During installment payment, conversion to in-kind payment may be possible if related law amendment passes

[Sejong=Asia Economy Reporter Kim Hyunjung] Samsung is expected to minimize the inheritance tax payment burden, estimated at about 13 trillion won, by donating some assets to society and opting for deferred tax payment. Under current law, it is not possible to pay taxes with artworks, but depending on the speed of processing the related amendment bill pending in the National Assembly and the detailed rules, the possibility of converting to payment in kind in the future cannot be ruled out.

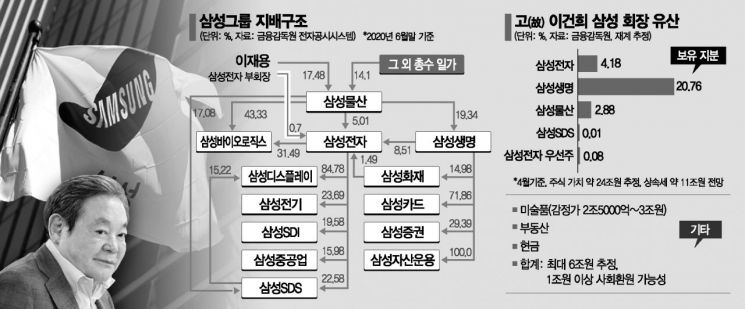

According to the business community on the 26th, Samsung is likely to donate part of the late Chairman Lee Kun-hee’s private assets and some high-priced artworks known as the ‘Lee Collection’ to society or foundations ahead of the inheritance tax filing and payment deadline for Chairman Lee’s inheritance share on the 30th.

One of the biggest interests inside and outside the business community is the value of the ‘Lee Collection,’ which consists of about 13,000 pieces. These artworks are estimated to have an appraisal value of 2.5 to 3 trillion won, and 50% of the inheritance value of artworks must be paid as tax.

The business community expects that Samsung is highly likely to donate artworks worth about 1 to 2 trillion won to exclude them from the taxable base. For other inherited artworks, under the current law (Enforcement Decree of the Inheritance and Gift Tax Act, Article 52, Paragraph 2, Subparagraph 2), the taxpayer estimates the tax amount based on the average appraisal value by two or more experts. If the appraisal value is lower than the amount appraised by the Appraisal Review Committee composed of three or more experts (appointed by the Commissioner of the National Tax Service), the inheritance tax is paid according to that appraisal value.

Under tax law, taxes must be paid in cash. Among corporate tax, inheritance tax, gift tax, capital gains tax, and local taxes such as property tax, payment in kind is only allowed for real estate or securities, but artworks are not included. In November last year, Rep. Lee Kwang-jae of the Democratic Party proposed a related amendment bill to allow inheritance tax payment with artworks, but it has been stalled due to opposition claiming it is a privilege for wealthy asset owners. There are also concerns that if artworks are entrusted for exhibition at domestic public art museums without resale to prevent overseas outflow, it could lead to a decrease in tax revenue.

If Samsung chooses deferred payment for inheritance tax and the amendment bill is passed and implemented, it may attempt payment in kind for the remaining tax amount. However, depending on the specific implementation timing and retroactivity set in the supplementary provisions, it may not be subject to payment in kind. Deferred payment requires paying one-sixth of the tax amount at the time of inheritance tax filing and paying the remaining five-sixths in installments, with a maximum of six payments. To do this, part of the inheritance share must be provided as collateral to the National Tax Service.

The inheritance tax on the Everland site located in Yongin City also draws attention. The standard for determining the land inheritance property value is the ‘market price,’ which refers to the sale price of the same land between two years before and 15 months after the inheritance commencement date (date of death). However, in the case of Everland land, where it is difficult to find comparable sales considered the same land, the appraisal value is regarded as the market price. In 2015, the National Pension Service valued the Everland site of Cheil Industries at 3.2 trillion won, but the accounting firm’s appraisal was much lower, ranging from 900 billion to 1.8 trillion won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.