[Asia Economy Reporter Jeong Hyunjin] As the government prepares to submit the proposed "Collective Litigation Act" to the National Assembly, an analysis has revealed that companies in the United States, which served as the model for this system, face more than 10 collective lawsuits annually. Accordingly, companies spend nearly 3 trillion won on related legal costs and suffer stock price declines, raising concerns that introducing a collective litigation system in Korea would increase the burden on companies.

On the 25th, the Federation of Korean Industries (FKI) announced that it analyzed the impact of the U.S. collective litigation system on companies and examined the ripple effects on Korean companies based on the "Carlton Class Survey," a collective litigation status survey conducted annually by the U.S. law firm Carlton Fields targeting compliance officers and chief legal officers of the top 1,000 U.S. companies by revenue. Previously, the Ministry of Justice announced the proposed "Collective Litigation Act" last September, which expands the collective litigation system from being limited to the securities sector to all fields and relaxes the requirements for litigation approval.

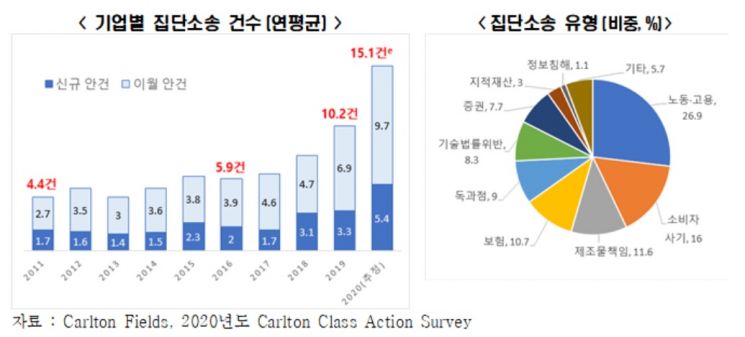

According to the FKI analysis, the number of collective lawsuits handled annually by U.S. companies increased 2.3 times from 4.4 cases in 2011 to 10.2 cases in 2019, and it was estimated to reach 15.1 cases last year. As of 2019, the most frequent types of lawsuits were labor and employment-related cases at 26.9%, followed by consumer fraud (16.0%), product liability (11.6%), insurance (10.7%), antitrust (9.0%), technology law violations (8.3%), and securities (7.7%).

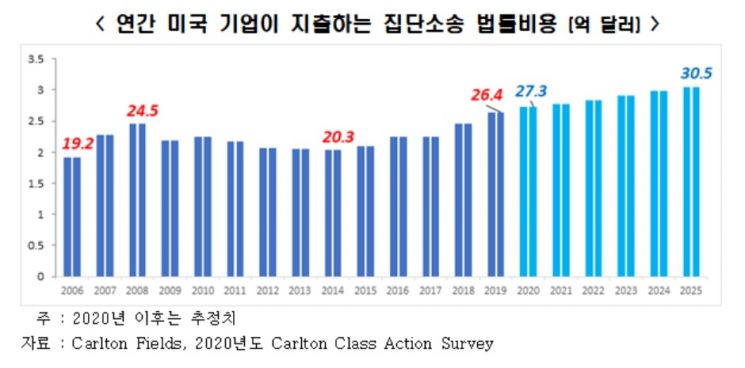

Legal costs related to collective lawsuits for U.S. companies steadily increased after 2014, reaching a peak of $2.64 billion (approximately 2.9 trillion won) in 2019. The FKI stated, "This accounts for 11.6% of the total U.S. litigation market size of about $22.75 billion and is comparable to the scale of SK Innovation's investment ($2.6 billion) in an electric vehicle battery plant under construction in Georgia, USA, and the creation of 2,600 new jobs." It added, "The rate of cost increase is also steep, with an average annual growth of about 2.45% from 2006 to 2019, and if this trend continues, it is estimated to exceed $3.05 billion by 2025."

Looking at the outcomes of collective lawsuits filed in the U.S., 60.3% of the cases in 2019 were settled, 31.2% were either dismissed by the court or still pending, and the remaining 8.5% were in trial. The FKI explained that the settlement rate decreased by 12.8 percentage points from 73.1% in 2018 to 60.3% in 2019, while cases in trial increased from 2% to 8.5% during the same period, indicating a growing tendency to choose litigation over settlement.

The FKI also pointed out that U.S. companies experienced stock price damage when news of collective lawsuits became public. From 1995 to early 2014, a total of 4,226 collective lawsuits were filed in the U.S., with 1,456 cases settled and total settlement amounts reaching $68 billion. However, the stock prices of these companies fell by an average of 4.4% upon the announcement of the lawsuits, resulting in estimated stock price losses totaling $262 billion, about four times the settlement amount.

Additionally, surveyed companies employed an average of 4.2 in-house lawyers dedicated to handling collective lawsuits, which corresponds to one lawyer per approximately $5.19 billion in revenue, according to the FKI. Based on this, if collective litigation is introduced in Korea, it is estimated that Samsung Electronics would need 40.8 additional staff, Hyundai Motor 17.9, LG Electronics 10.9, SK Hynix 5.5, and LG Chem 5.2.

The FKI emphasized that if the Collective Litigation Act is passed domestically, legal risks will increase more than in the U.S., urging caution in its introduction. Yuh Hwan-ik, Director of Corporate Policy at the FKI, said, "The 21st National Assembly has passed various bills strengthening corporate penalties, which already impose a heavy burden on companies. If collective litigation is also introduced, companies will face not only direct costs from frivolous lawsuits but also increased management uncertainty, which could hinder investment and job creation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.