No Overheating Signals Compared to January Rise and Valuation Pressure Eased

Expecting Stabilization Around 3200 Level and New Highs

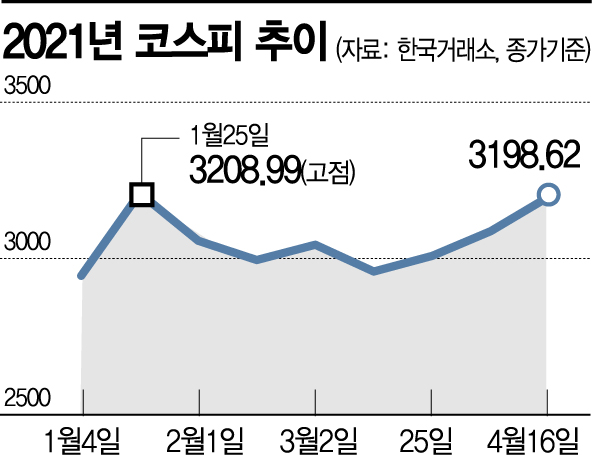

[Asia Economy Reporters Song Hwajeong and Ji Yeonjin] As the KOSPI continues its strong performance day after day, expectations for breaking past its previous high are growing. Compared to the peak recorded in January, the burden has also eased, making it highly likely that the index will set a new high.

As of 9:25 a.m. on the 19th, the KOSPI stood at 3,204.70, up 6.08 points (0.19%) from the previous day. The KOSPI started the day on an upward trend, briefly turned bearish, and then resumed its rise, maintaining a strong streak for six consecutive trading days.

Since the beginning of this month, foreign investors have returned to buying, helping the KOSPI break out of a two-month correction phase and gain momentum. After failing to reach the 3,200 level since January, the KOSPI has touched the 3,200 mark three days in a row during intraday trading, increasing expectations for stabilization above 3,200 and a breakthrough of the previous high.

Changed Atmosphere Compared to January

Analysts say the atmosphere is different from the January peak breakout. Seo Jeong-hoon, a researcher at Samsung Securities, said, "With concerns about interest rates calming down, the KOSPI rose close to the January peak," adding, "Unlike then, there are no overheating signals, valuation pressures have further eased, and notably, the main source of demand is foreign investors rather than individuals." First, the overheating signals that were prominent at the beginning of the year have disappeared. At that time, expectations for economic activity resumption combined with aggressive buying by individuals triggered warning signs in various technical indicators. Seo explained, "The relatively high performance compared to global stock markets has long been an excuse for foreigners to realize profits," and "Conversely, the index has been moving sideways for three months with reduced volatility, and compared to the Morgan Stanley Capital International All Country World Index (MSCI AC WORLD), the domestic index has continued to ‘underperform’ in the first quarter, turning relative price pressure into an attraction." Corporate earnings forecasts have also steadily risen, contributing to easing valuation pressures. The forward price-to-earnings ratio (PER) of the MSCI Korea Index fell from 15.1 times in January to 13.4 times.

Ahn So-eun, a researcher at IBK Investment & Securities, also said, "The third upward breakout of the KOSPI’s trading range since COVID-19 is imminent," adding, "Macro factors, earnings, and supply-demand conditions are all working favorably for the stock market." While there are concerns about inflation, she emphasized the need to view corporate earnings improvements positively. Ahn explained, "Fundamentally, price increases reflect changes in goods and service prices, which is positive for corporate profits," and "What negatively affects the stock market is a shift to monetary tightening to curb excessive inflation, but considering the current stance of the U.S. Federal Reserve (Fed), the likelihood of this happening is still low, making it a suitable time to enjoy the positive aspects of inflation."

Who Are the Leading Stocks? In the Past...

As the stock market continues its strong performance, interest in leading stocks is growing. The securities industry is looking for clues from the leading stocks during the 2010 market when the KOSPI surged 22% after the global financial crisis.

The KOSPI, which plunged due to the 2008 global financial crisis triggered by the collapse of Lehman Brothers in the U.S., surged 50% in 2009 and rose an additional 22% in 2010. After the massive crash caused by COVID-19, the KOSPI recorded a 30% increase last year compared to the end of the previous year and is currently up 11% this year.

Meanwhile, the annual operating profit of domestic companies is expected to increase compared to the previous year, but the growth rate is expected to slow down after peaking in the first quarter of this year. This resembles the pattern in 2011 when the KOSPI’s annual operating profit growth rate was 188% in the first quarter but gradually declined from the second quarter (64%).

Based on this, it is analyzed that among stocks expected to see a profit decline in the second half compared to the first half of this year, companies expected to grow profits will likely emerge as leading stocks. Among sectors with significant earnings improvements in the first quarter, securities and chemicals are mentioned, with Korea Financial Group and OCI cited.

Additionally, Kakao and Hyundai Mobis, expected to narrow the market capitalization and sales gap within leading industries, as well as Hyundai Mipo Dockyard and SFA, which are expected to improve earnings due to reduced debt levels, are also emerging as leading stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.