Samsung, Kiwoom, KINTU, Hi, etc.

Free Agency Services Continue to Emerge

[Asia Economy Reporter Park Jihwan] Ahead of next month's comprehensive income tax filing period, securities firms are increasingly offering tax filing agency services.

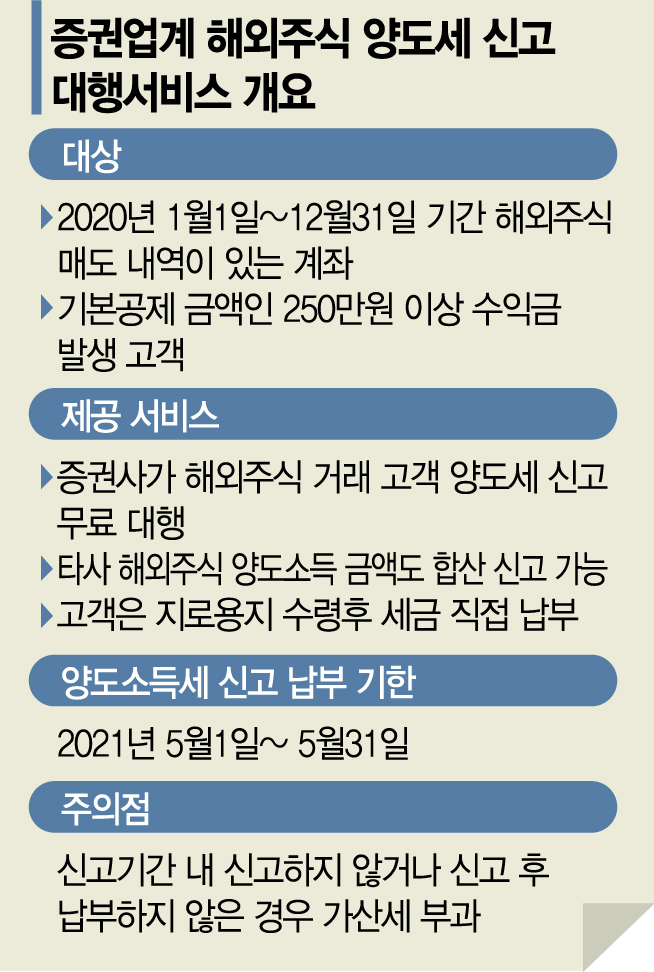

According to the financial investment industry on the 21st, in preparation for the May comprehensive income tax filing period, most securities companies are providing tax filing agency services through business partnerships (MOUs) with tax firms. Currently, Samsung Securities, Kiwoom Securities, Korea Investment & Securities, Meritz Securities, Hi Investment & Securities, Daishin Securities, and Hanwha Investment & Securities are offering free services that verify not only their own but also other companies' transaction details to handle overseas stock capital gains tax filings on behalf of customers.

Domestic investors who earned more than 2.5 million KRW in profits from overseas stock trading last year must complete capital gains tax filing and payment by the end of next month. A 22% tax is imposed on the amount exceeding 2.5 million KRW from investment gains. This differs from domestic stock investments, where no tax is levied on trading gains unless the investor meets the major shareholder criteria.

From the customer's perspective, this reduces the burden of complicated tax filing procedures and collecting supporting documents. However, there are precautions. Securities firms only handle the filing; when the payment slip is sent via email or mail, customers must pay the tax themselves. If an investor with gains exceeding 2.5 million KRW fails to file or pay, they must pay an additional penalty tax of 10-20%.

Securities firms also assist customers subject to comprehensive financial income taxation with their tax filings. If the total financial income, combining interest income and dividend income per investor, is 20 million KRW or less annually, financial institutions withhold income tax in advance, so no separate tax filing procedure is required. However, if financial income exceeds 20 million KRW, investors must file and pay income tax by combining it with other income such as business income. Financial income includes interest income from bonds and domestic and foreign deposits, as well as dividend income from domestic and foreign corporations, funds, and ELS profits.

The expansion of services by securities firms is interpreted as a strategic move to secure potential customers. According to the Korea Securities Depository, last year, the settlement amount for overseas stock purchases and sales by domestic individual investors was $198.322 billion USD (220.5737 trillion KRW), nearly five times the $41 billion USD from the previous year. As transaction volume increases, the number of taxpayers subject to capital gains tax is also expected to rise significantly. An industry official explained, "We expect to secure potential customers by providing services for clients who find tax issues difficult," adding, "For customers with large tax payment amounts, services are expanding to comprehensive asset management."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.