Announcement on June 28 of Samsung Family's KRW 12 Trillion Inheritance Tax Payment and Social Contribution Scale

KRW 12 Trillion Cash Payment Required Over 5 Years...Stock Collateral and Credit Loans Allowed

Record-Breaking Scale Sparks Intense Behind-the-Scenes Competition Among Financial Institutions for Attraction

[Asia Economy Reporter Lee Kwang-ho] As the Samsung family has agreed to pay more than 12 trillion won in inheritance tax for the late Chairman Lee Kun-hee, the financial sector's attention is focused on the funding arrangements. The scale of the inheritance tax is unprecedented not only domestically but also globally, and the amount to be raised through the financial sector is expected to be the highest single transaction amount.

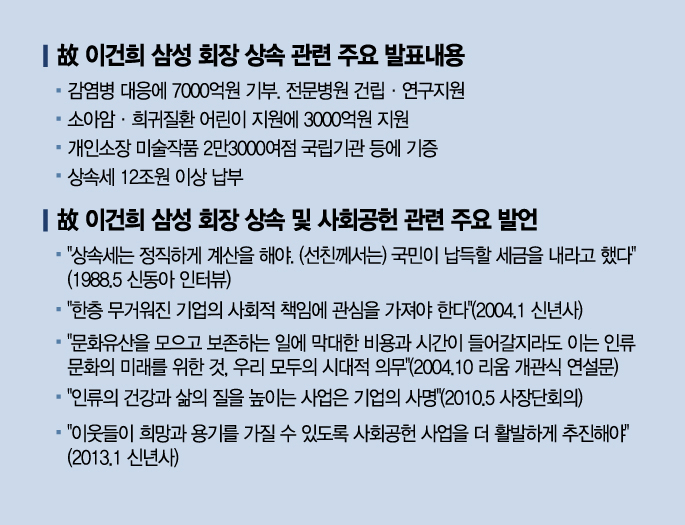

On the 28th, Samsung Group announced the expected amount of Chairman Lee's inheritance tax payment along with plans for a 1 trillion won social contribution and a donation of national treasure-level artworks worth around 3 trillion won. Chairman Lee's estate is estimated to be worth a total of 30 trillion won, including stocks, artworks, real estate, and cash assets. Among these, the value of Samsung affiliates' stocks held by Chairman Lee is about 19 trillion won, and the inheritance tax on the stock shares is estimated to reach 11.0366 trillion won. Including artworks, the Hannam-dong residence, the Everland site, and other real estate, the total tax payment exceeds 12 trillion won.

Samsung Group plans to pay the inheritance tax in six installments over five years starting from April this year through the installment payment system. The inheritance tax on the stocks held is calculated by applying the average closing price two months before and two months after the date of death, a 20% major shareholder surcharge, a maximum tax rate of 50%, and a 3% voluntary reporting deduction rate.

Funding is likely to be secured through personal assets, stock dividends, and loans from the financial sector. The most likely source is stock dividends. Chairman Lee and his family received a total of 1.3079 trillion won in dividends from Samsung Electronics last year, including special dividends. The special dividend from Samsung Electronics was the first in three years. In a normal year without special dividends, the regular dividends received by the family head are expected to be less than 1 trillion won.

Stock disposal is expected to be difficult because selling shares that affect the group's governance structure is challenging. Therefore, the shortfall in funds is expected to be covered by bank credit loans and loans from securities companies and insurance companies. Samsung's current main bank is Woori Bank. It is anticipated that the largest amount of funds will be raised through Woori Bank. In the case of stock-backed loans, up to 70% of the value of listed stocks can be borrowed.

However, from Woori Bank's perspective, providing a large-scale loan to Vice Chairman Lee Jae-yong personally at once poses a significant burden. This is because the resources available for other loans would inevitably decrease. Also, if the loan is made all at once from one place, there are concerns about preferential treatment controversies. This is why the behind-the-scenes competition among banks for Samsung's inheritance tax funding is expected to be fierce.

It is also reported that Mrs. Hong Ra-hee, Chairman Lee's wife, is proceeding with the loan procedures together. A financial industry official said, "In the case of the Samsung family, their personal creditworthiness is solid enough to allow loans worth several hundred billion won, so large-scale loans are possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.