Securing Proprietary Technology for High-Nickel Cathode and Low-Expansion Anode Materials... Aggressive Facility Investment Underway

POSCO Chemical Achieves Record Performance Despite COVID-19

Aggressive Expansion of US Factory Since Last Year

Expectations for Economies of Scale Starting This Year

As LG Energy Solution and SK Innovation reached a sudden agreement to end their battery dispute, companies related to battery materials and equipment have also spread their previously folded wings. The biggest gain is the removal of domestic and international business uncertainties. Orders that had stopped are resuming, and companies are going public (IPO), bringing renewed vitality to the battery-related market. According to market research firm SNE Research, last year, the global market share of K-batteries produced by the three domestic companies?LG Energy Solution, SK Innovation, and Samsung SDI?was about 35%, surpassing China to rank first. As Korean electric vehicle battery companies occupy a larger share in the global battery supply chain, the workload for their partners also increases. While automakers worldwide are struggling to gain dominance in the global electric vehicle hegemony battle, the value of domestic battery-related companies is rising even further.

[Asia Economy Reporter Park So-yeon] POSCO Chemical is a company that produces core materials for secondary batteries. Secondary batteries consist of four materials: cathode materials, anode materials, electrolytes, and separators. Among these, POSCO Chemical produces cathode materials, anode materials, and lithium, which is a raw material for cathode materials. In particular, based on proprietary technologies such as high-nickel cathode materials and low-expansion anode materials, it has secured major global battery companies as clients. POSCO Chemical is also attracting attention for proactively responding to the rapidly growing global electric vehicle and battery market through aggressive facility investments.

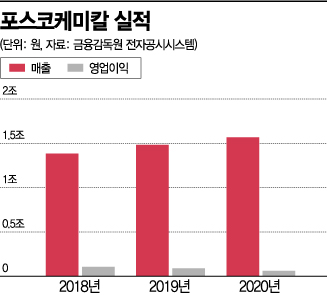

◆Strong performance in battery materials sector despite COVID-19=POSCO Chemical achieved its largest-ever sales since its founding last year despite the COVID-19 situation, thanks to the rapid growth of its secondary battery materials business. On a consolidated basis in 2020, it recorded sales of 1.5662 trillion KRW and an operating profit of 60.3 billion KRW.

The proportion of the secondary battery materials business in the overall business also increased from 15% the previous year to 34%, establishing itself as a core business. Sales of cathode materials used in electric vehicle batteries surged 257% compared to the previous year. Sales from cathode and anode materials alone reached 533.3 billion KRW, a 144% growth from 219 billion KRW the previous year.

In January this year, POSCO Chemical secured 1.2735 trillion KRW through a paid-in capital increase and is currently expanding production facilities to increase cathode material production. Along with phased expansion of the Gwangyang plant, it plans to establish overseas plants in Europe and China to build a global production system. In the mid to long term, as the supply volume of materials increases, the value of establishing local production systems is expected to become more prominent in terms of profitability.

◆Expectations for full realization of economies of scale this year=Especially from the first quarter of this year, analysis suggests that the secondary battery materials sector will begin to contribute profits in earnest. It is forecasted that the cathode materials business will turn profitable as the effects of ongoing expansion investments take full effect in the first quarter. According to financial information provider FnGuide, the consensus among securities firms for POSCO Chemical in Q1 this year is sales of 464.6 billion KRW and operating profit of 28 billion KRW. These figures represent an 18% increase in sales and a 58% increase in operating profit compared to the same period last year.

Since last year, aggressive expansion has been underway, and with the expansion effects becoming fully realized this year, expectations for achieving economies of scale are growing. POSCO Chemical plans to expand mass production capacity to establish a production system of 400,000 tons of cathode materials and 260,000 tons of anode materials by 2030. Through this, it aims to achieve a 20% global market share and annual sales of 23 trillion KRW in the secondary battery materials sector.

◆K-batteries as main customers, overseas orders including GM=POSCO Chemical is especially notable for possessing both cathode and anode materials, which are core materials of secondary batteries. It is considered a company with great future growth potential as it has LG Energy Solution, SK Innovation, Samsung SDI, and others as main customers and is actively pursuing expansion plans.

POSCO Chemical has also agreed to supply cathode and anode materials for electric vehicle batteries to Ultium Cells, a joint venture between the U.S. General Motors (GM) and LG Energy Solution. Ultium Cells is an electric vehicle battery cell joint venture established last year with a 50-50 stake by GM, the world's number one automaker, and LG Energy Solution, the world's number one battery manufacturer.

They are constructing a plant in Rose Town, Ohio, USA, and GM and LG plan to invest a total of 2.7 trillion KRW in stages to secure production capacity exceeding 30 GWh. The battery cells mass-produced here will be installed in GM's Ultium electric vehicle platform. The industry estimates that the production contract scale will reach several trillion KRW.

◆Financial stability indicators somewhat weakened due to aggressive investments=Due to consecutive aggressive investments, financial stability indicators have somewhat weakened. POSCO Chemical's investment amount based on acquisition of tangible and intangible assets was 104.7 billion KRW in 2018, 311.5 billion KRW in 2019, and 245.5 billion KRW in 2020. As of the end of last year, the debt ratio rose 32.1 percentage points year-on-year to 104%. During the same period, the total debt dependency increased by 12.4 percentage points to 40.3%.

Since the beginning of this year, due to the inflow of funds from a trillion-KRW-level paid-in capital increase, the debt ratio is understood to have decreased from 104% at the end of last year to about 46% currently. POSCO Chemical plans to use these funds for facility funds (687.8 billion KRW), operating funds (441 billion KRW), and acquisition of securities of other corporations (144.7 billion KRW). Kim Kwang-jin, a researcher at Yuanta Securities, said, "At a time when the importance of material stability is increasing, the ability to supply unified materials is clearly attractive," adding, "Simultaneous orders for cathode and anode materials from Ultium Cells are a representative case, and similar cases are expected to increase in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.