FSS Strengthens Oversight on Excessive Medical Use

Aggregates and Manages Non-Covered Insurance Claim Statistics

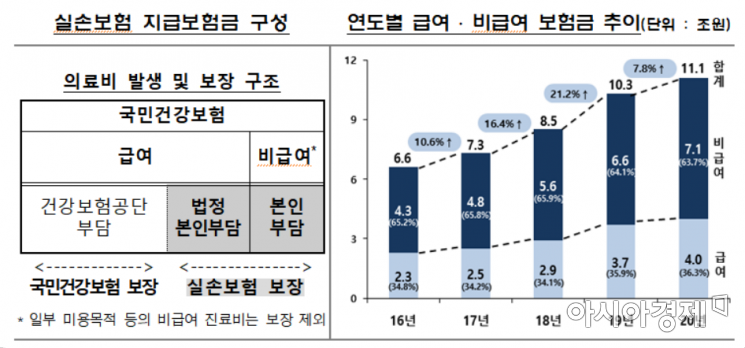

Status of Payment for Reimbursed and Non-Reimbursed Medical Expenses under Indemnity Health Insurance (Source: Financial Supervisory Service)

Status of Payment for Reimbursed and Non-Reimbursed Medical Expenses under Indemnity Health Insurance (Source: Financial Supervisory Service)

[Asia Economy Reporter Oh Hyung-gil] Financial authorities have decided to strengthen insurance claim reviews for non-reimbursable items under indemnity medical insurance, such as manual therapy and cataract treatment. Although premiums for indemnity insurance have been rising annually, there is a judgment that insurance payouts are increasingly leaking due to insufficient review standards for excessive medical treatment or non-reimbursable medical procedures.

On the 28th, the Financial Supervisory Service announced plans to establish reasonable coverage standards for non-reimbursable items causing insurance payout leakage due to excessive medical use, referencing decisions from dispute mediation committees and precedents.

They plan to systematically organize statistics on non-reimbursable medical expenses, conduct regular analyses, and share any abnormal signs with relevant authorities.

Indemnity insurance, known as the "people's insurance," had 34.96 million subscribers as of the end of last year, an increase of 540,000 cases (1.6%) compared to the previous year.

Depending on the sales period, it is divided into old indemnity (1st generation), standardized (2nd generation), and new indemnity (3rd generation), with standardized indemnity being the most common at 18.77 million cases (53.7%), followed by old indemnity at 8.54 million cases (24.4%) and new indemnity at 7.09 million cases (20.3%).

Premium income reached 10.5 trillion KRW last year, up 6.8% from the previous year due to increased new subscriptions and premium hikes. However, incurred losses rose 7.0% year-on-year to 11.8 trillion KRW, resulting in a deficit.

Last year, indemnity insurance incurred losses of about 2.5 trillion KRW, marking five consecutive years of losses. The combined ratio, which is the sum of the loss ratio and expense ratio, reached 123.7%. When the combined ratio exceeds 100%, the insurer incurs losses.

In particular, the old indemnity product, which has no deductible and experiences significant insurance payout leakage due to excessive non-reimbursable treatments, had the highest combined ratio at 136.2%.

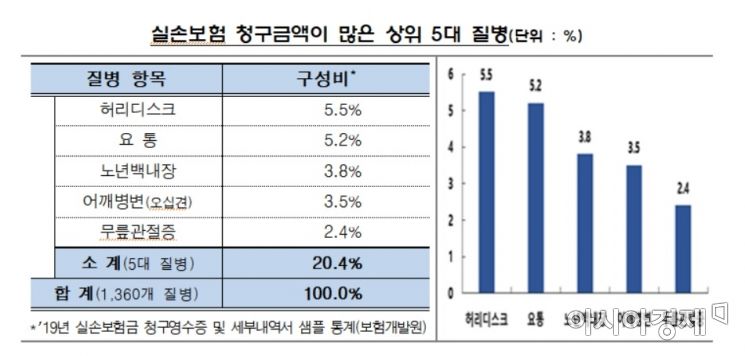

Top 5 Diseases for Reimbursement Claims in Indemnity Health Insurance (Source: Financial Supervisory Service)

Top 5 Diseases for Reimbursement Claims in Indemnity Health Insurance (Source: Financial Supervisory Service)

Improvement of Indemnity Insurance Coverage Standards... Targeting the Rapid Increase in Non-Reimbursable Items

Most losses occur in non-reimbursable items. Last year, indemnity insurance paid out a total of 11.1 trillion KRW in claims, of which 4 trillion KRW was for reimbursable (insured's share) and 7.1 trillion KRW for non-reimbursable items.

The proportion of non-reimbursable claims in indemnity insurance payouts was 63.7%, significantly higher than the 45.0% non-reimbursable proportion among National Health Insurance subscribers.

Among disease-related claim amounts, the top diseases were musculoskeletal disorders (herniated discs, back pain, shoulder lesions) and ophthalmologic diseases (cataract diseases). Major treatment items included manual therapy, extracorporeal shock wave therapy, MRI, proliferative therapy, adjustable intraocular lenses, ultrasound head and neck examinations, and ocular measurement tests.

Financial authorities are concerned about the sustainability of indemnity insurance as the combined ratio exceeds an appropriate level. They cited a lack of control mechanisms for excessive medical treatment and moral hazard among certain groups regarding non-reimbursable treatments as causes.

Additionally, they judged that insurers are selling fixed-amount insurance that covers excessive diagnostic fees, daily allowances, and surgery costs even for minor illnesses or accidents, with medical expenses covered by indemnity insurance and excess profits realized through fixed-amount insurance payouts.

A financial authority official explained, "To establish reasonable coverage standards for non-reimbursable items, we plan to prepare a compensation practical casebook and revise the standard terms and conditions of indemnity insurance," adding, "We will also guide insurers to strengthen internal controls when selling fixed-amount insurance products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)