[Asia Economy Reporter Buaeri] ‘Global market expansion’ has long been a challenge for Kakao. Although Kakao owns KakaoTalk, the ‘national messenger’ with 45.98 million users, it has always been labeled as a domestic service. To shed this label, Kim Beom-su, Chairman of Kakao’s Board, merged the webtoon subsidiary Kakao Page and the entertainment subsidiary Kakao M in January to launch Kakao Entertainment. This year, Kakao has embarked on an aggressive global expansion through Kakao Entertainment.

Heading to China and India

According to Kakao Entertainment on the 15th, Kakao Webtoon will officially begin targeting the Chinese-speaking market starting with Taiwan in June. It plans to enter the Chinese market within the year. Kakao Entertainment’s Page Company (Kakao Page) established a Hong Kong subsidiary last December. Industry insiders expect Kakao Entertainment to penetrate the challenging Chinese market through its Hong Kong subsidiary and a joint venture with Tencent. Tencent maintains a cooperative relationship by holding 6.72% and 3.75% stakes in Kakao Page through its affiliates Sky Blue and TCH, respectively.

Kakao Entertainment’s interest in China stems from it being the world’s second-largest content market. According to the Korea Creative Content Agency, China’s content market, including comics, dramas, and films, is second only to the United States. The size of China’s content market is $360.1 billion (approximately 405 trillion KRW), while the U.S. market is $862 billion (approximately 969 trillion KRW). South Korea’s market size is $63.6 billion (approximately 72 trillion KRW). Kakao Entertainment is also targeting the Indian market, which has a population of 1.3 billion. India’s content market is growing at a rate of 11.7%, making it the fastest-growing country in this sector. A Kakao Entertainment official explained, "We are also preparing to enter India in the second half of the year."

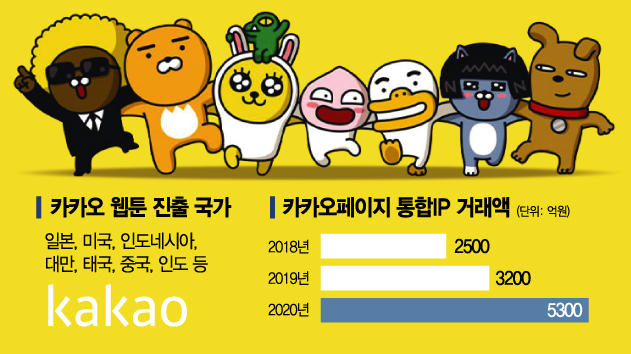

The overseas success potential of Kakao Page’s webtoon intellectual property (IP) has already been somewhat proven. In Japan, a comic powerhouse, Kakao’s webtoon platform Piccoma ranks first in app sales. Kakao Page exclusively supplies webtoons to Piccoma, where K-webtoons account for about 1% of the content but make up 40% of total sales. Thanks to its overseas performance, Kakao Page’s total IP transaction value grew 66% from 320 billion KRW in 2019 to 530 billion KRW last year.

Where will the 1 trillion KRW investment go this year?

Kakao Entertainment is making an all-out effort to become a global platform. Ahead of its planned listing next year, it announced an investment plan of $889 million (approximately 1 trillion KRW) for this year. Lee Jin-soo, CEO of Kakao Entertainment, said, "Our goal is to build Kakao’s webtoon platform worldwide," adding, "We have currently achieved about 10% of our target."

Kakao Entertainment has recently been aggressively acquiring overseas platforms. The competition with Naver is intense, especially in the North American market. Kakao Entertainment is acquiring management rights of Tapas Media, the first webtoon platform in North America. Kakao Page, which is also the largest shareholder, supplies major IPs to Tapas Media. Additionally, it is pursuing the acquisition of the North American web novel platform ‘Radish,’ with the acquisition price estimated at 400 billion KRW. Recently, it has also been reported that Kakao is considering acquiring the domestic web novel platform ‘Munpia.’

Experts also have a positive outlook on Kakao’s chances of success in the global webtoon business. Professor Lee Byung-min of Konkuk University’s Department of Cultural Contents said, "Interest in webtoons is increasing to the extent that people talk about Hallyu 4.0, so the possibility of success in overseas markets is positive," adding, "Naver and Kakao have gained confidence by establishing a foothold in the U.S. and Japanese markets, and they will gradually expand their markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)