Processing of Amendment Bills in the Second Half Regular National Assembly

Calculated to Aid Next Year's Election

Major Framework for Deregulation Established

Criticism of Policy Inconsistency Also Raised

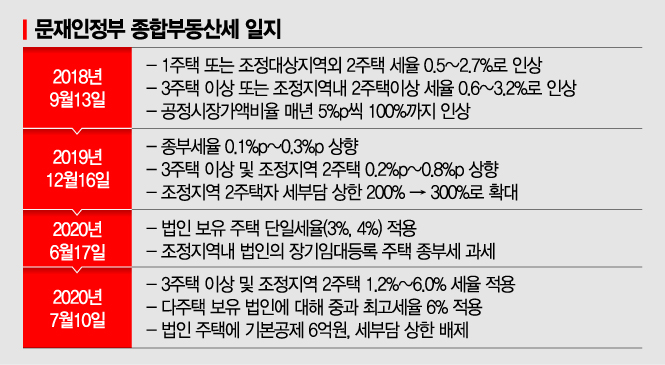

[Asia Economy Reporters Jang Sehee and Jo Gangwook] The Democratic Party of Korea’s decision to emphasize easing the previously hardline real estate regulations is interpreted as a response to the real estate policy being a cause of the crushing defeat in the April 7 by-elections, as well as consideration of the major event of next year’s presidential election. The ruling party plans to process a tax law amendment bill containing measures to ease real estate regulations during the regular National Assembly session in the second half of the year, once the party’s special real estate committee is fully operational following the election of the party leader next month. Since the tax law amendment bill, which includes easing the comprehensive real estate tax, will be applied starting next year, it is expected to be beneficial for the election.

Although the basic direction of easing real estate regulations has been set on a broad scale, concerns have been raised that the constantly changing discussions could undermine the consistency of government policy and only fuel market confusion.

Comprehensive Real Estate Tax Only on Top 1-2% of Home Prices? Ruling Party Watching Public Opinion

The ruling party’s shift in real estate policy was detected after the by-elections. However, the idea of imposing the comprehensive real estate tax only on owners of the top 1-2% of housing prices has attracted attention and is becoming more concrete. Currently, the comprehensive real estate tax is levied on the top 3.8% of homes, but there is a consensus to ease this standard to the top 2% level before the rapid rise in housing prices.

A key ruling party official said, “There are opinions that both the comprehensive real estate tax and property tax need to be revised,” adding, “We also plan to consider raising the housing price criteria for loans for actual demanders such as young people and newlyweds.”

However, the party leadership is cautious. On the 20th, Han Junho, the Democratic Party’s floor spokesman, drew a line under some media reports that the party is considering limiting the comprehensive real estate tax to owners of the top 1-2% of real estate holdings, saying, “There has been no discussion on that.” This is because adjusting the comprehensive real estate tax, which was introduced to overcome asset polarization, could be interpreted by the market as a complete revision of real estate policy.

Nevertheless, the plan to limit the comprehensive real estate tax to within the top 2% is considered more effective for market stability than raising the official property price standard, so it is difficult to simply shelve the idea. Raising the official property price standard for the comprehensive real estate tax from 900 million won to 1.2 billion won could potentially raise the housing prices of homes not subject to the tax. Accordingly, it is expected that once the party’s special real estate committee is fully operational, there will be intense discussions on specific measures.

Within the party, many opinions favor revising the comprehensive real estate tax in some way. On the same day, Representative Kim Byungwook proposed a bill to reduce the comprehensive real estate tax and property tax, and Representative Jeong Cheongrae and others are preparing a bill to raise the comprehensive real estate tax threshold for single-homeowners from “exceeding 900 million won” to “exceeding 1.2 billion won.”

In addition, there are forecasts that the property tax exemption threshold will be raised from the current 600 million won to 900 million won and that the pace of official property price increases will slow down. This is because the rapid rise in official property prices is sharply increasing the tax burden on actual residents amid the recent surge in housing prices centered on Seoul. There are also calls to revise loan regulations for first-time homebuyers and actual demanders, suggesting that the current housing mortgage loan-to-value ratio (LTV) of 40% should be eased to at least 60% for young people, newlyweds, and first-time homebuyers.

With Plans for Major Revisions, Government Also ‘Embarrassed’... “Basic Approach Is to Ease Transaction Taxes and Strengthen Holding Taxes”

The government is in an awkward position as the Democratic Party announces plans for major revisions to real estate policy. The core of policy is consistency, and erratic changes could only stir market confusion.

A government official said, “If real estate tax systems are changed just based on polls, the effectiveness of future real estate policies will diminish.” Another official expressed concern, saying, “Policies cannot be revised every time public opinion is unfavorable,” adding, “Excessive revisions to loan regulations could rather fuel housing price increases.”

Market participants agree that fundamental measures are needed to curb housing price rises. Recent dissatisfaction with the increased burden of real estate holding taxes such as the comprehensive real estate tax stems from the sharp rise in official property prices, which serve as the basis for these taxes. Eun Hyung Lee, senior researcher at the Korea Institute of Construction Policy, said, “If the policy to realize official property prices continues, debates over the comprehensive real estate tax and holding taxes will inevitably continue even after raising the standards,” adding, “It is necessary to calculate official property prices linked to inflation or housing price growth rates.” Professor Seo Jin-hyung of Gyeongin Women’s University (President of the Korea Real Estate Society) said, “The by-election for Seoul mayor revealed public sentiment on real estate policy,” and emphasized, “Tax policy reforms that impose burdens on the public should be expedited first.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.