2030s Rush into Dogecoin Despite Risks

Atmosphere of 'No Chance to Succeed from Humble Origins'

"Is It Just Get-Rich-Quick?" Gambling, Not Investment, Criticized

Disappointment Among 'Sudden Poor' After News of Hundreds of Millions Earned

Experts Warn "Dogecoin Is a Bubble... It Will Definitely Burst"

Elon Musk, co-founder and CEO of Tesla, is boosting his SpaceX by carrying 'Dogecoin' along with it. It appears to be a kind of parody photo, implying that Musk is launching Dogecoin. Photo by Online Community

Elon Musk, co-founder and CEO of Tesla, is boosting his SpaceX by carrying 'Dogecoin' along with it. It appears to be a kind of parody photo, implying that Musk is launching Dogecoin. Photo by Online Community

[Asia Economy Reporters Seunggon Han and Choyoung Kim] "It's not just an all-in bet. We have hope only if we do this."

The cryptocurrency craze is turning into a frenzy. In the past, investments by 'ants' (individual investors) continued alongside analyses such as the birth of new currencies through Bitcoin, but now there are criticisms that Dogecoin investment is closer to a form of gambling with speculative risks.

On the other hand, some argue that investment is a personal choice from the start, and since the goal is to increase money, there is no problem. Coupled with the reality that 'in Korean society, you can no longer become a dragon from a small stream,' there is also a view that people in their 20s and 30s are making 'reasoned blind investments.'

◆ 2030 Generation: "Why do we invest? It's a reasoned blind investment"

Kim, a man in his 20s working at a company who recently expressed interest in coin investment, pointed out that although he has a negative view of Dogecoin, there are reasons why young people flock to it.

Kim said, "I don't think people in their 20s and 30s invest in Dogecoin because they don't know the risks," adding, "They are well aware of how volatile Dogecoin is among cryptocurrencies." He continued, "The problem is why they take such risks to invest in Dogecoin. I wish people would understand this."

Choi, a man in his 30s working at a company who said he is about to invest in Dogecoin, said, "First, I want to feel a sense of achievement from making money through coins." He added, "I don't yet think I will make tens of millions of won through investment," and said, "Do ants really have a chance to make money through investment? There are various reasons behind the investment, such as resolving these issues through coin investment."

Summarizing the sighs of young people, they are forced into situations where they remain lifelong non-homeowners or have to give up having children. Even after breaking through the employment barrier and entering society, they inevitably face the bigger wall of 'owning a home.'

According to data released last October by the Korea Real Estate Board and Statistics Korea, the period for a two-person household under 39 years old to buy a house by saving their income as is (Price-to-Income Ratio, PIR) was 15 years. Even if they save half their salary monthly, it would take 30 years. The PIR was 11 years in June 2017 but increased by 4 years in this survey.

In this regard, young people's coin investments continue to increase. According to data obtained on the 20th by Rep. Eunhee Kwon of the People's Party from the four major domestic cryptocurrency exchanges (Upbit, Bithumb, Coinone, Korbit), 2,335,977 people in their 20s and 30s traded cryptocurrencies at least once in the first quarter (January to March) of this year (including duplicates).

Among them, 1,584,814 people in their 20s (816,039) and 30s (768,775) opened accounts and started investing in the first quarter. This means that 7 out of 10 cryptocurrency investors in their 20s and 30s started investing for the first time this year. This explains why terms like 'all-in loan,' 'all-in investment,' and 'all-in coin investment' have emerged, as they gather every last bit of their resources.

◆ "Not investment but just a get-rich-quick mentality," "Frustration of becoming a sudden pauper"

There are also voices of concern about this frenzy of investment among young people in their 20s and 30s. It is criticized as a kind of gambling aiming for sudden wealth. Park, a man in his 40s working at a company, said, "The only reason young people invest in coins is just luck to make billions; nothing more or less." He added, "Investment should be based on various analyses, but can investing in coins like Dogecoin be called investment?"

Along with the coin investment frenzy, more office workers are sighing. They feel frustrated and unable to focus on work after hearing news of office workers who made hundreds of billions through investment.

On an anonymous site for office workers, a post appeared saying that Son, who worked at Samsung Electronics, bought cryptocurrency with 50 million won as seed money and earned over 40 billion won. Samsung Electronics responded, "It is true that the employee resigned, but we do not know the exact reason for the resignation."

Also, Han, who worked in a financial sector PR team, quit his job last month. He explained that he invested 230 million won, including a 100 million won loan, in cryptocurrencies and earned profits in the 30 billion won range in about a year.

As a result, more people are feeling psychological deprivation. They sigh that they became so-called 'sudden paupers' because they failed to ride the cryptocurrency upswing. Kim, a man in his 30s working at a company, said, "Even if there was some risk, I wonder if things would have been different if I had just watched and followed to invest. I have such regrets."

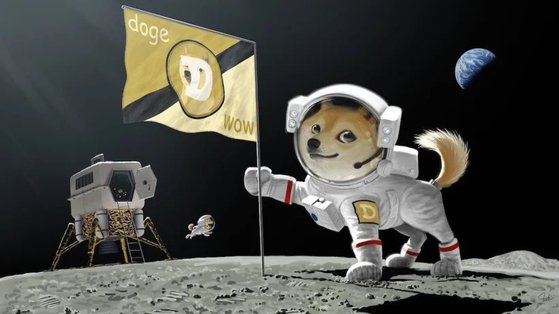

An image posted by Elon Musk, Tesla CEO, last February. It depicted a Shiba Inu, symbolizing Dogecoin, landing on the moon. Photo by Elon Musk Twitter capture

An image posted by Elon Musk, Tesla CEO, last February. It depicted a Shiba Inu, symbolizing Dogecoin, landing on the moon. Photo by Elon Musk Twitter capture

◆ Experts: "Individual investors' funds will disappear quickly"

However, the cryptocurrency market continues to show unstable signs with rapid price surges and fluctuations. Experts warn that the cryptocurrency investment market is overheated and caution against 'blind investments.'

David Kimberly, a researcher at UK investment firm Pretrade, said in an interview with US CNBC, "People don't invest in Dogecoin because they think it has value. They invest thinking they will sell when the price rises," adding, "If the typical 'greater fool theory' behavior continues, the bubble will inevitably burst."

Charles Hoskinson, founder of Cardano, also warned, "The Dogecoin price bubble will definitely burst, causing massive losses to individual investors," and said, "Dogecoin's price is unsustainable and will soon collapse, and a huge amount of individual investors' funds will disappear quickly."

Additionally, Akhand Sitra of TRM Labs, a cryptocurrency risk management platform company, strongly criticized on his LinkedIn post that the Dogecoin market is controlled by about 100 people. Sitra said, "The Dogecoin bubble will easily burst by the end of the year," and criticized that 98 electronic wallets hold 65% of all coins circulating in the Dogecoin market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.