Many Complaints About Incomplete Sales in Life Insurance

Non-life Insurance Dominates Insurance Payment Calculations

[Asia Economy Reporter Oh Hyung-gil] More than half of all financial complaints last year originated from the insurance sector. Although insurance complaints have been increasing annually, no adequate solution has yet emerged. The issues vary widely, ranging from disputes between insurance companies and consumers over claim payments to policy cancellations and mis-selling.

Consumers are increasingly filing complaints first to resolve issues with insurers, and specialized agencies that handle complaints on their behalf have also appeared, causing a surge in the number of complaints. As a bill has been proposed to amend legal regulations to allow the insurance industry to autonomously resolve these complaints, attention is focused on whether a solution can be found.

6 out of 10 Cases Are 'Insurance Complaints'... Dissatisfaction with Claim Assessment

According to the Financial Supervisory Service, out of 90,334 total financial complaints last year, 53,294 were insurance complaints, accounting for 59% of the total.

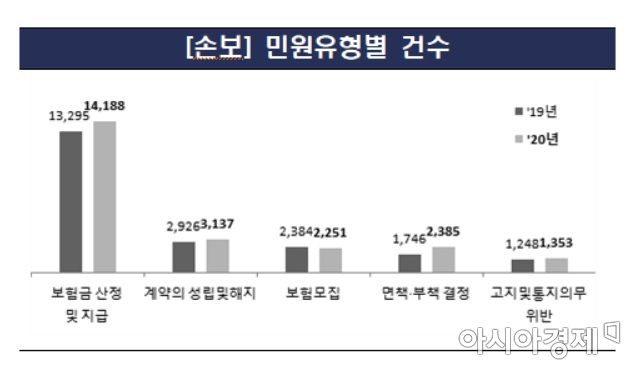

Among insurance complaints, non-life insurance accounted for 32,124 cases, a 4.1% increase compared to the previous year. By complaint type, claim assessment and payment accounted for the largest share (44.2%), followed by contract formation and cancellation (9.8%), and insurance solicitation (7.0%).

Complaints related to claim assessment and payment (893 cases), exemption decisions (639 cases), contract formation and cancellation (211 cases), and violations of disclosure and notification obligations (105 cases) increased, while complaints related to insurance solicitation (133 cases) decreased.

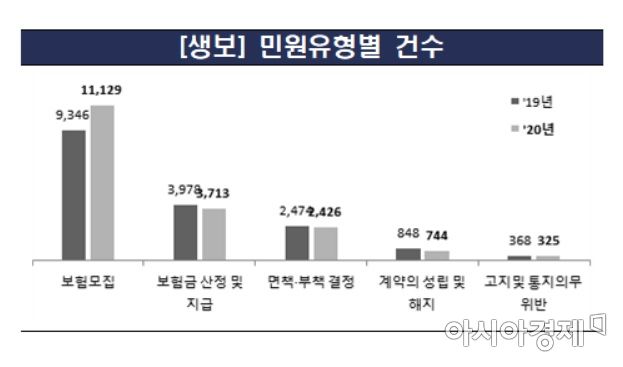

Life insurance complaints totaled 21,170 cases, a 4.1% increase from the previous year. Complaints related to insurance solicitation (52.6%) were the most frequent, followed by claim assessment and payment (17.5%) and exemption decisions (11.5%).

While most complaint types decreased, complaints related to insurance solicitation (1,783 cases, up 19.1%) increased compared to the previous year. In particular, complaints about mis-selling (such as insufficient product explanation) in life insurance reached 9,663 cases, a 23.0% increase from the previous year.

Since last month, the Financial Consumer Protection Act has been enforced, strengthening regulations on the sales process of financial products, including enhanced disclosure obligations. The six major sales regulations include suitability principle, appropriateness principle, disclosure obligations, prohibition of unfair sales practices, prohibition of improper solicitation, and prohibition of false or exaggerated advertising. Violations can result in punitive surcharges of up to 50% of revenue.

Notably, consumers have the right to freely withdraw contracts within a certain period through the right of withdrawal, and if sales principles are violated, consumers can exercise the right to cancel illegal contracts within one year from the date they become aware of the violation or within five years from the contract date, whichever comes first. As consumer rights have significantly expanded, complaints are also expected to be affected.

Association-Led Complaint Handling... Korea Financial Investment Association and Credit Finance Association Already Implementing

To promptly handle the increasing number of complaints, a legal amendment is being pursued to allow the Insurance Association to lead and autonomously resolve complaints.

Kim Han-jung, a member of the National Assembly's Political Affairs Committee from the Democratic Party of Korea, has introduced a bill to amend the Insurance Business Act to provide the Insurance Association with the authority to handle complaints, autonomously resolve disputes, and conduct counseling services.

A significant portion of insurance complaints involves simple issues such as violations of disclosure and notification obligations or questions and suggestions. Currently, all complaints are concentrated at the Financial Supervisory Service regardless of type, leading to longer complaint and dispute resolution periods. The bill aims to prevent this.

In 2019, the average processing time for financial complaints was 24.8 days, an increase of 6.6 days compared to 2018. Longer processing times result in greater harm to consumers.

The amendment stipulates that the Insurance Association may perform complaint handling, autonomous dispute resolution, and other counseling services related to insurance complaints, and requires the association to establish regulations and procedures for complaint handling and dispute resolution.

In the capital markets and credit finance sectors, associations already handle complaint processing. Currently, the Korea Financial Investment Association under the Capital Markets and Financial Investment Business Act and the Credit Finance Association under the Specialized Credit Finance Business Act perform autonomous dispute resolution and counseling and handling of user complaints related to member business activities.

Representative Kim stated, "If the relevant authorities thoroughly review the scope of complaints that the Insurance Association can handle and the complaint handling procedures, consumer dissatisfaction and inconvenience can be reduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.