OPEC+ to Increase Production from May... International Oil Prices Expected to Fall

Q2 Inventory Revaluation Losses Likely to Rise

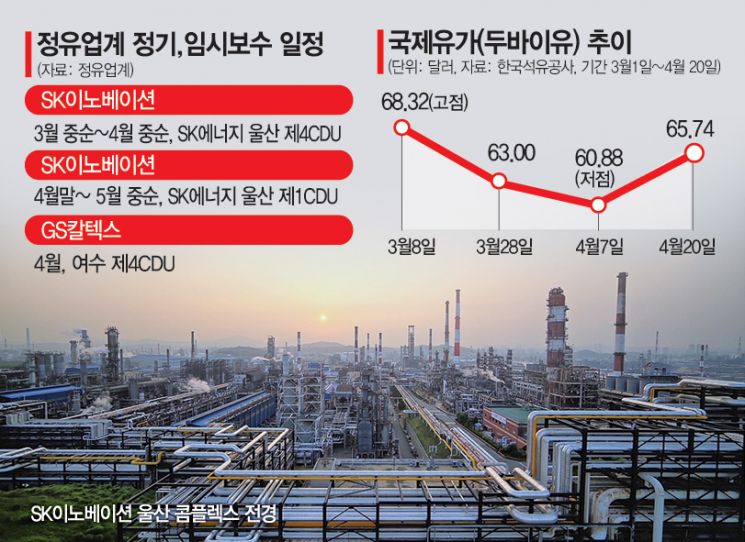

SK Inno and GS Caltex Adjust Reserve Schedules

[Asia Economy Reporter Hwang Yoon-joo] It has been confirmed that SK Innovation and GS Caltex have moved up their regular maintenance schedules in preparation for a possible decline in international oil prices in the second quarter. This decision comes amid the judgment that there is a high possibility of inventory valuation losses this quarter, as the Organization of the Petroleum Exporting Countries (OPEC) and major oil-producing countries including Russia, collectively known as OPEC Plus (OPEC+), have decided to increase production starting next month. It is interpreted as a measure to defend second-quarter performance immediately, amid expectations that oil demand may increase as COVID-19 vaccination rates rise mainly in major developed countries in the second half of this year.

According to the industry on the 21st, SK Energy will bring forward the temporary maintenance of its Ulsan No. 1 Crude Distillation Unit (CDU) by one month, starting at the end of this month. The processing capacity of the No. 1 CDU is 60,000 barrels per day. SK Energy is currently also conducting regular maintenance on the No. 4 CDU (240,000 barrels per day) in Ilsan. GS Caltex has been conducting regular maintenance on the Yeosu No. 4 CDU with a capacity of 330,000 barrels per day since last month. S-OIL and Hyundai Oilbank carried out their regular maintenance ahead of schedule last year, and it is known that there are no scheduled regular maintenances this year.

The change in the regular maintenance schedule is aimed at reducing inventory valuation losses in the second quarter. Refining industry performance is closely linked to inventory valuation, which assesses the value of crude oil purchased in advance, and when international oil prices fall, inventory valuation losses are typically recorded. This is because crude oil is imported and then refined, and sold two to three months later, putting the industry in a situation where it has to sell products at a lower price than the cost of raw materials purchased at a higher price.

The price of Dubai crude oil, which South Korea imports the most, has been gradually declining over the past month. It peaked at $68.32 on March 8, then recorded $66.57 (March 17), $63.18 (March 22), $60.88 (April 7), and $65.74 (April 20). Although there is optimism about oil demand recovery due to COVID-19 vaccinations, the refining industry is betting more on the possibility of a decline in international oil prices. This is because OPEC+ announced earlier this month that it will gradually increase daily production cuts by 350,000 barrels in May, 350,000 barrels in June, and 440,000 barrels in July. Saudi Arabia, the largest oil producer, also proposed gradually reducing its daily production cut of 1 million barrels and stopping cuts by July.

Meanwhile, domestic consumption of major petroleum products remains flat. Gasoline margins have improved, but diesel, jet fuel, and kerosene margins remain sluggish due to continued low demand. As of cumulative data in February this year, diesel consumption decreased from 12.96 million barrels to 12.74 million barrels, and jet fuel from 1.65 million barrels to 1.47 million barrels. Only gasoline consumption increased from 6.13 million barrels to 6.49 million barrels.

Han Sang-won, a researcher at Daishin Securities, predicted, "While refining margins are expected to normalize in the second half and the direction of oil demand recovery is clear, the possibility of a strong international oil price is limited, so performance in the second quarter is expected to deteriorate compared to the first quarter due to inventory-related gains and losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)