[Asia Economy Reporter Kiho Sung] K-Bank announced on the 15th that it has launched an ‘Emergency Fund Loan’ product that allows customers to receive small amounts of funds immediately through the app whenever urgently needed.

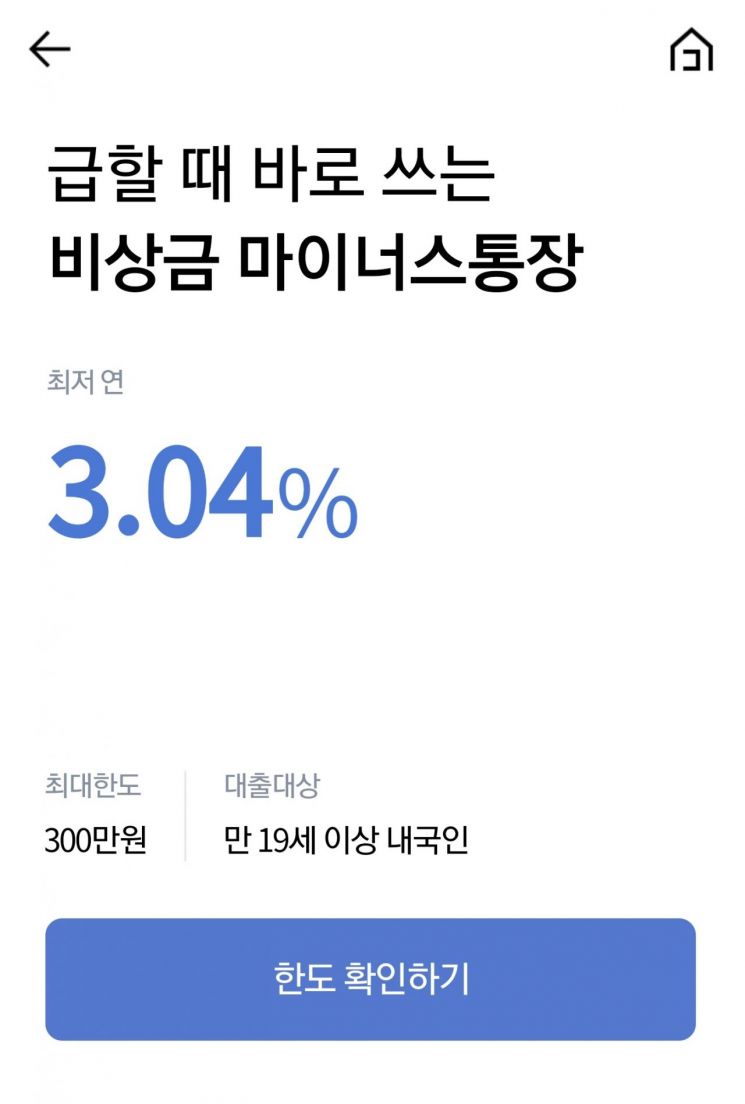

This product is characterized by the fact that customers with a K-Bank deposit and withdrawal account can complete the loan application and execution process in about one minute. Depending on the credit rating, customers can borrow up to 3 million KRW through an overdraft account method, and applications are available 24/7, 365 days a year (excluding settlement times), regardless of holidays.

The interest rate starts at an annual rate of 3.04% (as of the 15th, based on the 12-month variable rate of financial bonds), with a maturity of one year and the possibility of extension up to 10 years. The ‘Emergency Fund Loan’ can be applied for through the ‘Products’ section of the K-Bank app.

K-Bank is gradually diversifying its loan portfolio by launching the Emergency Fund Loan product following the linked loan service introduced in February this year. K-Bank is also preparing to launch Jeonse/Monthly Rent Deposit Loans and Sa-it-dol Loans.

Meanwhile, K-Bank recently launched the ‘My Credit Management’ service, which allows customers to manage their credit scores in real time using the app. Through this service, K-Bank customers can view their credit scores, card payments, loans, and delinquency status at a glance. Furthermore, they can easily submit health insurance and income tax payment records to credit rating agencies with just a joint authentication login to improve their credit scores.

In particular, KT customers can submit up to two years of telecommunication fee payment records to credit rating agencies with a simple ‘one-click’ process without a separate login procedure, enabling additional credit score increases.

A K-Bank official stated, “We have enhanced user convenience so that customers can easily and conveniently check loan interest rates and limits and receive the necessary loan amount anytime and anywhere when relatively small funds under 3 million KRW are urgently needed.” He added, “K-Bank will continue to introduce products that can further support the everyday economy, such as Jeonse/Monthly Rent Deposit Loans and Sa-it-dol Loans.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)