[Asia Economy Reporter Suyeon Woo] While the Framework Act on Service Industry Development has failed to pass the National Assembly for 10 years, South Korea's service industry competitiveness remains among the lowest in OECD countries.

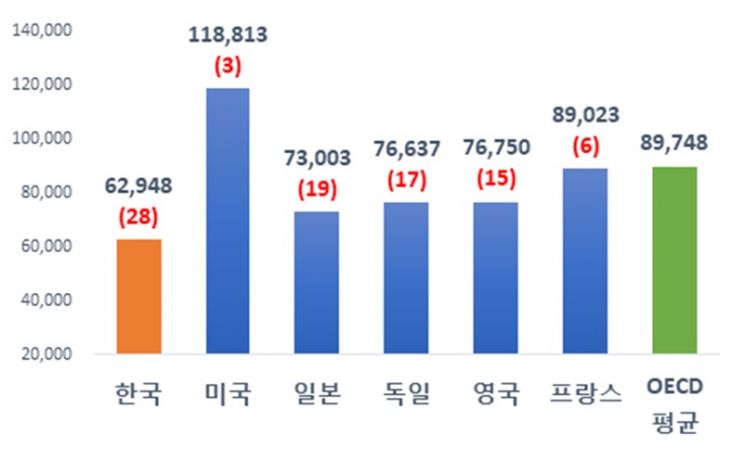

On the 20th, the Federation of Korean Industries (FKI) analyzed OECD statistics and found that South Korea's labor productivity per employed person, which indicates service industry competitiveness, ranked 28th, placing it in the lowest tier. This level is only 70.1% of the OECD average.

The ratio of service industry labor productivity to manufacturing labor productivity stood at 50.3%, ranking 32nd out of 33 OECD countries, revealing a significant productivity imbalance between industries. Although South Korea's service industry productivity steadily increased between 2012 and 2018, its ranking within the OECD remained between 27th and 29th, comparable to Greece (24th), Slovenia (27th), and Lithuania (29th).

OECD Major Countries Service Industry Productivity (Unit: Dollar) / Source: Federation of Korean Industries

OECD Major Countries Service Industry Productivity (Unit: Dollar) / Source: Federation of Korean Industries

Investment in research and development (R&D), which will determine the future competitiveness of the service industry, was also found to be insufficient compared to major countries. As of 2018, South Korea's service industry R&D amounted to $7.2 billion, significantly lower than major manufacturing powerhouses such as the United States ($136.5 billion), Japan ($16.3 billion), and Germany ($13.3 billion). The share of service industry R&D in total R&D was also in the single digits at 9.1%.

The service balance has also been in deficit for 21 consecutive years since 2000. The cumulative deficit over the past decade (2011?2020) reached $167.8 billion, with the deficit in royalties and license fees, closely related to high value-added industries, accounting for $33.9 billion, or 20.2% of the total service balance deficit.

The FKI explained that the causes of this include ▲a lack of high value-added service industries ▲high regulatory levels ▲excessive competition. Leading global companies are focusing on enhancing profitability by integrating and expanding manufacturing and offline businesses into high value-added service industries (such as software and subscription services). In contrast, South Korean companies are evaluated to be slower in the servitization of manufacturing. Regulatory risks related to the emergence of new service industries, such as shared vehicle service regulations, early morning delivery, and restrictions on complex shopping mall operations, also act as obstacles to productivity improvement.

Excessive competition due to South Korea's high proportion of self-employed workers is also an unfavorable condition for productivity improvement. As of 2018, the ratio of non-wage workers (self-employed plus unpaid family workers) in South Korea was 25.1%, ranking 6th among 34 comparable OECD countries. To overcome this, the government and political circles have recognized the importance of the service industry and have been promoting the enactment of the Framework Act on Service Industry Development since 2011. However, progress has stalled for 10 years due to disputes in some areas, such as the medical industry sector.

Yoo Hwan-ik, head of corporate policy at the FKI, advised, "Since South Korea's manufacturing productivity has reached a world-class level, we must create a breakthrough for economic growth by improving productivity in the service industry. We need to accelerate the enactment of the Framework Act on Service Industry Development, expand the application of the Corporate Vitality Act, promote the integration and transformation of high value-added service industries, alleviate competition among the self-employed by expanding wage worker jobs, and improve regulations in the service industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)