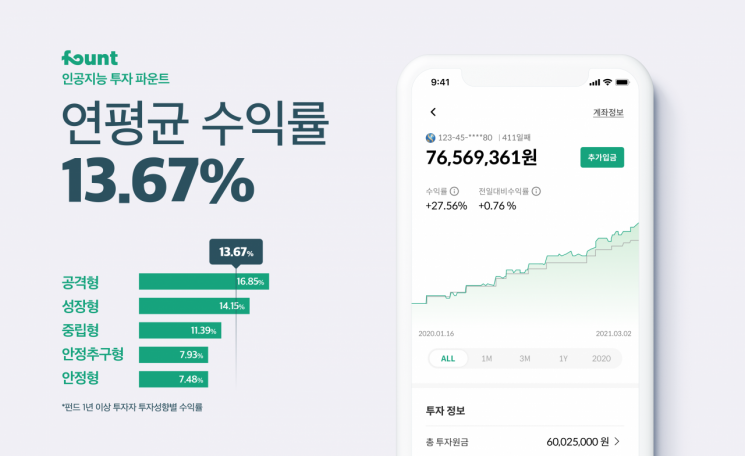

[Asia Economy Reporter Minji Lee] AI investment specialist company Fount announced on the 20th that the fund's 1-year return rate for investors was recorded at 13.67%. In addition, pensions showed 11.52%, and domestic ETFs showed 4.43%.

Looking at the annual average return rates by investment type for fund investors with over one year of investment, aggressive type recorded 16.85%, growth type 14.15%, neutral type 11.39%, stability-seeking type 7.93%, and stable type 7.48%. For cumulative returns, the aggressive portfolio was 45.96%, neutral 29.94%, and stable 19.15%.

The annual average return rate for pensions was 13.29% for aggressive type, 13.15% for growth type, and 7.31% for stability-seeking type, with the cumulative return for aggressive pension reaching 30.32%.

Domestic ETFs showed an annual average return of 5.86% for aggressive type and 4.11% for growth type, with the cumulative return of the aggressive domestic ETF portfolio recorded at 14.82%.

Investors with over one year of investment endured last year's COVID-19 crash and the mixed trends from the U.S. earlier this year, achieving stable returns based on long-term optimism. In particular, funds generated over 7% returns across all portfolios, achieving the stable 7-8% returns targeted by robo-advisors.

Fount’s AI algorithm, developed in-house, combines economic and market indicators from around the world and produces over 52,000 scenario results to generate the ‘Fount Market Score.’ By organically responding to global economic trends based on this score, Fount provides differentiated services that allow investors to perform frequent rebalancing themselves, resulting in stable investment performance.

Fount CEO Youngbin Kim said, “Because robo-advisors operate based on objective big data without being swayed by themes or issues, their returns are not significantly higher than direct individual stock investments, but the biggest advantage is that investors can continue investing comfortably and stably. Since long-term investment also benefits from compound interest, it is important to maintain steady, long-term investment perspectives.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.