SKT Rises on Announcement of Demerger

LG's Demerger Gains Momentum for Consecutive Days Next Month

Future Business Impact Likely to Determine Direction Beyond Simple Corporate Split News

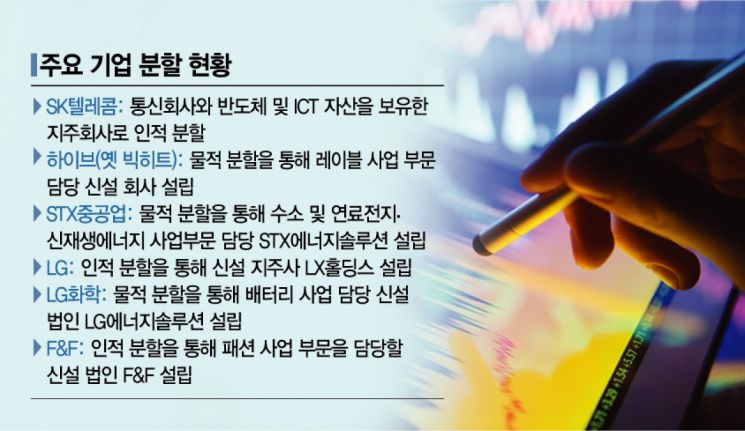

[Asia Economy Reporter Song Hwajeong] As major companies are successively undergoing corporate splits, the stock prices are also being affected. However, it appears that the direction of stock prices is determined more by the impact on future business rather than the simple news of the split.

As of 9:21 a.m. on the 15th, SK Telecom was trading at 297,000 KRW, up 3,500 KRW (1.19%) from the previous day. The stock price rise is interpreted as the market positively receiving the company split announcement made the previous day.

SK Telecom announced that it will pursue a spin-off to enhance shareholder value and accelerate growth by splitting into a wired and wireless telecommunications company (the surviving company) based on telecommunications and an investment specialist company (newly established company) holding semiconductor and ICT assets. The existing mobile network operator (MNO) business division and SK Broadband will belong to the surviving company, while SK Hynix, ADT Caps, 11st, and T map Mobility will belong to the newly established company. Minha Choi, a researcher at Samsung Securities, analyzed, "The spin-off method allows shareholders to equally divide shares of both the surviving and newly established investment companies, providing shareholders with investment choices, which can be positive for stock prices. It will be an opportunity for investment subsidiaries such as ADT Caps and 11st, which had not been properly valued due to being overshadowed by the wireless business, to receive their true value." Samsung Securities raised SK Telecom's target stock price from 320,000 KRW to 345,000 KRW.

Hive (formerly Big Hit) also recently decided on a corporate split. On the 1st, Hive announced that it will establish a new company by splitting off the label business division responsible for artist discovery, development, and music production through a physical split. Although individual investors were concerned that the stock price would inevitably fall if BTS was separated, the stock price soared to 285,000 KRW immediately after the split decision as Hive acquired the major U.S. label Ithaca Holdings. Although the stock price has recently declined due to concerns over the release of locked shares, it showed a strong rise of over 4% on this day due to low-price buying inflows following the recent decline. Sunhwa Lee, a researcher at KB Securities, analyzed, "This restructuring created an environment where Hive can operate additional acquired labels as independent subsidiaries, respecting the independence among labels and the individuality of artists. Having secured about 1.5 trillion KRW in cash through an IPO, further label acquisitions can be expected."

LG, which is scheduled for a spin-off next month, has recently seen its stock price rise continuously, surpassing 100,000 KRW. On the 26th of last month, LG passed a split plan at the shareholders' meeting to separate four subsidiaries?LG International, LG Hausys, Silicon Works, and LG MMA?and establish a new holding company, LX Holdings. Accordingly, the existing holding company LG and the newly established holding company LX Holdings will be separated.

F&F, scheduled for a split on the 1st of next month, has also shown strong performance, hitting record highs continuously. It has risen more than 28% just this month. F&F will establish a new company responsible for the fashion business division through a spin-off. Trading will be suspended from the 29th of this month to the 20th of next month due to the spin-off. After the split, the surviving company will be re-listed on the KOSPI, and the newly established company will be re-listed separately. Hanuri, a researcher at Meritz Securities, said, "With expectations high due to a 3.4-fold increase in sales in China this year, considering China's growth potential, the spin-off, and low liquidity ratio, we recommend buying before the trading suspension."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)