. Semiconductor memory shipments were solid, centered on PC and mobile, but were partially affected by falling NAND prices and initial costs of new production lines. In particular, the Austin plant halted production due to a cold wave in the US in February, causing a decline in foundry business performance. Han Seung-hoon, Executive Vice President in charge of Samsung Electronics’ semiconductor foundry business, stated during the conference call that the loss from the Austin plant production disruption amounted to about 71,000 wafers, which translates to approximately 300 to 400 billion KRW, and that the plant is now fully operational.

The display division saw profits decline quarter-on-quarter due to weak demand in the small- and medium-sized segment’s off-season, but profits improved year-on-year thanks to increased OLED utilization rates.

The IM division, responsible for the smartphone business, posted sales of 29.21 trillion KRW and an operating profit of 4.39 trillion KRW, while the CE division recorded sales and operating profit of 12.99 trillion KRW and 1.12 trillion KRW, respectively. Wireless sales surged significantly due to strong sales of flagship and mid-to-low-end smartphones, and the Galaxy ecosystem products such as tablets, PCs, and wearables also showed growth, expanding their contribution to earnings. The CE division saw increased profits quarter-on-quarter and year-on-year as pent-up demand for home appliances continued due to COVID-19 and sales of premium TV products expanded.

Samsung Electronics’ capital expenditure in Q1 was 9.7 trillion KRW, with 8.5 trillion KRW invested in semiconductors and 700 billion KRW in displays. For memory semiconductors, investments focused on expanding advanced processes and process transitions at the Gyeonggi Pyeongtaek and Xi’an, China plants to meet rising demand. Foundry investments centered on expanding advanced processes such as extreme ultraviolet (EUV) 5nm (1nm equals one billionth of a meter). Research and development expenses reached a record quarterly high of 5.44 trillion KRW, surpassing the previous record of 5.36 trillion KRW set in Q1 last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.